Can a money order be rejected?

Why would a money order be rejected

A money order may not be cashed if there is even just one small mistake on it, such as an incorrect date or unreadable writing. You should write your name and the month(s) you are paying for on the actual money order. You should always keep a copy of your actual money order.

Cached

What happens if money order is rejected

Because money orders are prepaid, they can't be rejected for insufficient funds.

Cached

Are money orders guaranteed

To obtain a cashier's check or a money order, the full amount must be paid to the issuer upfront, so there's no risk of the payment bouncing. A cashier's check or money order is guaranteed and can be redeemed only by the payee.

Can a money order get canceled

You cannot stop payment on postal money orders, but a lost or stolen money order can be replaced. Money order loss or theft may take up to 30 days to confirm. Investigating a money order's lost or stolen status may take up to 60 days.

Can a money order can never bounce

Money orders are another alternative to paying with a personal check, cash or cards. A money order is a prepaid check that isn't tied to a bank account. And because money orders are prepaid, the funds are guaranteed. So like a cashier's check, money orders also can't bounce.

Do you have to verify a money order

Before depositing a money order, always verify the funds. Call the phone number or website listed on the document. For Western Union money orders, you can call (800) 999-9660. You should also look for signs of forgery.

Do money orders bounce back

Many recipients prefer money orders because, unlike a personal check, a money order can't “bounce” and clears almost immediately; therefore, they provide a fast, risk-free form of payment.

Do they verify money orders

If the money order seems suspicious, call the U.S. Postal Service Money Order Verification System at 866-459-7822.

What are the risks of money orders

There's no risk of a money order bouncing, and if it's lost or stolen, you can often receive a refund or cancel it.

Can a bank refund a money order

There's no risk of a money order bouncing, and if it's lost or stolen, you can often receive a refund or cancel it.

Why can’t money order bounce

Like a check, only the recipient can cash it. You don't want to bounce a check. Money orders are prepaid, so there's no chance that the bank can return it due to insufficient funds in the sender's account.

Can a money order ever bounce

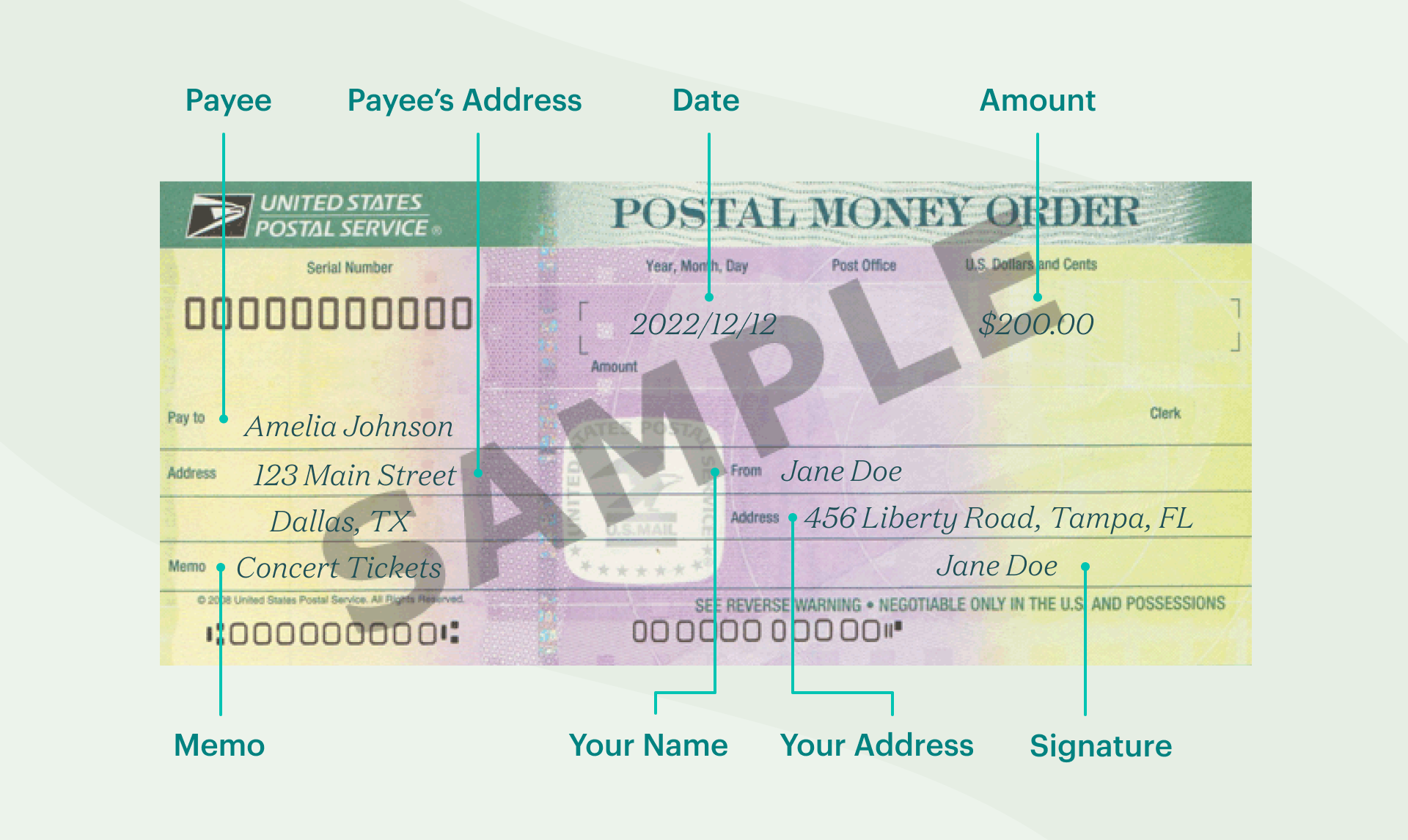

Unlike a check, money orders can't bounce. You purchase a money order with cash or another guaranteed form of payment, such as a traveler's check or debit card. When purchasing a money order, you must provide the payee's name (the recipient), and the issuing financial institution's name must be on the order.

How do they verify money orders

Check that the proper security features are present: n When held to the light, a watermark of Benjamin Franklin is repeated from top to bottom on the left side. n When held to the light, a dark line (security thread) runs from top to bottom with the word “USPS” repeated.

Do money orders clear immediately

Faster and safer deposits cost more

The cashier's check and money order cleared the fastest — the money was immediately available since both of them are considered guaranteed funds.

Do money orders get flagged

However, for individual cashier's checks, money orders or traveler's checks that exceed $10,000, the institution that issues the check in exchange for currency is required to report the transaction to the government, so the bank where the check is being deposited doesn't need to.

How long does it take for a money order to clear

Present your ID and the money order to the teller or clerk. Receive payment. If the order is deposited into a bank account, it may take a couple days for the funds to become available.

Is accepting a money order safe

Assuming you have a legitimate money order, accepting it as a form of payment is free of risk because the sender has already provided the funds. By contrast, a personal check is accepted in good faith that the sender's bank account has sufficient funds or overdraft protection to cover the check.

Can a money order bounce back

Many recipients prefer money orders because, unlike a personal check, a money order can't “bounce” and clears almost immediately; therefore, they provide a fast, risk-free form of payment.

How do I know if my money order went through

Customers wanting to find out if a money order has been cashed may go online to USPS.com to check the status. They will need to enter the money order serial number, Post Office number, and issued amount—all printed on the money order receipt—in order to obtain near real-time status information.

How long do money orders take to process

Present your ID and the money order to the teller or clerk. Receive payment. If the order is deposited into a bank account, it may take a couple days for the funds to become available.