Are taxes refundable on airline tickets?

What taxes are refundable on an airline ticket

Airline tickets are subject to a 7.5% excise tax on all domestic flights, which is collected by the IRS. The agency says that if an airline does indeed refund the ticket, a proportionate amount of any excise taxes may be refunded as well.

Cached

Can you get airport tax refund

Explain that you are not after a ticket refund but only Air Passenger Duty refund, i.e. airport tax refund. This is always refundable. The procedures for claiming a refund vary, depending on the airline. Some refund the tax automatically, while others require you to fill out a form.

Cached

How much are taxes on airline tickets

The U.S. government charges an excise tax on all domestic travel of 7.5 percent. In addition, there is a Flight Segment Tax of $4.20 per segment. Finally, passengers pay a September 11th tax of $5.60 to the federal government per one-way trip.

Cached

How can I avoid paying taxes on flights

How do you avoid taxes on flightsBook flights using a different frequent flyer program.Book flights on a different airline.Book flights from a different departure city.

What are non refundable expenses for airline tickets

Understanding 'nonrefundable'

Depending on the ticket type, often, 'nonrefundable' simply means: The airline will not give you all of your money back if you cancel (true for most basic economy tickets). The airline will not refund your ticket value as cash (it will be remitted as a voucher instead).

How much refund will I get if I cancel my flight

Most airlines offer 100% refund on flight tickets that are cancelled from their end.

How do you get a tax refund

The IRS uses direct deposit to electronically issue tax refund payments directly into taxpayers' financial accounts. In most cases, you will receive your tax refund in less than 21 days after you file your federal tax return.

Do all airlines offer refunds

Airlines are not required to offer both a hold and a refund option. Check your airline's policy before purchasing a ticket. However, if an airline accepts a reservation without payment, it must allow the consumer to cancel the reservation within 24 hours without penalty.

Is sales tax on airline tickets deductible

Airline tickets are 100 percent tax deductible, unless you are traveling internationally and spend less than 25 percent of your time on business.

Do plane tickets include tax

When you book a flight with cash or miles, expect to pay various taxes and fees. These fees may be imposed by the country in which your trip starts, the country in which your trip ends or both. The amount of these fees can vary significantly. For example, you've likely noticed a $5.60 fee for flights in the U.S.

Why are flight taxes so expensive

Airport taxes often consist of government taxes, security checks, oil prices, noise nuisance fees, and fuel surcharges. A lot of different aspects! This being the case, it is not surprising that the prices of some flight tickets are so high.

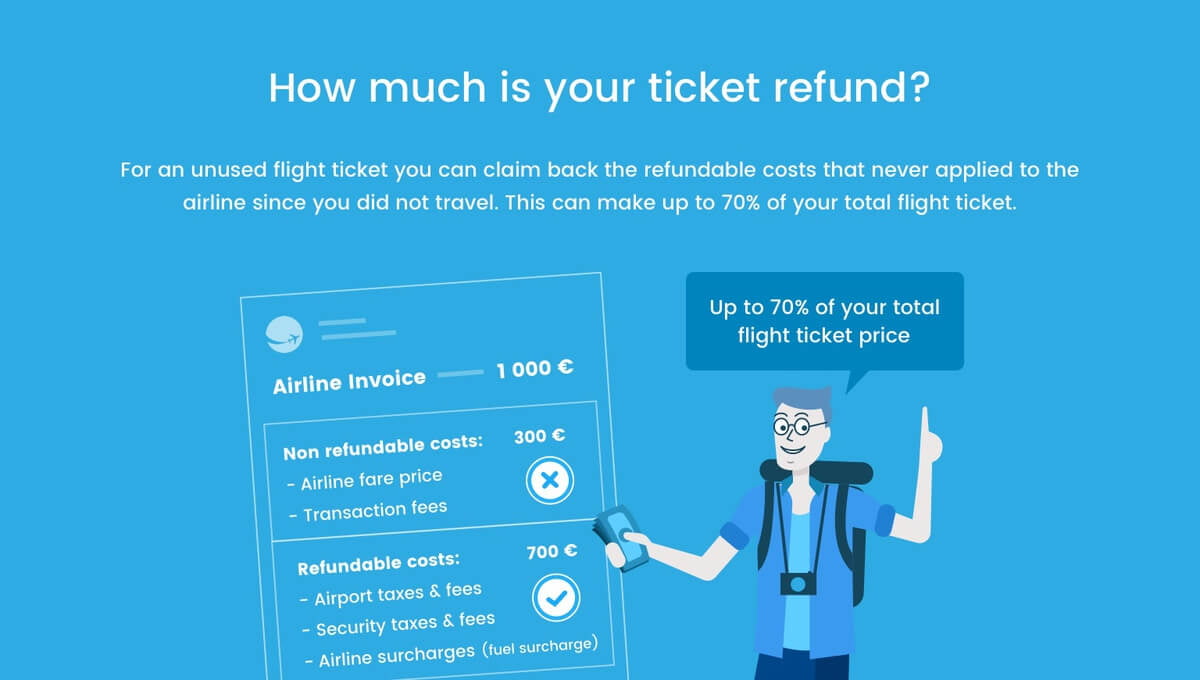

What is the difference between refundable and nonrefundable airline tickets

Some refundable tickets require the purchaser to pay an airline service fee in order to process the refund, so you won't end up getting reimbursed for the full cost of the ticket. Nonrefundable fares, on the other hand, cannot be returned for a full refund.

What is a nonrefundable ticket vs refundable

Non-refundable tickets are usually a fraction of the cost of refundable tickets and most non-refundable airline tickets are reusable (with a change fee) in the case of a cancellation. Please keep in mind that airline tickets are non-transferrable and must be used by the same person whose name is on the original ticket.

How to cancel flight ticket without cancellation charges

WHAT DO YOU GET During the booking process, select 'ZERO Cancellation' option by paying an additional fee of Rs. 99/- per passenger & enjoy ZERO penalty in case you wish to cancel the booking. To process your cancellation at ZERO penalty, logon to support.makemytrip.com and process the cancellation.

Is it possible to cancel flight ticket

Yes. You can cancel flights tickets. However, if you haven't purchased a fully-refundable ticket, you may not be entitled to a refund. In some instances, the airline may apply a cancellation fee.

Can tourists claim tax refund in USA

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government – the same way that Value Added Tax (VAT) is paid in many countries.

How does tax refund works

How a Tax Refund Works. Tax refunds usually are issued either as checks and sent by U.S. mail or as direct deposits to the taxpayer's bank account. Alternatively, taxpayers can use the refund to buy U.S. Series I Savings Bonds. The fastest way to get a refund is to e-file your tax return and choose direct deposit.

How do I know if my flight is refundable

How Do I Know My Flight Is RefundableCheck if the refundable filter is applied on the flight page.Low fare denote non-refundable tickets and high fare denote refundable tickets.Contact customer care of the airlines at 1-802-341-3403.Ask for details from the travel agent who is booking your flight ticket.

How much of a ticket is tax deductible

The cost of the ticket isn't tax-deductible – though the event's proceeds will go towards a charitable cause, the hosting organization itself isn't a non-profit.

What kind of travel is tax deductible

You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home). Deductible expenses include transportation, baggage fees, car rentals, taxis and shuttles, lodging, tips, and fees.