Are there credit scores in UK?

Does the UK have credit scores

The UK credit score system centres around three main credit reference agencies (CRAs): Experian, Equifax and TransUnion. Each one collects information from creditors and factors these into an algorithm that calculates your credit score. Each CRA uses a unique rating scale and may receive different data points.

What is credit score called in UK

There are three main credit score models in the UK, which are: Equifax, Experian and Callcredit. Each credit bureau has its own scoring system, which is why your score may be different depending on which one you use. These are called models because each one has a different way of calculating your score.

How do you find out your credit score UK

Experian is the UK's largest credit reference agency. You can access your Experian credit score by registering on the Experian website. It's quick and doesn't cost anything. To get a peek at your full credit report, you'll need to register for the free 30-day trial of Experian's CreditExpert service.

Are credit scores the same in US and UK

Many countries, including Canada and the U.K., have credit scoring systems that are similar to the American system. Yet, there is no communication between the systems. So your credit score in the U.S. will not affect your credit score in the U.K.

Cached

What countries have no credit score

Japan. In Japan, there's no formal nationwide credit system. A person's creditworthiness is typically determined by each bank, based on its relationship with the consumer. Each financial institution will look at factors like salary, length of employment and current debts to determine their level of risk as a borrower.

Is the US the only country with credit scores

Aside from the United States, countries that use credit scores include Canada, Germany, Australia, China and the United Kingdom. However, keep in mind that each credit system works a little differently so your credit score doesn't apply internationally.

What is a poor credit score UK

In the UK, having bad credit can impact how many lenders are willing to give you a credit card, mortgage or bank loan. A bad credit score with Equifax is under 379. A 'Poor' credit score with Equifax is 280-379, and a 'Very Poor' credit score is under 279.

What countries do not have a credit system

Japan. In Japan, there's no formal nationwide credit system. A person's creditworthiness is typically determined by each bank, based on its relationship with the consumer. Each financial institution will look at factors like salary, length of employment and current debts to determine their level of risk as a borrower.

Why can’t I find my credit score UK

You are under 18:Your credit score isn't usually available until you are 18 years old. You have never used credit:If you have never used credit or don't have any bills, such as energy, water or a mobile phone contract in your name, you won't be able to build a credit score.

What countries don’t use a credit score

Not all countries use credit scores to assess a debtor's creditworthiness. Japan, the Netherlands, and Spain rely on factors like one's income, repayment history, and length of employment to determine creditworthiness.

Is US credit history valid in UK

The short answer is no. For a number of reasons, and despite the fact that Experian and Equifax have bureaus in both the US and UK, your credit score is as irrelevant overseas as is your GPA after college.

Do credit scores only exist in America

If you've ever wondered “do other countries have credit scores" the answer is yes, other countries besides the United States have credit scores. Assessments of creditworthiness, however, can differ across the globe, and you may be surprised how someone's creditworthiness is determined.

What is a good credit score UK

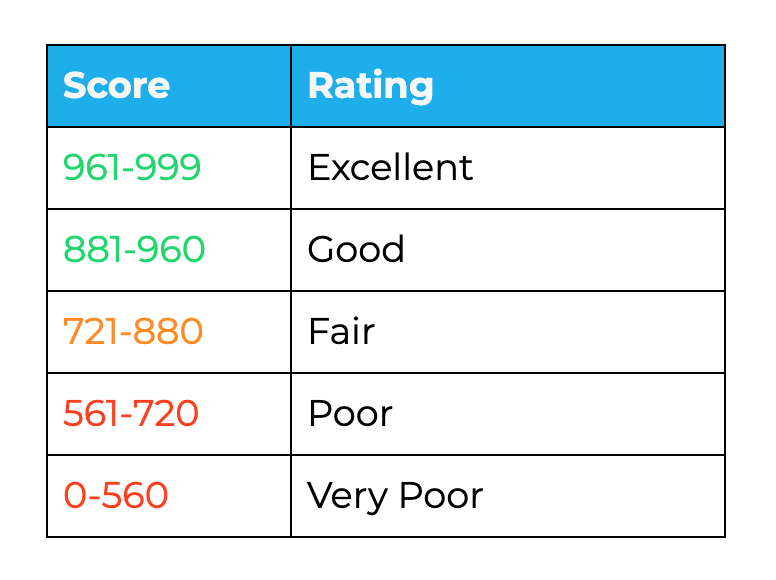

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good.

Why is my credit score 0 UK

You've not used any credit in a long time

If it's been longer than that, and you don't have any other credit accounts on your report, you might not see a credit score. It's a good idea to start building your score again – you could take out a credit builder card .

Is a credit score of 400 good UK

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 400 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

Do foreigners have credit scores

It can take immigrants with no credit several months to build a positive credit report. Generally, it takes at least three months and probably six months of activity before a credit score can be calculated. Many immigrants are able to develop a good score within a year.

Why don t I have a credit score UK

You are under 18:Your credit score isn't usually available until you are 18 years old. You have never used credit:If you have never used credit or don't have any bills, such as energy, water or a mobile phone contract in your name, you won't be able to build a credit score.

Do credit scores exist outside the US

Global credit scores currently don't exist, so you can't transfer a U.S. credit score overseas. Other countries might use their own systems to determine creditworthiness. Giving international lenders a copy of your credit report, employment history and income verification could help you build creditworthiness.

Does anyone have a 999 credit score

There's no universal number that indicates a good score because each credit agency uses a different scoring system. Experian, for example, uses a range from 0 to 999. A score of between 881 and 960 is good, between 961 and 999 your score is excellent.

What is minimum credit score in UK

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good.