Can a kid own a debit card?

Is it legal for a 12 year old to have a debit card

Teens must share a joint account with a parent or guardian, since many banks require students to be 18 before getting an account on their own (although some banks, like Citizens, will open a standalone account for a 17-year-old; learn more here).

Cached

Can my 7 year old have a debit card

Prepaid cards are available for children as young as six years old, while the lower limit for a debit card tends to be 11. Most prepaid cards will require you to pay a monthly or yearly subscription fee, whereas kids' debit cards are free.

Cached

How old can you be to own a debit card

Generally speaking, you have to be 18 years old to get a debit card, just as you would with a credit card. However, online banks, mobile apps, and credit unions offer joint accounts to help teens navigate the world of present-day banking solutions.

Can I get my 8 year old a debit card

If the teen is under 18 years of age, there typically needs to be a joint account holder (parent or guardian) who is at least 18 years old to sign up for an account.

Can you get a debit card at 6

The minimum age to open a bank account can vary by bank or credit union and go even younger. Chase, for example, offers a bank account for kids as young as 6 that includes a debit card. Parents must be current Chase customers to open the account, and they will own the account.

Is it OK for a 10 year old to have a debit card

Typically, a child becomes eligible for a debit card when they turn 13 and their parent or legal guardian can open a joint checking account with a teen. That said, many banks, credit unions and online financial companies allow kids as young as 6 to get debit cards.

Can I get my 10 year old a debit card

Most teen debit cards are designed as mobile-first applications, with the ability to sign up online. If the teen is under 18 years of age, there typically needs to be a joint account holder (parent or guardian) who is at least 18 years old to sign up for an account.

How much is a debit card

Debit cards are usually a perk of checking accounts, and maintaining those accounts may require a monthly fee of roughly $10 to $15. At many banks, these fees are waived if you maintain a certain minimum monthly balance or authorize direct deposits into your account.

Can a 5 year old have a debit card

Typically, a child becomes eligible for a debit card when they turn 13 and their parent or legal guardian can open a joint checking account with a teen. That said, many banks, credit unions and online financial companies allow kids as young as 6 to get debit cards.

Are debit cards free

Debit cards themselves typically don't have fees, but the linked checking account can come with a variety of fees, including: monthly account maintenance fees (if minimum balance requirements aren't met), ATM fees, foreign transaction fees and overdraft fees.

Can a 1 year old have a debit card

Typically, a child becomes eligible for a debit card when they turn 13 and their parent or legal guardian can open a joint checking account with a teen. That said, many banks, credit unions and online financial companies allow kids as young as 6 to get debit cards.

Should you give a 6 year old a debit card

A: “This is largely a decision by the parent about what is right for their family. Research shows kids can develop their attitudes and habits towards money as young as 7 years old, so between the ages of 7 and 13 is a great time to get started.

Can kids have Cash App

Anyone 13+ can create a Cash App account. Customers 13-17 can get access to expanded Cash App features in the US with a sponsored account.

Can a 12 year old use Apple pay

If you're less than 13 years old, you can't add a card to Wallet to use with Apple Cash. Apple Cash services are provided by Green Dot Bank, Member FDIC.

Is it free to own a debit card

Though many credit cards charge an annual fee, debit cards don't. There's also no fee for withdrawing cash using your debit card at your bank's ATM. Credit cards, on the other hand, can charge a cash advance fee plus a steep interest rate for that convenience.

Is a debit card free money

Debit cards themselves typically don't have fees, but the linked checking account can come with a variety of fees, including: monthly account maintenance fees (if minimum balance requirements aren't met), ATM fees, foreign transaction fees and overdraft fees.

What card can a 12 year old get

Comparing card fees and age restrictions

| Card | Monthly fees | Age |

|---|---|---|

| GoHenry Debit Card | $5 for one child; $10 for up to four children | 6 to 18 |

| Step Debit Card | None | Any |

| BusyKid Debit Card | $4 | Any |

| Axos First Checking | None | 13 to 17 |

Can I get a debit card at 13

How old do you have to be to get a debit card You can get a debit card from the age of 13 at most US banks when a parent or guardian opens a joint checking account on the child's behalf. These typically come with a contactless debit card or a cash card they can use to make ATM withdrawals.

Should I get my 10 year old a debit card

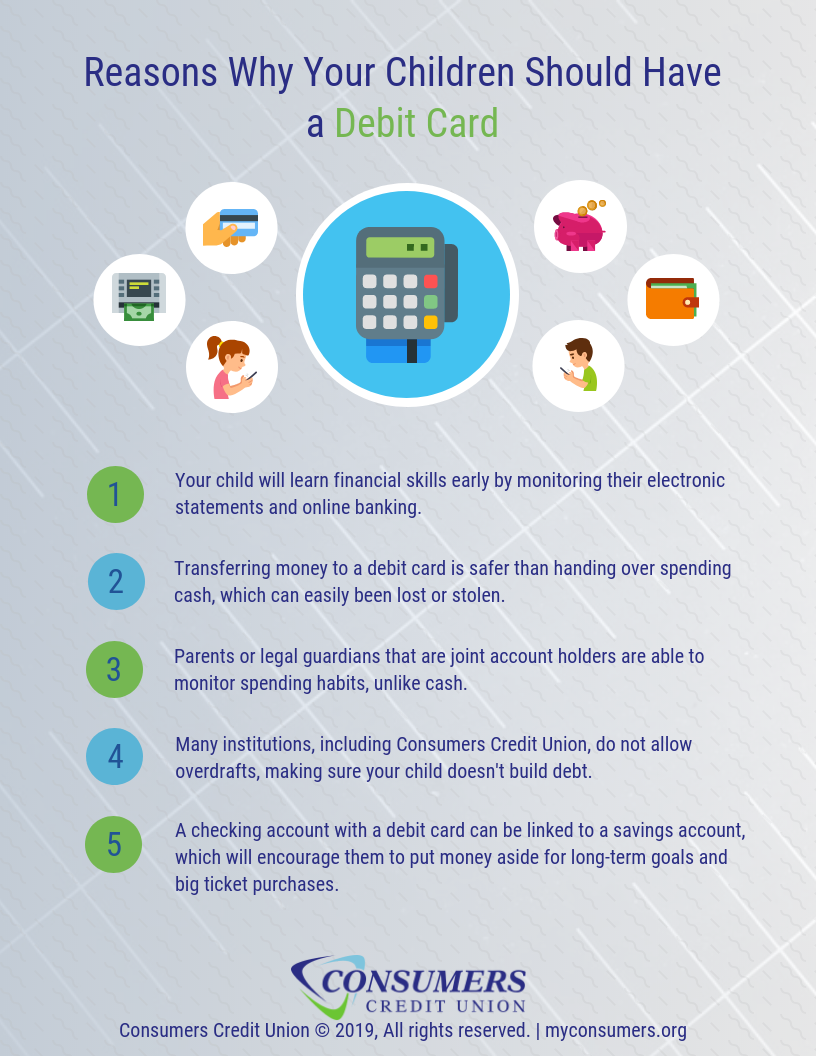

Giving your child a debit card can help them develop good financial habits. For example, a debit card can be a helpful way for kids to explore the basics of: Tracking expenses with banking apps, online tools, and text alerts. Creating a plan for monthly spending using allowance and earnings.

Can a minor have venmo

The account will require parents to sign up on behalf of their teenagers. Once approved, you can get a teen debit card and parents will be able to send money to their children through the Venmo app. Venmo's regular user agreement specifically requires users to be at least age 18.