Can a 7 year old have a Roth IRA?

Can I open a Roth IRA for my 7 year old

There's no age limit. Even babies can contribute to a Roth IRA: The hurdle to opening this account is about earned income, not age. The child must have earned income. If a kid has earned income, they can contribute to a Roth IRA.

Cached

What is the youngest age for Roth IRA

What Is the Youngest Age You Can Open a Roth IRA There is no age threshold or limit for Roth IRAs, so anyone can open and fund an account.

What is the limit for Roth IRA for kids

IRA contributions cannot exceed a minor's earnings, e.g., if a minor earns $1,000, then only $1,000 can be contributed to the account. There's an annual maximum contribution of $6,000 per child, per year for 2023 and $6,500 per year for 2023. There is no minimum to open the account.

How do I prove my child’s income for a Roth IRA

How do I prove my child's income for a Roth IRA Ideally your child should have a W2 or a Form 1099 to show evidence of the earned income.

Cached

Can I buy my kids a Roth IRA

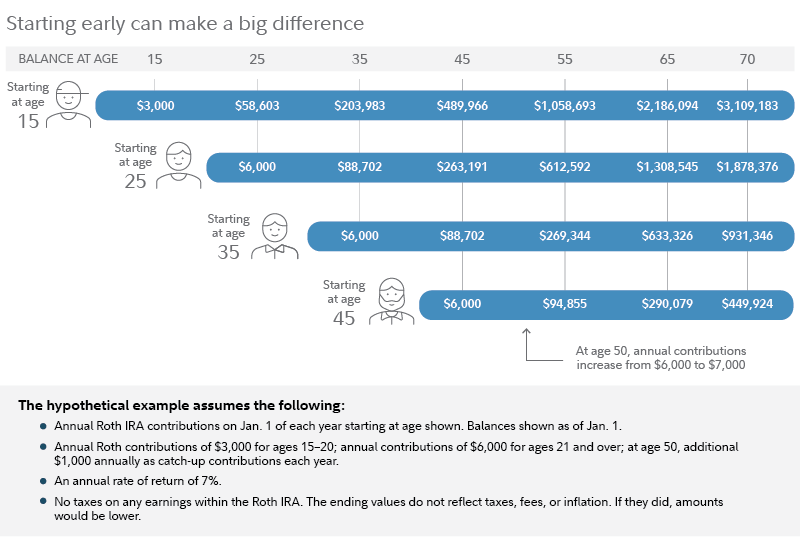

A Roth IRA for Kids can be opened and receive contributions for a minor with earned income for the year. Roth IRAs provide the opportunity for tax-free growth. The earlier your kids get started saving, the greater the opportunity to build a sizeable nest egg.

Can I open a Roth for my grandkids

The key to opening a Roth IRA for your grandchild is earned income. Your grandchild must have a job that earns a wage. That could be a traditional job where taxes are withheld from their paycheck, or it could be wages earned doing odd jobs like babysitting or mowing lawns.

Can a 6 year old open a Roth IRA

Minors cannot generally open brokerage accounts in their own name until they are 18, so a Roth IRA for Kids requires an adult to serve as custodian. The custodian maintains control of the child's Roth IRA, including decisions about contributions, investments, and distributions.

Can I open a Roth IRA for my 5 year old

A Roth IRA can be opened for a minor child who has earned income for the year. Roth IRAs can offer tax benefits, including tax-free qualified distributions in retirement. Parents maintain control of the Roth IRA until the child reaches adulthood, at which time the account is transferred to them.

Is it a good idea for kids to have Roth IRA

In general, the Roth IRA is the IRA of choice for minors who have limited income now—as it's recommended for those likely to be in a higher tax bracket in the future. "If a child keeps [a Roth] until age 59½ (under today's rules), any withdrawal will be tax-free.

Can a parent open a Roth IRA for a minor child

A Roth IRA can be opened for a minor child who has earned income for the year. Roth IRAs can offer tax benefits, including tax-free qualified distributions in retirement. Parents maintain control of the Roth IRA until the child reaches adulthood, at which time the account is transferred to them.

Can parents contribute to a Roth IRA for a child

A parent or any other adult can contribute to a child's Roth IRA, so long as the child has earned income for the year. By starting early and consistently contributing the maximum amount, your kid has a chance to secure a million-dollar Roth IRA before retirement.

Can I open a Roth IRA for my infant child

Roth IRAs do not have an age limit, meaning an account can be established for newborns as long as they have a Social Security number and compensation (which includes earned income from self-employment, discussed further below).

Can I open a Roth in my child’s name

A Roth IRA for Kids can be opened and receive contributions for a minor with earned income for the year. Roth IRAs provide the opportunity for tax-free growth. The earlier your kids get started saving, the greater the opportunity to build a sizeable nest egg.

What is the best way to give money to a grandchild

8 Ways to Gift Assets to Your GrandchildrenCash is King.Pay for educational or medical costs.Make gifts to a custodial account or a trust.Set funds aside for higher education in a 529 account.Go traditional with IRAs and savings bonds.So many ways to make a difference for your grandchildren.

What is the best IRA for a child

That means a Roth IRA is one of the best ways of saving for kids' tuition. In fact, it's one of the very best ways to save for kids' college. The IRS also allows IRA owners to withdraw up to $10,000 for the purchase of a qualified first-time home purchase.

Can a parent fund a child’s Roth IRA

Anyone can contribute to a child's Roth IRA

As long as your child meets the earned income requirement, you or anyone else can make the contribution – or a part of it — on their behalf.

Can you open a Roth IRA for a child with no income

A contribution to a Roth IRA for Kids can be made if a minor has earned income during the year. Eligible income can include formal employment income or self-employment income. Activities like babysitting or mowing lawns can qualify a minor for Roth IRA contributions.

Does my child need to file a tax return to open a Roth IRA

The deadline to make a Roth IRA contribution is April 15th following the end of the calendar year. We often get the question: "Does my child need to file a tax return to make a Roth IRA contribution" The answer is "no".

Can I open an IRA for my child

Any child, regardless of age, can contribute to an IRA provided they have earned income; others can contribute too, as long as they don't exceed the amount of the child's earned income. A child's IRA has to be set up as a custodial account by a parent or other adult.

How can my child have earned income

Earned income applies to wages and salaries your child receives as a result of providing services to an employer or from self-employment, even if only through a part-time job. However, even if your child earns less than $12,950 during 2023, it may be a good idea to file a tax return for them.