Can a corporation claim a foreign tax credit?

How does foreign tax credit work for corporations

The corporate foreign tax credit

U.S. corporations earn foreign source income by operat- ing branches abroad and by operating or investing in affiliates incorporated abroad. If the foreign source income is earned through a foreign branch, it is subject to U.S. tax in the same tax year in which it is earned.

Cached

What is the foreign tax credit limitation for corporations

Foreign Tax Credit Limit

Your foreign tax credit cannot be more than your total U.S. tax liability multiplied by a fraction. The numerator of the fraction is your taxable income from sources outside the United States. The denominator is your total taxable income from U.S. and foreign sources.

What is not allowed foreign tax credit

The IRS states the following types of foreign taxes are not eligible for the FTC: Taxes on excluded income (for example, if you've already used the foreign earned income exclusion) Taxes refundable to you. Taxes paid to a foreign country deemed to support international terrorism.

Cached

Who is eligible for foreign tax credit

The foreign tax credit is a U.S. tax credit used to offset income tax paid abroad. U.S. citizens and resident aliens who pay income taxes imposed by a foreign country or U.S. possession can claim the credit.

Cached

Where does foreign tax credit go on 1120

Foreign taxes paid (Schedule K, line 14l)

What form is foreign tax credit for corporations

What Is Form 1118 Form 1118 lets foreign corporations report the income they already owe taxes on to a foreign government so that it can be exempted from US taxation.

What is the 80% limitation for foreign tax credit

The foreign income taxes paid are restricted to 80 percent of the product of the domestic corporation's inclusion percentage multiplied by the aggregate tested foreign income taxes paid or accrued by CFCs.

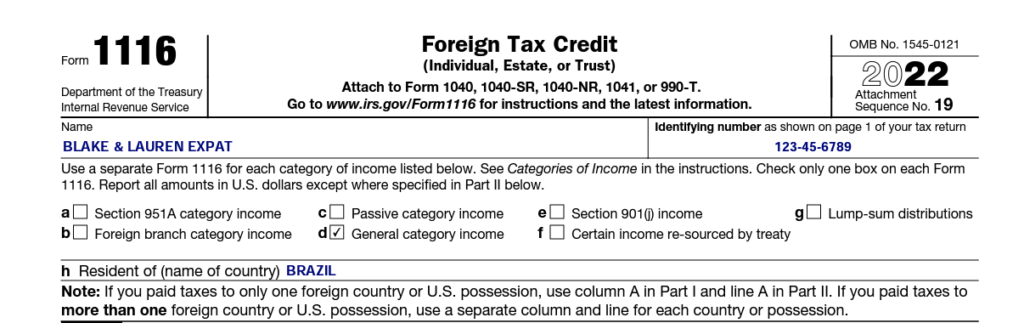

Who can claim foreign tax credit without filing Form 1116

Single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing Form 1116. But using the form enables you to carry forward any unused credit balance to future tax years; without filing Form 1116, you give up this carryover tax break.

What is the maximum foreign tax credit without Form 1116

You can claim the full amount of your foreign tax credit—without any limitation—and without even using Form 1116, provided that: Your only foreign source of gross income for the tax year is passive income such as dividends and interest.

What is the difference between a corporate foreign tax credit and a deduction

Foreign tax credit (FTC)

An FTC reduces US income tax liability dollar for dollar, while a deduction reduces the US income tax liability at the marginal rate of the taxpayer.

How do I record foreign tax credit

To claim the foreign tax credit, file IRS Schedule 3 on your Form 1040; you may also have to file Form 1116. Internal Revenue Service. 2023 Instruction 1040.

Who can claim foreign tax credit without filing form 1116

Single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing Form 1116. But using the form enables you to carry forward any unused credit balance to future tax years; without filing Form 1116, you give up this carryover tax break.

Who needs form 5471

Who files Form 5471 Any U.S. citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file Form 5471.

How to claim foreign tax credit without filing Form 1116

You can use the foreign tax credit without Form 1116 if the following apply:Your only source of foreign income for the tax year is passive income.Your qualified foreign taxes for the year are not more than $300 USD ($600 USD dollars if you're filing a joint return)

How much foreign tax credit can I claim without filing form 1116

$300

Form 1116. You must prepare Form 1116 if your qualified foreign taxes are more than $300 for a single filer ($600 for married couples filing jointly), the income is non-passive, or your gross foreign income and taxes were not reported on a payee statement (such as a 1099).

What is the exemption exception for form 1116

The Form 1116 Exemption Exception:

Form 1116 Exemption applies to individual taxpayers whose foreign tax does not exceed $300 ($600 in the case of a joint return) and their entire amount of creditable foreign tax and income is passive and reported on Form 1099, Schedule K-1 or Schedule K-3.

Can you claim foreign tax credit without filing Form 1116

To choose the foreign tax credit, you generally must complete Form 1116 and attach it to your Form 1040, Form 1040-SR or Form 1040-NR.

How to claim foreign tax credit without Form 1116

You can use the foreign tax credit without Form 1116 if the following apply:Your only source of foreign income for the tax year is passive income.Your qualified foreign taxes for the year are not more than $300 USD ($600 USD dollars if you're filing a joint return)

Does a corporation have to file 5471

Any U.S. citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file Form 5471. If you aren't sure if you qualify, you can see detailed qualifications of who is liable on pages 1-3 of the instructions for Form 5471.

What is diff between 5471 and 5472

Form 5471 is the “Information Return of U.S. Persons With Respect to Certain Foreign Corporations,” whereas Form 5472 is the Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business.”