Are credit card rates increasing?

Are credit card rates going up in 2023

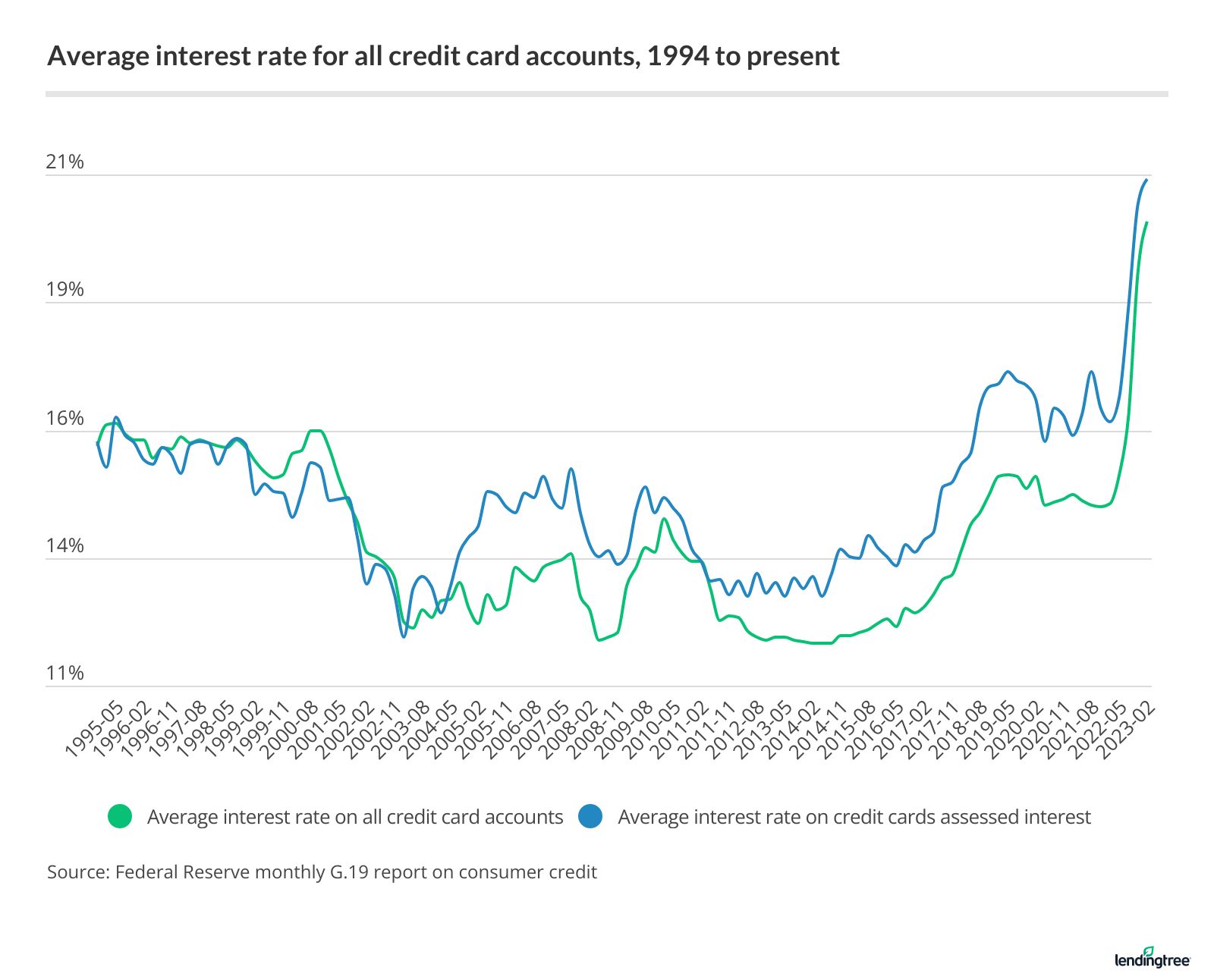

Credit card rates are going up in 2023, mostly due to the Federal Reserve increasing its federal funds rate in response to inflation. The average credit card interest rate for new offers has risen from 21.43% in the fourth quarter of 2023 to 22.15% as of the end of Q1 2023, the latest data available.

