Can a business have a credit union account?

Is it better to use a credit union or a bank for a small business

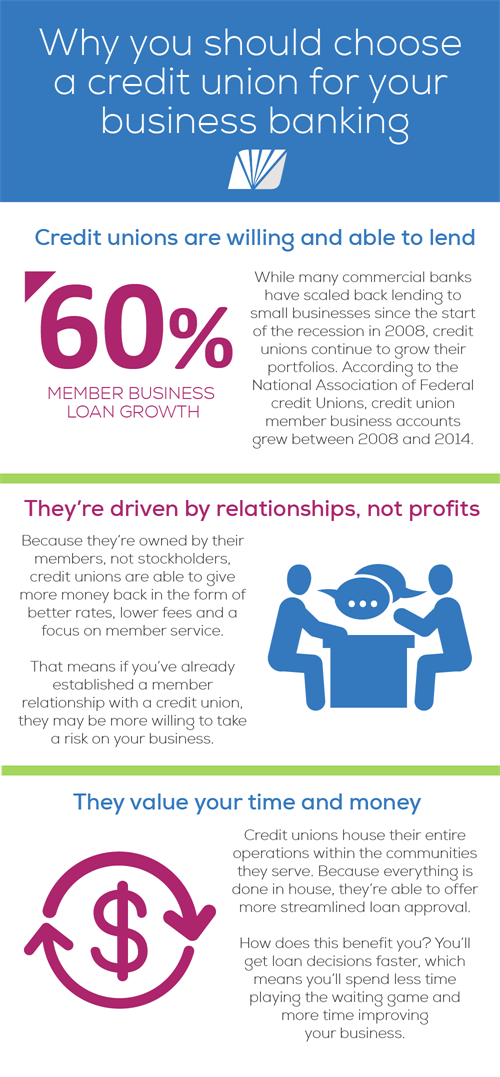

Because credit unions are not-for-profit, they generally charge fewer (or lower) fees on their business accounts. In addition, they provide more value to their members in the form of offering lower loan rates and paying higher dividends on deposit accounts. Local market knowledge.

Cached

What is a credit union in business

What is a Credit Union A credit union is a not-for-profit financial institution that accepts deposits, make loans, and provides a wide array of other financial services and products.

Can a business use a regular bank account

The quick answer is yes, you can use a personal bank account for your business, but there is more to it than that. The bank you use and the type of business you have are some of the things that it will all depend on.

Is a credit union in business to make money

Credit unions are technically not-for-profit organizations, but they still need to make money to pay expenses. How does a credit union work Credit unions are a type of financial institution that provides banking services, loans and other related financial services.

Is there a downside to a credit union

Membership required. Credit unions require their customers to be members. Account holders must meet eligibility requirements to use the products and services.

Why choose a credit union over a big bank

Credit unions typically offer lower fees, higher savings rates, and a more personalized approach to customer service for their members. In addition, credit unions may offer lower interest rates on loans. It may also be easier to obtain a loan with a credit union than a larger bank.

Why use a credit union instead of a bank

Credit unions typically offer lower fees, higher savings rates, and a more personalized approach to customer service for their members. In addition, credit unions may offer lower interest rates on loans. It may also be easier to obtain a loan with a credit union than a larger bank.

Are credit unions safer than banks

Why are credit unions safer than banks Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks. The National Credit Union Administration is a US government agency that regulates and supervises credit unions.

What kind of bank account is used by business owners

Current account

A current account is a deposit account for traders, business owners, and entrepreneurs, who need to make and receive payments more often than others.

What two types of bank accounts should business owners have

Business checking accounts. A business checking account is the most versatile and widely used form of deposit account.Business savings accounts.Business certificates of deposits (CD) accounts.Merchant accounts.Business money market accounts (MMAs)Foreign currency accounts.

How much capital do you need to start a credit union

Typically, it runs from $5,000 to $50,000 to open a credit union, depending on the state. This is because there are many fees associated with starting a credit union, including the initial application fee, chartering fees, and bonding fees. States with lower costs of living have a lower cost of starting a credit union.

How do credit unions make money if they are non profit

Banks are organized to make money for shareholders by distributing net proceeds to shareholders only. As not-for-profit organizations, credit unions distribute net proceeds in the form of lower fees, higher returns on savings rates, and lower borrowing rates. These perks apply to: Savings and checking accounts.

What is the biggest drawback of a credit union

5 Drawbacks of Banking With a Credit UnionMobile Banking Might Be Limited or Unavailable.Fees Might Not Be as Low as You Think.Credit Card Rewards Might Be Limited.ATMs and Branches Might Not Be Convenient.There Might Be Fewer Services.The Bottom Line.

What is safer a bank or credit union

Why are credit unions safer than banks Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks. The National Credit Union Administration is a US government agency that regulates and supervises credit unions.

What are the cons of a credit union

Cons of credit unionsMembership required. Credit unions require their customers to be members.Not the best rates.Limited accessibility.May offer fewer products and services.

Is your money safer in a credit union or a bank

Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks.

What are disadvantages of banking with credit unions

Cons of credit unionsMembership required. Credit unions require their customers to be members.Not the best rates.Limited accessibility.May offer fewer products and services.

What are three cons of a credit union

Cons of credit unionsMembership required. Credit unions require their customers to be members.Not the best rates.Limited accessibility.May offer fewer products and services.

What are the 5 accounts every business owner should have

Even if a business has many accounts in their books, they all fall under one of these five categories: assets, expenses, liabilities, equity, and income, or revenue.

How do you pay yourself when you own a business

Business owners can pay themselves through a draw, a salary, or a combination method:A draw is a direct payment from the business to yourself.A salary goes through the payroll process and taxes are withheld.A combination method means you take part of your income as salary and part of it as a draw or distribution.