Are credit cards financial liabilities?

Is a credit card a financial liability

Credit cards are a liability and not an asset, as the money on the card is not yours and this credit line does not increase your net worth.

Are credit cards assets or liabilities

Liabilities are debts. Loans, mortgages and credit card balances all fit into this category. Your net worth is calculated by adding up the value of all your assets, then subtracting your total liabilities.

Cached

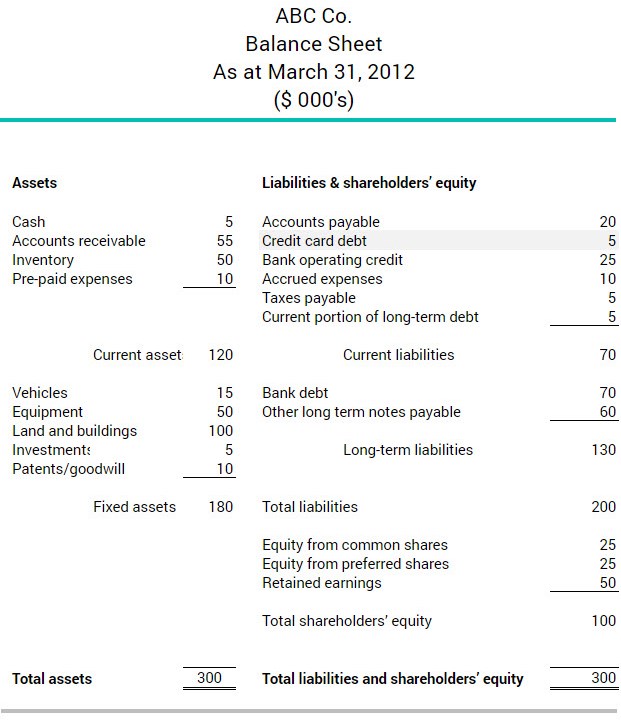

What are the financial liabilities on a balance sheet

Liabilities are the debts you owe to other parties. A liability can be a loan, credit card balances, payroll taxes, accounts payable, expenses you haven't been invoiced for yet, long-term loans (like a mortgage or a business loan), deferred tax payments, or a long-term lease.

Cached

What are 5 examples of liabilities

Examples of liabilities are -Bank debt.Mortgage debt.Money owed to suppliers (accounts payable)Wages owed.Taxes owed.

What does financial liability include

Financial liabilities include debt payable and interest payable, which is as a result of the use of others' money in the past, accounts payable to other parties, which are as a result of past purchases, rent and lease payable to the space owners, which are as a result of the use of others' property in the past and …

Why are credit cards a liability

In contrast, credit card debts are liabilities. Each credit card transaction creates a new loan from the credit card issuer. Eventually the loan needs to be repaid with a financial asset—money.

Is credit a liability or owner’s equity

The credit side of the entry is to the owners' equity account. It is an account within the owners' equity section of the balance sheet.

What are examples of financial liabilities

What are some examples of liabilitiesAuto loans.Student loans.Credit card balances, if not paid in full each month.Mortgages.Secured personal loans.Unsecured personal loans.Payday loans.

What is a financial liability example

Examples of financial liabilities are accounts payable, loans issued by an entity, and derivative financial liabilities.

What falls under liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities can be contrasted with assets. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

Which of the following items is not a liability

The correct option is (d) Cost of goods sold. Cost of goods sold is an expense for business and would reflect in the income statement and not on the balance sheet.

What are financial and non financial liabilities examples

Some examples of financial liabilities are trades payable, debentures loans payable, non-equity shares, etc. Some of the examples of non-financial liabilities are taxes payable, warranty obligations, equity shares, etc.

What is the difference between a financial liability and a liability

Financial liabilities are those liabilities which are related to cash related liabilities which result in an outflow of cash or other assets whereas Operating liabilities are those liabilities which are related to the production of goods and services.

How is credit a liability

A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account. Thus, a credit indicates money leaving an account. You can record all credits on the right side, as a negative number to reflect outgoing money.

What is an example of a non financial liability

Examples include: unearned revenues, product warranties, and customer loyalty programs. For these types of liabilities, the determination of the amount to be settled, and the timing of the settlement, may not always be clear.

What type of liability is credit

Definition of liability accounts

A debit to a liability account means the business doesn't owe so much (i.e. reduces the liability), and a credit to a liability account means the business owes more (i.e. increases the liability).

Which are not a financial liabilities

As described in Section 12.2, non-financial liabilities are those liabilities that are settled through the delivery of something other than cash. Often, the liability will be settled by the delivery of goods or services in a future period.

What are financial and non-financial liabilities

The financial liabilities are contractual obligations of a business organization to deliver cash or financial assets to the party involved. The non-financial liabilities are contractual obligations of a business organization that does not require the delivery of cash or financial assets to the party involved.

What are other financial liabilities

What Are Other Current Liabilities Other current liabilities, in financial accounting, are categories of short-term debt that are lumped together on the liabilities side of the balance sheet. The term "current liabilities" refers to items of short-term debt that a firm must pay within 12 months.

What are the non financial liabilities

Examples include: unearned revenues, product warranties, and customer loyalty programs. For these types of liabilities, the determination of the amount to be settled, and the timing of the settlement, may not always be clear.