Will credit card rates go down in 2023

And when the prime rate goes up, variable interest rates soon follow. In fact, interest rates on credit cards continue moving up, with the national average APR higher than 20 percent as of May 3, 2023, up from 16.34 percent in March 2023.

Cached

Why are my credit card interest rates going up

Bottom line. As a result of the Fed changing the federal funds rate, the prime rate also changes and your credit card APR will fluctuate accordingly — meaning an increase in the federal funds rate and prime rate results in an increase in your card's APR.

Has credit card interest increased

Interest rates on credit cards have risen substantially, with average interest rates going over 20% . Given the trends for the 175 million Americans with credit cards, the CFPB estimates that outstanding credit card debt may continue to set records and could even hit $1 trillion.

Cached

How high will interest rates go by the end of 2023

The Mortgage Bankers Association predicts rates will fall to 5.5 percent by the end of 2023 as the economy weakens. The group revised its forecast upward a bit — it previously expected rates to fall to 5.3 percent.

What is the interest rate forecast for 2023 and 2024

Both estimates are largely in line with fresh projections from officials in March. The Fed penciled in a 5-5.25 percent peak interest rate for 2023, after which officials see rates falling to 4.25-4.5 percent by the end of 2024.

Why did my credit card interest rate go up 2023

It's certainly possible your credit card interest rate will go up in 2023. Most credit cards have variable interest rates, meaning your account's interest rate is tied to a benchmark such as the Prime Rate. When the Prime Rate increases, your credit card APR also goes up.

Will interest rates go down in 2023

“We expect that 30-year mortgage rates will end 2023 at 5.2%,” the organization noted in its forecast commentary. It since has walked back its forecast slightly but still sees rates dipping below 6%, to 5.6%, by the end of the year.

Will interest rates go down in 2023 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.

What will interest rates be in 2023 2024

Direct Loan Interest Rates for 2023-2024

| Loan Type | 10-Year Treasury Note High Yield | Fixed Interest Rate |

|---|---|---|

| Direct Subsidized Loans and Direct Unsubsidized Loans for Undergraduate Students | 3.448% | 5.50% |

| Direct Unsubsidized Loans for Graduate and Professional Students | 3.448% | 7.05% |

What is the interest rate forecast for 2023

Fannie Mae.

30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast.

How high will US interest rates go in 2023

So far in 2023, the Fed raised rates 0.25 percentage points twice. If they hike rates at the May meeting, it is likely to be another 0.25% jump, meaning interest rates will have increased by 0.75% in 2023, up to 5.25%.

What will interest rates be in 2023 and 2024

The Fed penciled in a 5-5.25 percent peak interest rate for 2023, after which officials see rates falling to 4.25-4.5 percent by the end of 2024.

Are interest rates going to go back down in 2023

When Will Interest Rates Go Down First, we expect the Fed to pause its rate hikes by summer 2023 (the May hike was the last one, in our view). Then, starting around the end of 2023, we expect the Fed to begin cutting the federal-funds rate.

Will the interest rates go up in 2023

Fed forecasts show one more rate hike could be possible for 2023, likely at the May 3 meeting. But Federal Reserve Chair Jerome Powell emphasized they “may” hike rates one more time, suggesting that increase might not happen. So far in 2023, the Fed raised rates 0.25 percentage points twice.

Will interest rates go down in 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.

What is the prediction for interest rates in 2024

Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point. Figures are the predicted quarterly average rates for the 30-year fixed-rate mortgage.

What are the interest rates predicted for 2024

Mortgage Interest Rate predictions for May 2024. Maximum interest rate 5.66%, minimum 5.16%. The average for the month 5.45%. The 30-Year Mortgage Rate forecast at the end of the month 5.32%.

How high will interest rates rise in 2023

14 months of rate hikes from the Fed

| Date | rate change | target rate |

|---|---|---|

| Dec. 13-14, 2023 | 0.50% | 4.25% – 4.5% |

| Jan. 31-Feb. 1, 2023 | 0.25% | 4.5% – 4.75% |

| March 21-22, 2023 | 0.25% | 4.75% – 5% |

| May 2-3, 2023 | 0.25% | 5% – 5.25% |

How high will interest rates be in 2023

Fannie Mae.

30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast.