Are there any new tax changes for 2023?

What tax changes are coming in 2023

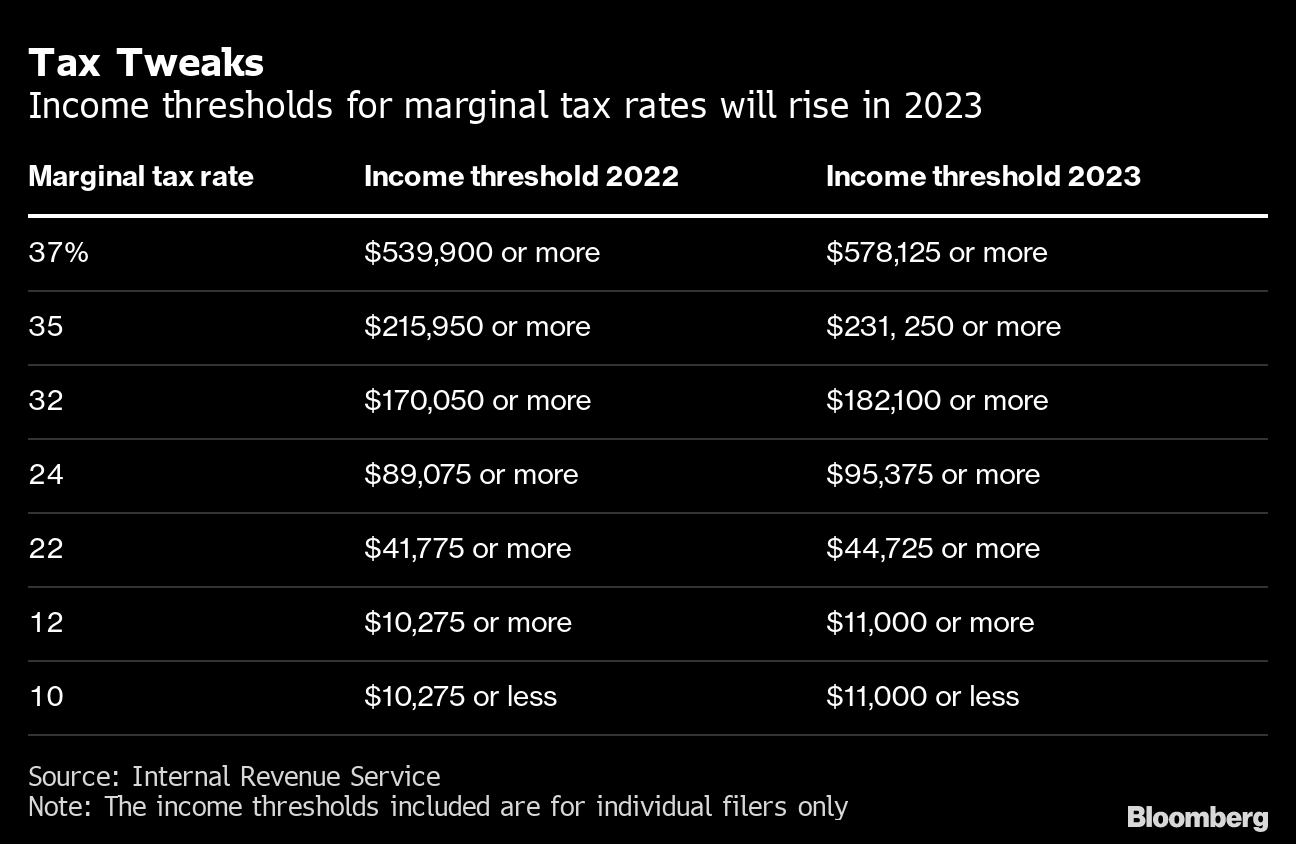

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.

Cached

Are federal taxes changing as of 2023

What are the tax brackets for 2023 The U.S. taxes income at progressively higher rates as you earn more. Those rates—ranging from 10% to 37%—will remain the same in 2023. What's changing is the amount of income that gets taxed at each rate.

