Are soft pulls accurate?

Can lenders see soft pulls

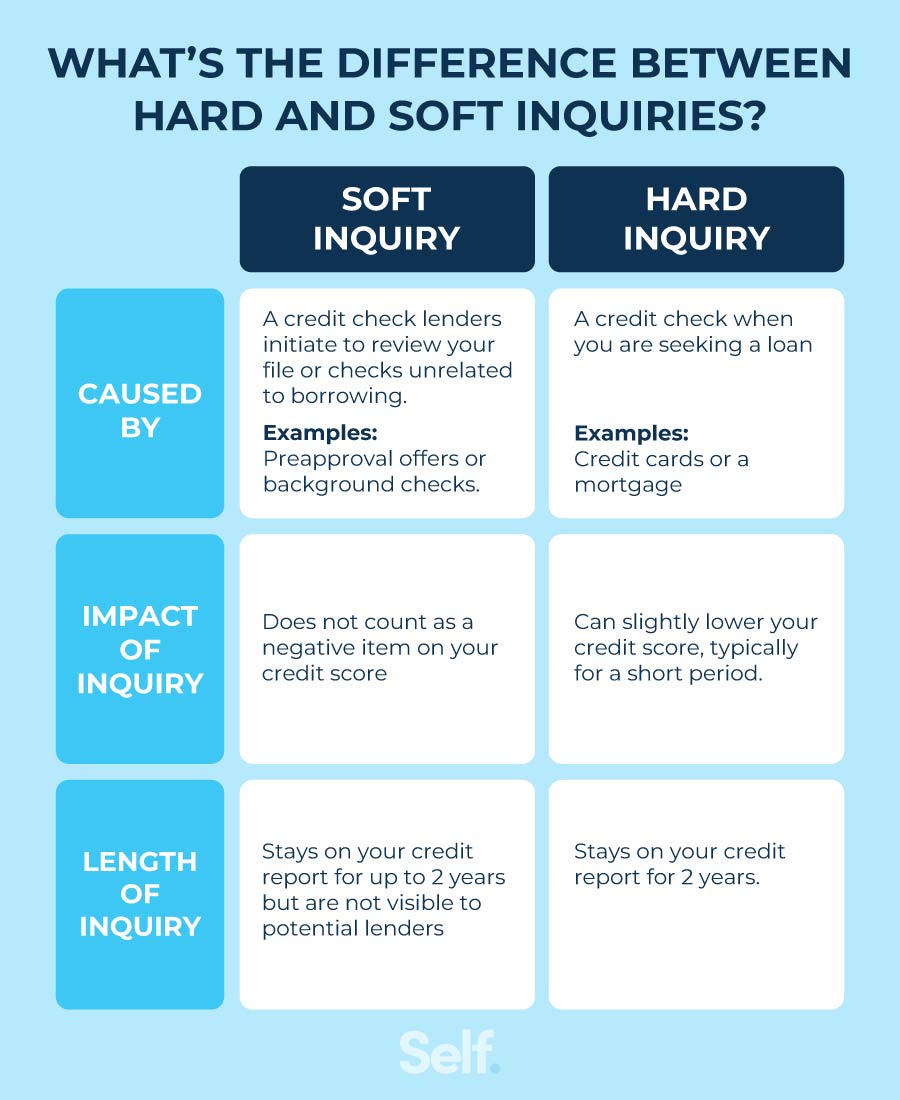

Soft inquiries are also not disputable. However, remember that potential lenders won't be able to see them (except for insurance companies and debt-settlement companies as we've noted earlier).

Cached

Does a soft pull affect buying a house

Unlike a hard pull, a soft pull won't impact your credit score. Your mortgage lender wants to make sure that both credit reports match, and if they don't, you may need to provide additional documentation or send your loan application through underwriting a second time.

Do you get a credit score with a soft pull

A soft inquiry does not affect your credit score in any way. When a lender performs a soft inquiry on your credit file, the inquiry might appear on your credit report but it won't impact your credit score.

Cached

Does a soft credit pull show late payments

A soft credit pull can show information such as credit accounts, late payments, collection activity and hard credit inquiries. Only you can see what soft credit inquiries have been run on your credit report.

How many soft inquiries is too many

Soft inquiries don't drop your credit score, so there isn't a number that could be considered too much.

Do lenders care about soft inquiries

Soft inquiries or soft credit pulls

These do not impact credit scores and don't look bad to lenders. In fact, lenders can't see soft inquiries at all because they will only show up on the credit reports you check yourself (aka consumer disclosures).

Can you get a pre approval from a soft pull

Essentially, the pitch is a soft credit inquiry does not impact your credit score and the lender will be able to pre-qualify you, or even PRE-APPROVE you without a hard credit inquiry, which is the kind that does MINIMAL impact to a credit score.

How many times does underwriter pull credit

Number of times mortgage companies check your credit. Guild may check your credit up to three times during the loan process. Your credit is checked first during pre-approval. Once you give your loan officer consent, credit is pulled at the beginning of the transaction to get pre-qualified for a specific type of loan.

How many points does your credit score go down for a soft inquiry

Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports.

What do companies see in a soft pull

A soft pull credit check shows the same information that you can find on a hard pull. It will show a customer's lines of credit and loans. It will outline their payment history. It will also show any accounts that have been sent to a collection agency or if they have a tax lien.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Why do I have so many soft inquiries

Soft inquiries, which only you can see, appear for a variety of reasons, including promotional offers, employment verification and even you pulling your own report. Only hard inquiries affect your credit score, but all inquiries will stay on your credit report for two years.

Can you get a credit limit increase with a soft pull

If your credit card issuer offers an increase in your credit limit, it might have carried out a soft credit pull. Whether or not you accept the increase is up to you. If you choose not to accept the increase, you might need to call your card issuer or reduce it on your own by using your card provider's website or app.

Is pre-approval a hard or soft pull

hard inquiry

A pre-approved offer will be sent out after a soft inquiry indicates that you're a good prospect for additional credit. If you apply based on the offer, the lender may make a hard inquiry before issuing the credit. A soft inquiry has no impact on your credit rating.

Do they pull your credit the day of closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

What percentage of loans fail underwriting

You may be wondering how often underwriters denies loans According to the mortgage data firm HSH.com, about 8% of mortgage applications are denied, though denial rates vary by location and loan type. For example, FHA loans have different requirements that may make getting the loan easier than other loan types.

How long do soft pulls stay on credit report

12-24 months

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How do I get rid of soft inquiries

Request removal of erroneous inquiries

If you find an inquiry on your credit report that you don't recognize, contact the creditor or the credit bureau to request its removal. You'll need to provide proof that the inquiry was unauthorized or fraudulent.