Are ENERGY STAR windows tax deductible?

Can you write off ENERGY STAR windows

If you replaced your old windows with new energy-efficient windows, skylights, doors, or other qualifying items in 2023, you could be eligible to claim a windows tax credit of up to $600. Current energy tax credits for window replacement have been extended until December 31, 2032.

Cached

Are ENERGY STAR products tax deductible

A broad selection of ENERGY STAR certified equipment is eligible for the tax credits. Independently certified to save energy, ENERGY STAR products are a smart investment for energy efficiency you can count on.

Cached

Are new windows tax deductible in 2023

Energy Efficient Home Improvement Credit

As part of the Inflation Reduction Act, beginning Jan. 1, 2023, the credit equals 30% of certain qualified expenses: Qualified energy efficiency improvements installed during the year which can include things like: Exterior doors, windows and skylights.

Are energy-efficient replacement windows tax deductible

2023 Window & Door Tax Credit. You may be entitled to a tax credit of up to $500*** if you installed energy-efficient windows, skylights, doors or other qualifying items in 2023**. Current federal tax credits for certain energy-efficient improvements to existing homes have been extended through December 31, 2023.

Cached

Are new skylights tax deductible

The Inflation Reduction Act, passed in August 2023 and signed into law by President Joseph Biden, extended the 30% tax credit to 2032. The following VELUX products qualify for the tax credit: Solar-powered fresh air skylights. Fixed or manual fresh air air skylights with factory installed solar-powered shades.

Which windows qualify for tax credit

What Windows Qualify for the Tax Credit You must install new windows that fall within these energy tax requirements: The energy property tax applies only to windows installed onto a taxpayer's primary residence. The windows must be energy-efficient certified by their manufacturer or have an Energy Star label.

What windows qualify for tax credit

What Windows Qualify for the Tax Credit You must install new windows that fall within these energy tax requirements: The energy property tax applies only to windows installed onto a taxpayer's primary residence. The windows must be energy-efficient certified by their manufacturer or have an Energy Star label.

How do I write off my ENERGY STAR appliances

How do you claim energy efficient tax credits on your tax return To claim the credits, you'll need IRS Form 5695. Work out the credit amount on that form, then enter it on your Form 1040.

What home improvements are tax deductible 2023

More In Credits & Deductions

If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032.

What is the Inflation Reduction Act window tax credit

Beginning in tax year 2023, homeowners can earn an energy tax credit of 30% of the cost of new windows, up to a maximum $600. This structure is part of the Inflation Reduction Act of 2023, which extends and increases benefits of the Energy Efficient Home Improvement Credit (EEHIC).

Do skylights qualify for energy tax credit

The Inflation Reduction Act, passed in August 2023 and signed into law by President Joseph Biden, extended the 30% tax credit to 2032. The following VELUX products qualify for the tax credit: Solar-powered fresh air skylights. Fixed or manual fresh air air skylights with factory installed solar-powered shades.

What qualifies as an energy-efficient window

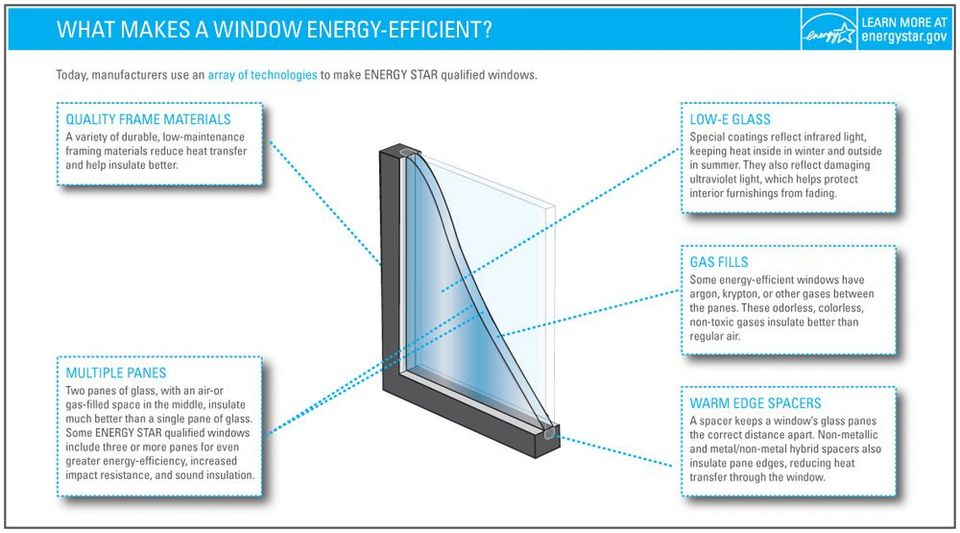

In summary, a double or triple-pane vinyl window with Low-E glass is the most energy-efficient window option.

What makes a window ENERGY STAR

ENERGY STAR certified windows, doors, and skylights: Are manufactured by an ENERGY STAR partner, Are independently tested, certified, and verified by the National Fenestration Rating Council (NFRC), and. Have NFRC ratings that meet strict energy efficiency guidelines set by the US Environmental Protection Agency (EPA).

Are energy-efficient appliances tax deductible in 2023

Beginning January 1, 2023, the amount of the credit is equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, including (1) qualified energy efficiency improvements installed during the year, (2) residential energy property expenditures during the year, and (3) home energy audits …

What is the 2023 elderly deduction

If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status). If you're both 65 and blind, the additional deduction amount is doubled.

What energy efficient items are tax deductible

Energy Efficient Home Improvement Credit

Exterior doors, windows, skylights and insulation materials. Central air conditioners, water heaters, furnaces, boilers and heat pumps. Biomass stoves and boilers.

Who qualifies for Inflation Reduction Act rebates

Eligible applicants: Low- or moderate-income (LMI) households. Owners of eligible LMI multifamily buildings. Governmental, commercial, or nonprofit entity carrying out a project for an eligible household or an owner of an eligible multifamily building.

What qualifies for federal energy tax credit

These expenses may qualify if they meet requirements detailed on energy.gov: Exterior doors, windows, skylights and insulation materials. Central air conditioners, water heaters, furnaces, boilers and heat pumps. Biomass stoves and boilers.

Are ENERGY STAR windows worth it

A salesperson might say EnergyStar research shows that you can save between $101 and $583 per year, in total, when replacing windows. If each window costs $650 and you use the higher of the two figures—$583—you have nearly paid for the windows in ten years: $5,830 in savings. At that point, you're only short $670.

How do I know if I have ENERGY STAR windows

What do I look for ENERGY STAR® certified windows have a sticker. The sticker has product identification information printed on it including the manufacturer's name, model number, testing metrics such as U-factor, certification number, as well as the blue ENERGY STAR® logo.