Cached

Will 2023 taxes be the same as 2023

With federal tax brackets and rates, the tax rates themselves aren't changing. The same seven tax rates in effect for the 2023 tax year – 10%, 12%, 22%, 24%, 32%, 35%, and 37% – still apply for 2023.

What to expect 2023 tax refund

The IRS has announced it will start accepting tax returns on January 23, 2023 (as we predicted as far back as October 2023). So, early tax filers who are a due a refund can often see the refund as early as mid- or late February. That's without an expensive “tax refund loan” or other similar product.

Will less taxes be taken out in 2023

2023 Tax Bracket Changes

Broadly speaking, the 2023 tax brackets have increased by about 7% for all filing statuses. This is significantly higher than the roughly 3% and 1% increases enacted for 2023 and 2023, respectively.

What is the standard deduction for seniors in 2023

If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status). If you're both 65 and blind, the additional deduction amount is doubled.

What is the IRS inflation adjustment for 2023

Inflation last year reached its highest level in the United States since 1981. As a result, the IRS announced the largest inflation adjustment for individual taxes in decades: 7.1 percent for tax year 2023.

Why are tax refunds lower for 2023

The IRS previously forecast that refund checks were likely to be lower in 2023 due to the expiration of pandemic-era federal payment programs, including stimulus checks and child-related tax and credit programs.

Will refunds be bigger in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.

What is the IRS tax adjustment for 2023

How other tax provisions changed for 2023. The standard deduction also increased by nearly 7% for 2023, rising to $27,700 for married couples filing jointly, up from $25,900 in 2023. Single filers may claim $13,850, an increase from $12,950.

What are the payroll changes for 2023

For 2023, the Social Security tax wage base for employees will increase to $160,200. The Social Security tax rate for employees and employers remains unchanged at 6.2% on wages up to $160,200. Medicare tax will also apply to all wages and will be imposed at a rate of 1.45% for both employees and employers.

What are the Medicare tax rates and limits for 2023

Social security and Medicare tax for 2023.

The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2023. There is no wage base limit for Medicare tax.

What is the Social Security and Medicare tax rate for 2023

7.65 percent

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2023 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is the senior deduction for 2023

The standard deduction for those over age 65 in 2023 (filing tax year 2023) is $14,700 for singles, $27,300 for married filing jointly if only one partner is over 65 (or $28,700 if both are), and $21,150 for head of household.

What is the tax deduction for seniors in 2023

If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status). If you're both 65 and blind, the additional deduction amount is doubled.

Are people getting less tax refunds in 2023

The IRS previously forecast that refund checks were likely to be lower in 2023 due to the expiration of pandemic-era federal payment programs, including stimulus checks and child-related tax and credit programs.

What is the 2023 tax proposal

For tax years beginning after December 31, 2023, the proposal generally would impose a 25% minimum tax on the total income, including unrealized capital gains, of any taxpayer with wealth (assets minus liabilities) exceeding $100 million.

Are payroll taxes going down in 2023

The 6.2% social security tax rate — the larger part of the Federal Insurance Contributions Act (FICA) rate of 7.65% — will remain unchanged. At most, a person will pay $9,932.40 ($160,200 x 6.2%) in social security tax in 2023.

What is the federal payscale increase for 2023

Step 1: Apply the across-the-board pay adjustment to the GS-11, step 5, rate. 2023 GS rate: $64,579. 2023 locality rate: $75,041 ($64,579 x 1.1620). 2023 GS rate: $67,227 (after 4.1% across-the-board increase).

Will Medicare Part B premiums increase in 2023

The Part B basic premium in calendar year 2023 is scheduled to be $164.90 per month, or about 25 percent of expected Part B costs per enrollee age 65 or older. Premiums can be higher or lower than the basic premium for enrollees who receive Part B benefits through the Medicare Advantage program.