Are credit card balances a part of the money supply?

Are credit card balances M1 or M2

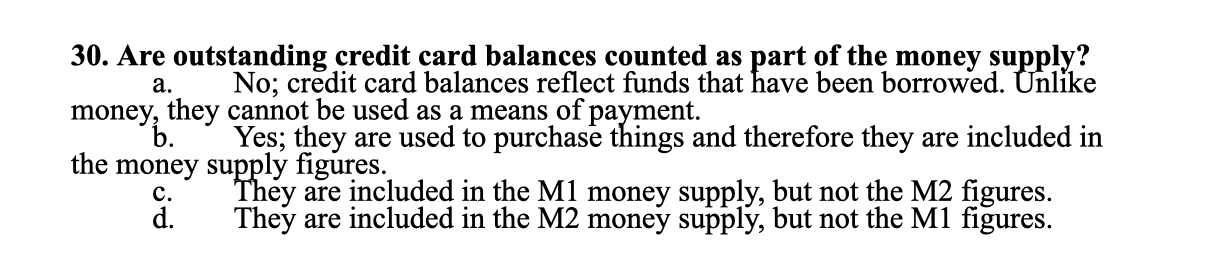

Credit cards are not included in either M1 or M2. It is not money but instead a pre-approved credit line. By using a credit card you are not transferring your money to the seller. You are transferring the bank's money to the seller and now owe the bank money.

Are credit card balances a component of M1

In the given statement, credit cards are not included in M1 and M2 as purchases done from credit cards serve as a loan to the credit card company to an individual who holds a credit card. M1 money includes the physical currency, and the medium of exchange is the use of debit cards and ATMs.

Are credit cards included in both M1 and M2

Answer and Explanation: This option is correct because credit cards are neither included in M1 nor M2. It is not a part of narrow money or broad money because M1 and M2 do not involve transactions related to credit cards. It includes coin and currency, money market mutual funds, and traveler's checks.

What effect do credit cards have on money supply

However, having more credit cards or debit cards does not change the quantity of money in the economy, any more than printing more checks increases the amount of money in your checking account.

Cached

Are credit card balances part of M1 quizlet

a monetary unit for measuring and comparing the relative values of goods. (Consider This) Credit card balances are: not a component of M1 or M2.

Why aren t credit cards included in M1 or M2 quizlet

Why AREN'T credit cards included in M1 or M2 Credit is not a form of money, since it is a debt that is owed to the issuer of the card.

What is not included in M1 money supply

Key Takeaways. M1 is a narrow measure of the money supply that includes currency, demand deposits, and other liquid deposits, including savings deposits. M1 does not include financial assets, such as bonds.

Is credit card balances part of M2

It is false because M2 is a measure of the money supply and the money supply is the total value of monetary assets. A credit card balance is not a monetary asset. To the contrary, a credit card balance represents liabilities. Therefore, the credit card balance is not part of the money supply.

Are credit cards included in M3

However, credit cards may be included in M2 and M3 if they are associated with a borrowing account that can be used to obtain cash or credit. Stocks are not typically considered money because they do not represent a direct claim on the money.

Do credit cards increase the money supply

Thus, if there is greater use of credit cards, the money supply will increase. Interest rate: With the increase in credit card availability, the money supply will increase, lowering the interest rates in an economy.

Why are credit cards not considered part of the money supply quizlet

Credit cards are not considered part of the money supply because: they are a loan which you have to use money to pay for later.

Are debit card balances part of money supply M1

M1 includes demand deposits and checking accounts, which are the most commonly used exchange mediums through the use of debit cards and ATMs. Of all the components of the money supply, M1 is defined the most narrowly. M1 does not include financial assets, such as bonds.

What is part of M1 money supply

The M1 money supply is the aggregation of money circulation in a nation's economy, comprising all coins, currencies, banknotes, and overnight deposits. It is a category made up of the most liquid parts of the economy.

Why are credit cards not part of the money supply

When calculating the money supply, the Federal Reserve includes financial assets like currency and deposits. In contrast, credit card debts are liabilities. Each credit card transaction creates a new loan from the credit card issuer. Eventually the loan needs to be repaid with a financial asset—money.

Are credit cards part of the M2 money supply

It is false because M2 is a measure of the money supply and the money supply is the total value of monetary assets. A credit card balance is not a monetary asset.

What is excluded from money supply

ITEMS EXCLUDED FROM MONEY SUPPLY:

1) The stock of monetary gold Held in reserves as a backing to paper currency is not included in money supply. This is so because it is not permitted to circulate within the country. 2) The cash held by commercial banks Is not included in money supply.

Which of the following is not part of the money supply

The correct option is b.

Bonds are not a part of the money even though they can influence the money supply. Buying of bonds by the central bank, for example, increases the money supply in the economy.

Are credit cards money macroeconomics

Other Money

It is important to note that in our definition of money, it is checkable deposits that are money, not the paper check or the debit card. Although you can make a purchase with a credit card, it is not considered money but rather a short term loan from the credit card company to you.

What does the money supply include

The money supply is the total amount of money—cash, coins, and balances in bank accounts—in circulation. The money supply is commonly defined to be a group of safe assets that households and businesses can use to make payments or to hold as short-term investments.

What are the components of the money supply

COMPONENTS OF MONEY SUPPLY: There are two main components of money supply, currency (or fiat money) and demand deposits.