Can a fixed interest rate go up?

Why is my fixed rate loan increasing

A change in taxes and/or insurance will affect the escrow portion of your total monthly payment, thereby increasing your total monthly mortgage payment.

CachedSimilar

Do fixed rates fluctuate

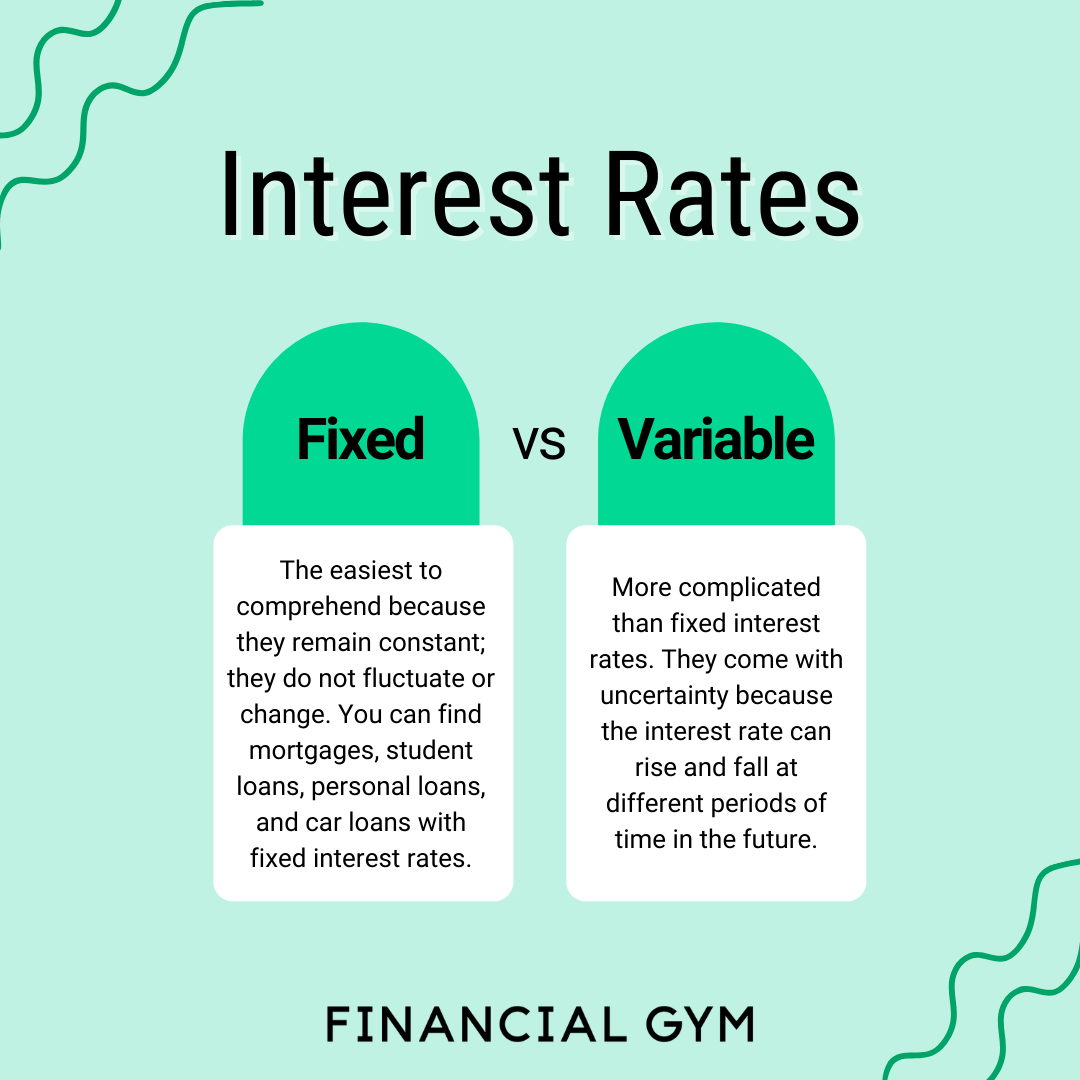

Interest rates on fixed rate loans stay the same for the loan's entire repayment term. This means the cost of borrowing money stays constant throughout the life of the loan and won't change with fluctuations in the market.

What are the disadvantages of a fixed interest rate

Less flexibility: Fixed rate loans may limit a borrower's ability to pay off their loan faster by restricting additional repayments or capping them at a certain amount a year. Significant break fees can apply if you want to refinance, sell your property or pay off your loan in full before the fixed term has ended.

Why does my interest payment fluctuate on a fixed rate

The interest charged is different due to the interest rate, the balance of the account (including any offsets), as well as the number of days in the month. As some months have more days than others, interest will either be higher or lower.

What happens to fixed interest when interest rates rise

Most bonds and interest rates have an inverse relationship. When rates go up, bond prices typically go down, and when interest rates decline, bond prices typically rise.

What happens if I pay an extra $200 a month on my mortgage

If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000. Another way to pay down your mortgage in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment.

How often do fixed mortgage rates change

With a fixed-rate mortgage, the mortgage rate and payment you make each month will stay the same for the term of your mortgage . With a variable-rate mortgage, however, the mortgage rate will change with the prime lending rate as set by your lender.

Do fixed rates change with inflation

Does inflation affect fixed-rate mortgages If you are already paying off an existing fixed-rate mortgage loan, higher inflation will not impact your payment. Your interest rate is already fixed and won't rise even if interest rates rise for new mortgages.

Is fixed interest risky

The two main risks related to fixed income investing are interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

What are the pros and cons of a fixed rate

Pros and cons of a fixed-rate mortgage

| Fixed-rate mortgage pros | Fixed-rate mortgage cons |

|---|---|

| Easy to budget for (monthly payments are always the same) | Higher monthly payments |

| No prepayment penalties | May be harder to qualify for |

| Good for long-term homeowners | May not be as good for short-term homeowners |

Can the bank change my fixed interest rate

During the time your interest rate is fixed, both your interest rate and your required repayments won't change. A variable interest rate home loan, on the other hand, can change at any time. Lenders may increase or decrease the interest rate attached to the loan.

Are fixed-rate mortgages affected by rising interest rates

Of course, if you have a fixed-rate mortgage, the rising rate will have no impact on your loan: Your interest rate and the monthly payment will remain the same. However, rising interest rates could raise your monthly payment if you have an ARM, and fixed mortgage rates may be more expensive for new home loans.

Are fixed-rate loans affected by interest rates

The interest rate on a fixed-rate loan remains the same during the life of the loan.

How to pay off a 30 year mortgage in 5 years

Here are some ways you can pay off your mortgage faster:Refinance your mortgage.Make extra mortgage payments.Make one extra mortgage payment each year.Round up your mortgage payments.Try the dollar-a-month plan.Use unexpected income.

What happens if I pay an extra $5000 a year on my mortgage

Putting extra cash towards your mortgage doesn't change your payment unless you ask the lender to recast your mortgage. Unless you recast your mortgage, the extra principal payment will reduce your interest expense over the life of the loan, but it won't put extra cash in your pocket every month.

Will my mortgage go up when my fixed rate ends

When your fixed rate mortgage comes to an end, you will automatically move onto a standard variable rate (SVR) mortgage. No matter the term of your fixed contract, the interest rate on SVR mortgages is usually a considerable increase and your monthly repayments could rise dramatically.

Can my bank change my fixed rate

Unlike a variable interest rate — which can go up or down in response to changes in the prime rate or other index rate — a fixed rate remains the same unless the lender changes it.

Will interest rates go down in 2023

1) Interest-rate forecast.

We project a year-end 2023 federal-funds rate of 4.75%, falling below 2.00% by mid-2025.

Will mortgage rates go down in 2024

Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point. Figures are the predicted quarterly average rates for the 30-year fixed-rate mortgage.

Why are fixed rates bad

Cons of a fixed-rate mortgage

It could cost more in interest over the life of the loan if you secure the loan at a higher rate and you don't refinance if rates drop. It is virtually identical from lender to lender and generally cannot be customized.