Are tax deductions worth it?

Is a tax deduction a good or bad thing

Deductions can help you qualify for other tax breaks

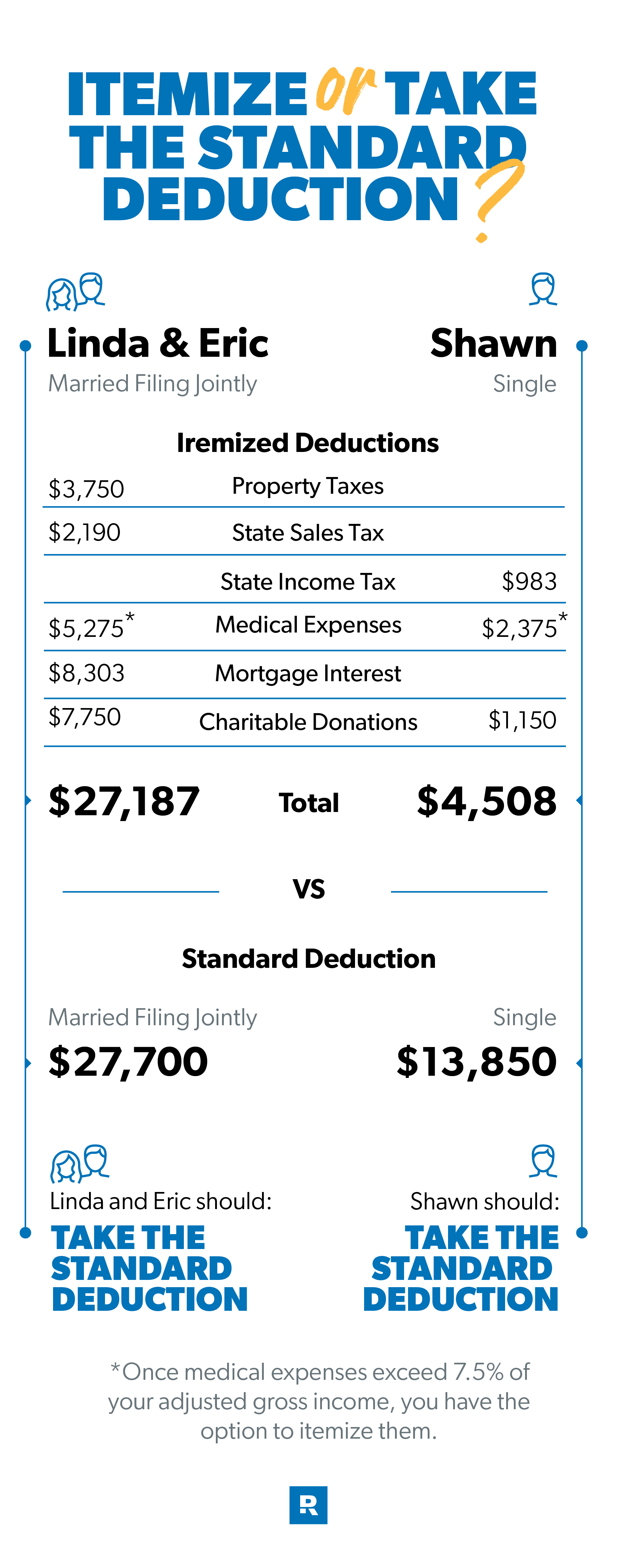

Taxpayers generally opt to itemize their deductions — such as those for charitable donations, mortgage interest, state and local taxes, and certain medical and dental expenses — if their total value exceeds the standard deduction amount.

Do tax deductions give you a bigger refund

In terms of your tax refund, credits typically yield a bigger tax return than deductions. But that doesn't mean you should overlook key write-offs for which you qualify. Instead of reducing the amount of tax you owe, deductions reduce the amount of income that is subject to tax.

How much does a deduction reduce taxes

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Who benefits most from tax deductions

Lower Income Households Receive More Benefits as a Share of Total Income. Overall, higher-income households enjoy greater benefits, in dollar terms, from the major income and payroll tax expenditures.

Is it better to have more or less deductions

When you have too much money withheld from your paychecks, you end up giving Uncle Sam an interest-free loan (and getting a tax refund). On the other hand, having too little withheld from your paychecks could mean an unexpected tax bill or even a penalty for underpayment.

What is the advantage of deduction

Saving tax with deductions

When you claim a tax deduction, it reduces the amount of your income that is subject to tax. The amount of the deduction you are eligible to claim is precisely the amount of the reduction to your taxable income.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

What is the average tax return for a single person making $60000

If you make $60,000 a year living in the region of California, USA, you will be taxed $13,653. That means that your net pay will be $46,347 per year, or $3,862 per month.

How much does $1000 deduction save someone on their taxes

For most non-business deductions, the savings are based upon your tax bracket. For example, if you are in the 12% tax bracket, a $1,000 deduction would save you $120 in taxes. On the other hand, if you are in the 32% tax bracket, the $1,000 deduction will save you $320 in taxes.

Do deductions put you in lower tax bracket

How do deductions affect your tax bracket Deductions are a way for you to reduce your taxable income, which means less of your income is taxed in those higher tax brackets. For example, if your highest tax bracket this year is 32 percent, then claiming a $1,000 deduction saves you $320 in taxes (32 percent of $1,000).

What is the highest tax taken out of paycheck

Federal income tax rates range from 10% up to a top marginal rate of 37%. The U.S. real median household income (adjusted for inflation) in 2023 was $70,784. 9 U.S. states don't impose their own income tax for tax year 2023.

What taxes take the most out of your paycheck

The largest amount withheld from your wages is usually for federal income taxes. The amount withheld is based on your gross income, your W-4 Form, and a variety of other factors. Your employer also withholds 6.2% of your wages to pay your portion of the Social Security tax to help fund Social Security and Medicare.

Why does my refund go down with more deductions

If your refund doesn't budge after you've entered your medical expenses, charitable contributions, mortgage interest, sales taxes, or your state, local, or property taxes, it's probably because your Standard Deduction is currently higher than your itemized deductions.

How can I get the most back on my taxes

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

How do people get large tax refunds

By contributing more toward your tax bill with each paycheck, you'll increase the amount you pay in during the year—and thereby increase your chances of getting a bigger refund.

What is the average tax refund for a single person making $30000

What is the average tax refund for a single person making $30,000 Based on our estimates using the 2023 tax brackets, a single person making $30,000 per year will get a refund of $1,556. This is based on the standard deduction of $6,350 and a standard $30,000 salary.

How can I get a bigger tax refund

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

What does 100% tax deductible mean

When something is tax deductible — meaning that it's able to be legally subtracted from taxable income — it serves as a taxpayer advantage. When you apply tax deductions, you'll lower the amount of your taxable income, which, in turn, lessens the amount of tax you'll have to pay the Internal Revenue Service that year.

How do deductions affect my paycheck

Post-tax deductions are taken from an employee's paycheck after all required taxes have been withheld. Since post-tax deductions reduce net pay, rather than gross pay, they don't lower the individual's overall tax burden.

What is the best way to lower your tax bracket

Increasing your retirement contributions, delaying appreciated asset sales, batching itemized deductions, selling losing investments, and making tax-efficient investment choices can help you avoid moving into a higher tax bracket.