Are there different routing numbers for ACH and wire?

Is ACH and wire details the same

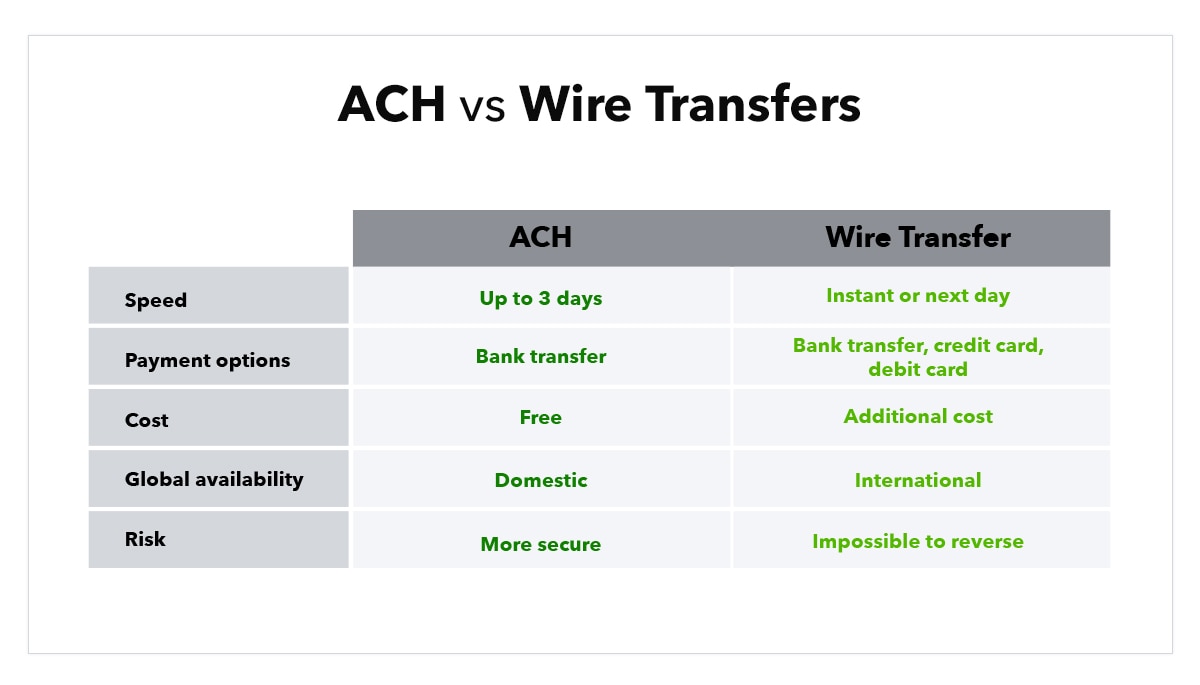

An ACH transfer goes through an interbank system for verification before it's completed. A wire transfer goes directly and electronically from one bank account to another without an intermediary system. ACH transfers typically have lower fees than wire transfers have.

Do banks have different routing numbers for ACH

Technically speaking, ABA routing numbers apply to paper checks while ACH routing numbers apply to electronic transfers and withdrawals. Most major banks today use the same routing number for both. However, it's not uncommon to see separate ABA and ACH routing numbers for regional lending institutions.

Why does my bank have 2 different routing numbers

Banks also can have separate routing numbers for different types of transactions — one for processing paper checks and another for wire transfers, for example.

Cached

Which routing number do I use for ACH

ACH stands for Automated Clearing House. To find your ACH routing number, first check your checkbook. It may be the nine-digit number to the left of your account number. ACH is an electronic money transfer system that lets individuals receive or send payments via the Federal ACH network of banks in the United States.

Cached

Which routing number to use for wire transfer

Instead, a wire transfer uses the recipient's bank account number and ABA routing number. This is a unique 9-digit number that identifies each banking institution. If you don't know your bank's routing number, you can find it using a quick internet search.

Can you use ACH for wire transfer

Availability: ACH transfers only work for domestic transactions. If you want to send funds abroad through the ACH network, you must do so using an international wire transfer.

Why are there 3 routing numbers

Your Bank might have More than One Number

While no banks will ever have the same routing numbers, one bank might have multiple numbers. Banks often have separate routing numbers per type of transaction. Make sure you use the right routing number if you are transferring via wire, sending checks online, etc.

What happens if you have the wrong routing number for a wire transfer

What Happens If A Wire Transfer Goes To The Wrong Account Transactions are usually rejected if you have entered the wrong routing number or bank account number. If the transfer goes through, it's possible to initiate wire transfer reversal by the bank to reject the transaction.

Is ABA routing number the same as wire routing number

ABA routing numbers encompass all routing numbers, including ACH numbers and domestic wire transfer numbers. So when people use the term routing number, they're typically referring to an ABA routing number. Generally, smaller banks are assigned a single routing number, while large, multinational banks may have several.

Why do I have a different routing number for wire transfers

Banks have different ACH (Automated Clearing House) and wire transfer routing numbers because ACH is U.S.-only, whereas wire transfers are international.

Can routing number 021000021 be used for ACH

The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code. Click here to see routing number for Chase in other states.

What is the difference between ABA and ACH vs wire routing number

ABA routing numbers encompass all routing numbers, including ACH numbers and domestic wire transfer numbers. So when people use the term routing number, they're typically referring to an ABA routing number. Generally, smaller banks are assigned a single routing number, while large, multinational banks may have several.

Is ABA number same as routing number for wire transfer

An ABA number (also known as routing number or routing transfer number) is a sequence of nine numeric characters used by banks to identify specific financial institutions within the United States.

What is the difference between ACH EFT and wire transfer

EFT is a versatile method of e-payment that may have longer processing times and varying fees. Wire transfers are processed in real-time and are convenient and secure, but expensive and support only one-time transfers. ACH is ideal for recurring transactions and takes 2-3 business days to complete.

What info is needed for a wire transfer

When sending a domestic bank wire, you will need to provide the recipient's name, address, bank account number, and ABA number (routing number).

Does it matter which routing number in use

If you're not sure which routing number you'll need for a particular transfer type, you should check with your bank beforehand. Careful. Using the wrong number can lead to delays in processing the transfer.

What are the three types of routing

There are three types of Routing:Static Routing.Default Routing.Dynamic Routing.

Should I use direct deposit routing number or wire transfer

Direct deposit is best for just about any payment between U.S. banks, credit unions, or other financial institutions. It's much cheaper, it's marginally more secure, and, in some cases, it can be just as fast as wire transfers.

Can a bank have 2 routing numbers

While no banks will ever have the same routing numbers, one bank might have multiple numbers. Banks often have separate routing numbers per type of transaction.

Is 021000021 a wire or ACH number

The routing number for Chase in New York is 021000021 for checking and savings account. The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code.