Are routing numbers the same for ACH and wire?

What is the difference between a wire routing number and an ACH routing number

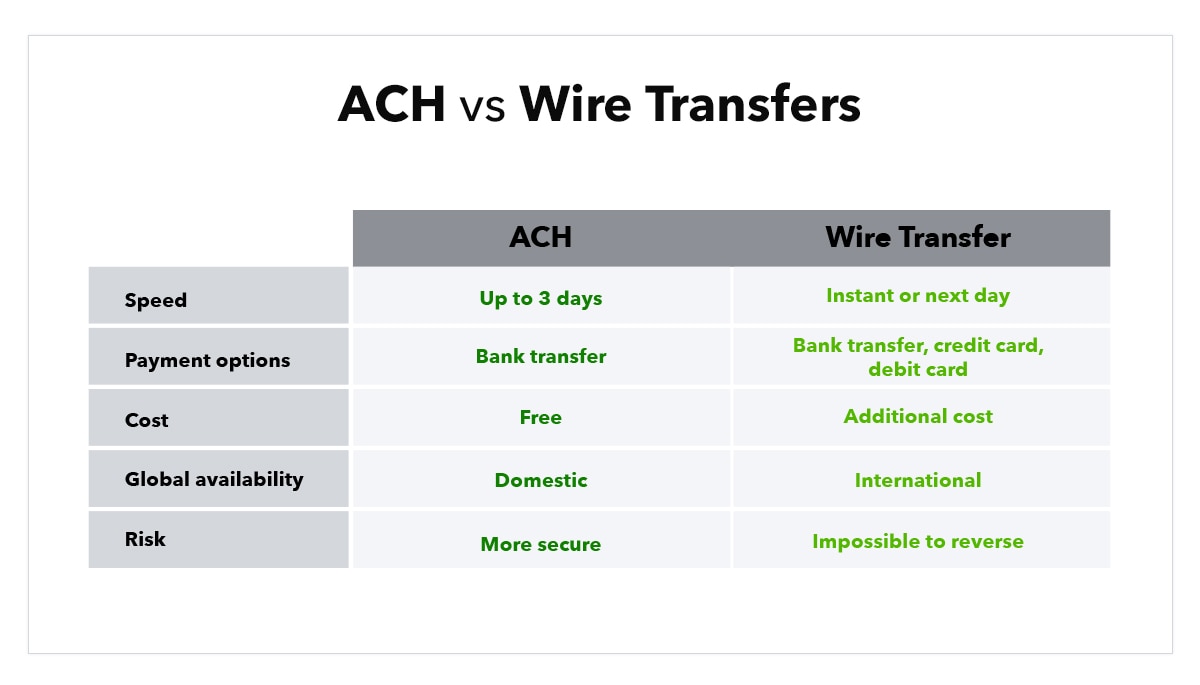

What Is the Difference Between ACH and Wire Transfers An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the direct movement of money from one bank account to another, typically for a fee.

Cached

What happens if you use wire routing number instead of ACH

What happens if I accidentally provided a wire transfer routing number for an ACH deposit transaction Unless both the numbers are the same, the transaction will not go through and will be reversed and usually takes 4–6 days.

Why do I have 2 routing numbers

A bank or credit union may have more than one routing number. This is often the case with big banks like Bank of America and Chase Bank, which have two routing numbers in some states.

Cached

Which routing number do I use for wire transfer

Instead, a wire transfer uses the recipient's bank account number and ABA routing number. This is a unique 9-digit number that identifies each banking institution. If you don't know your bank's routing number, you can find it using a quick internet search.

Cached

Is 121042882 an ACH routing number

The routing number for Wells Fargo in California is 121042882 for checking and savings account. The ACH routing number for Wells Fargo is also 121042882.

Can you use ACH for wire transfer

Availability: ACH transfers only work for domestic transactions. If you want to send funds abroad through the ACH network, you must do so using an international wire transfer.

Can routing number 021000021 be used for ACH

The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code. Click here to see routing number for Chase in other states.

How do I know which routing number to use

Your bank statement. Your bank's website or mobile app. Through your bank's phone customer service. The American Bankers Association's routing number lookup.

Does it matter which routing number in use

If you're not sure which routing number you'll need for a particular transfer type, you should check with your bank beforehand. Careful. Using the wrong number can lead to delays in processing the transfer.

Can a bank have 2 different routing numbers

While no banks will ever have the same routing numbers, one bank might have multiple numbers. Banks often have separate routing numbers per type of transaction.

Do you need a different routing number for wire transfers

You will need both routing numbers and bank account numbers for domestic wire transfers within the United States. The ABA routing transit number (ABA RTN) is a nine-digit code printed on the bottom of checks which identifies the financial institution from which the funds are sent.

Is ACH and wire the same thing

An ACH transfer goes through an interbank system for verification before it's completed. A wire transfer goes directly and electronically from one bank account to another without an intermediary system. ACH transfers typically have lower fees than wire transfers have.

Is an ACH transfer a wire transfer

An ACH transfer goes through an interbank system for verification before it's completed. A wire transfer goes directly and electronically from one bank account to another without an intermediary system. ACH transfers typically have lower fees than wire transfers have.

Is 121000248 an ACH routing number

ACH Routing Number 121000248 – WELLS FARGO BANK, NA.

Do you need routing number for ACH transfer

An ACH routing number is a 9-digit, unique numeric ID assigned to each banking institution in the US. It's needed for banks to identify where payments should be taken from and sent to. The routing number is used in conjunction with an account number to send or receive an ACH payment.

What is the difference between ACH EFT and wire transfer

EFT is a versatile method of e-payment that may have longer processing times and varying fees. Wire transfers are processed in real-time and are convenient and secure, but expensive and support only one-time transfers. ACH is ideal for recurring transactions and takes 2-3 business days to complete.

Is 021000021 a wire or ACH number

The routing number for Chase in New York is 021000021 for checking and savings account. The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code.

Is 021000021 a wire routing number

021000021 is a routing number provided by Chase for domestic and international wire transfers only.

What happens if you use the wrong routing number

Writing the wrong routing or account number can cause your transaction to be delayed, denied or even posted to a wrong account. If you made a mistake with your routing or account number, the bank may catch the problem and reject the transaction.

Is my routing number the same for all accounts

If you hold two accounts at the same bank, the routing numbers will, in most cases, be the same, but your account numbers will be different. Anyone can locate a bank's routing number, but your account number is unique to you, so it is important to guard it, just as you would your Social Security number or PIN code.