Are credit cards liabilities?

Are credit cards assets or liabilities

Liabilities are debts. Loans, mortgages and credit card balances all fit into this category. Your net worth is calculated by adding up the value of all your assets, then subtracting your total liabilities.

Cached

What are 5 examples of liabilities

Examples of liabilities are -Bank debt.Mortgage debt.Money owed to suppliers (accounts payable)Wages owed.Taxes owed.

Is a credit card a liability for a mortgage

Having credit card debt isn't going to stop you from qualifying for a mortgage unless your monthly credit card payments are so high that your debt-to-income (DTI) ratio is above what lenders allow.

Is personal credit card debt a liability

Common types of reportable liabilities include: boat loans, capital commitments, credit card debt, exercised lines of credit, margin accounts, mortgage debt, student loans, loans from non-commercial sources (e.g., loan from a friend), and liabilities for which you co-signed and have a current legal obligation to repay.

CachedSimilar

Is a credit card payment a liability or expense

Liabilities

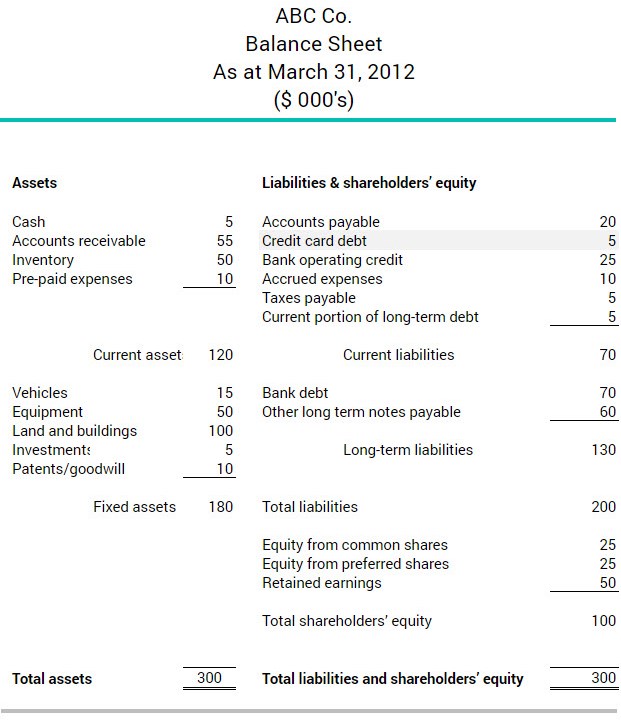

Credit Cards as Liabilities

The balance owed on a credit card can be treated either as a negative asset, known as a “contra” asset, or as a liability.

Is credit a liability or owner’s equity

The credit side of the entry is to the owners' equity account. It is an account within the owners' equity section of the balance sheet.

What qualifies as liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities can be contrasted with assets. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

Which of the following items is not a liability

The correct option is (d) Cost of goods sold. Cost of goods sold is an expense for business and would reflect in the income statement and not on the balance sheet.

What type of liability is credit

Definition of liability accounts

A debit to a liability account means the business doesn't owe so much (i.e. reduces the liability), and a credit to a liability account means the business owes more (i.e. increases the liability).

Am I responsible for my wife credit card debt in a divorce

You are generally not responsible for your spouse's credit card debt unless you are a co-signer for the card or it is a joint account. However, state laws vary and divorce or the death of your spouse could also impact your liability for this debt.

How do you record credit cards in accounting

Set Up Credit CardsIn the Chart of Accounts: Create Liability accounts for each credit card you use. Add an Expense account for credit card interest & fees.Enter Beginning Balances for each credit card.Create a Journal called “Credit Cards” or you may prefer to have a separate journal for each card.

Is payment to creditors a liability

Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.

Is a credit on the balance sheet a liability

An increase in liabilities or shareholders' equity is a credit to the account, notated as "CR." A decrease in liabilities is a debit, notated as "DR." Using the double-entry method, bookkeepers enter each debit and credit in two places on a company's balance sheet.

What are 6 examples of liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

What are not liabilities

Non current liabilities are referred to as the long term debts or financial obligations that are listed on the balance sheet of a company.

What accounts are not a liability

Cash is not a liability Account.

As against liability is the financial value of an obligation or debt payable by the business to another organization or person.

What are examples of liabilities

For most households, liabilities will include taxes due, bills that must be paid, rent or mortgage payments, loan interest and principal due, and so on. If you are pre-paid for performing work or a service, the work owed may also be construed as a liability.

What are the 3 types of liabilities

There are three primary classifications for liabilities. They are current liabilities, long-term liabilities and contingent liabilities. Current and long-term liabilities are going to be the most common ones that you see in your business.

Can creditors go after my spouse for my debt

A divorce decree or property settlement may allocate debts to a specific spouse, but it doesn't change the fact that a creditor can still collect from anyone whose name appears as a borrower on the loan or debt.

How do I protect myself from my husband’s debt

A prenuptial agreement is a contract you make with your fiancé to specify how assets and debts will be handled during the marriage and divided in the event of a divorce. With a prenup, you and your intended can agree to keep your debts separate and even specify who will be responsible for the monthly payments.