Can a removed collection come back?

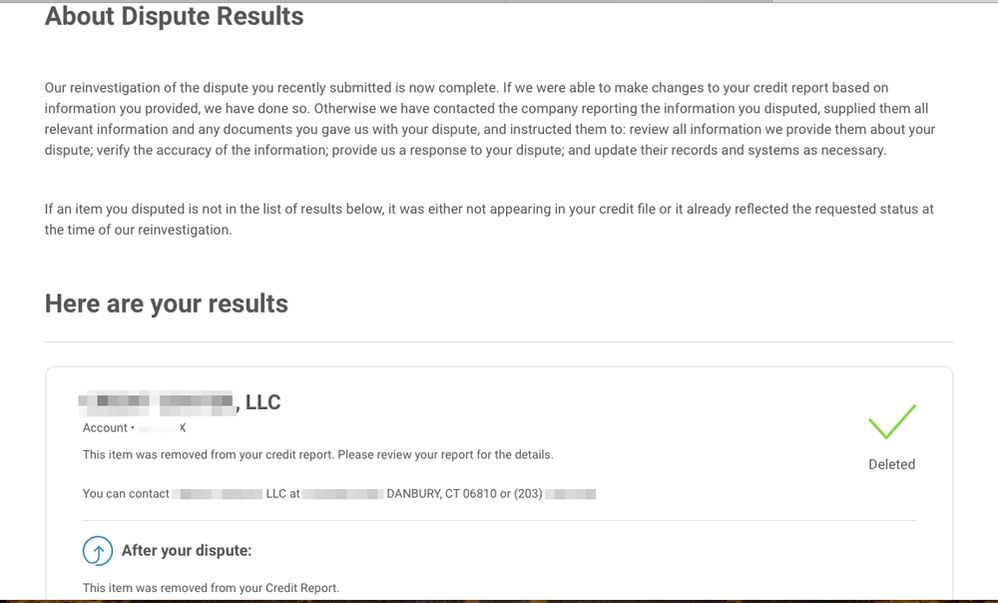

What happens after a collection is removed from credit report

Following up after removing collections from credit reports

Credit bureaus are legally required to disclose the results of their investigations, and they have 30 days to investigate a credit report error in most cases. Creditors aren't required to respond to your request for goodwill deletion, but you can ask.

Cached

Can a collection be reopened

Debt collectors can restart the clock on old debt if you: Admit the debt is yours. Make a partial payment. Agree to make a payment (even if you can't) or accept a settlement.

Do I still have to pay removed collections

If the collection was legitimate, it is unlikely that you will be able to remove it from your credit reports. In this case, you should still pay your collection. This shows future lenders that you take your debts seriously. Then you simply have to wait for the account to be removed from your credit report in due time.

Cached

Does removing a collection drop your score

If you already paid the debt: Ask for a goodwill deletion

A record of on-time payments since the debt was paid will help your case. Your credit record will still show the late payments leading up to the collection action, but removing the collection itself takes away a source of score damage.

Cached

Can a removed debt be put back on your credit report

If a removed item reappears on your credit report, the credit bureau is required to send you a five-day reinsertion notice. If you believe the reinserted item shouldn't be on your report, you have the same rights to redispute the information with the credit reporting agency, the furnisher, or both.

Why didn t my credit score go up after collections were removed

It is not uncommon for credit scores to drop after paying off a collection account. There are several factors as to why your credit score dropped. The first is to look at the age of the debt. The older the date of the debt, the less impact it has on your credit score.

Can a collection agency close an account then reopen it

If your creditor closed it, you can ask if it'll reopen the account, but it's not required to.

Can a collection agency restart your account

Collection activities can restart, though, after the debt collector sends verification responding to the dispute. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2023.

Is it better to have a collection removed or paid in full

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years.

How many points will my credit score increase if a collection is deleted

One of the ways to delete a collection account is to call the collection agency and try to negotiate with them. Ask them to delete the collection in exchange for paying off your debt. Also, get the agreement in writing. If they accept it, your credit could increase by as much as 100 points.

How much does credit go up when collection is removed

One of the ways to delete a collection account is to call the collection agency and try to negotiate with them. Ask them to delete the collection in exchange for paying off your debt. Also, get the agreement in writing. If they accept it, your credit could increase by as much as 100 points.

What happens when a collection is removed from credit report after 7 years

After seven years, that negative information will automatically drop off your credit report, even if a collection agency has assumed the debt.

Can you settle a debt and have it removed

You can agree to settle your account and partially pay your balance if your creditor agrees to delete the delinquency from your credit report. Many credit repair or debt settlement companies specialize in settling accounts.

How much will my credit score go up if a collections is removed

One of the ways to delete a collection account is to call the collection agency and try to negotiate with them. Ask them to delete the collection in exchange for paying off your debt. Also, get the agreement in writing. If they accept it, your credit could increase by as much as 100 points.

How long will it take for my credit score to improve after a collection is removed

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Can a debt go to collections twice

For example, if a collector is unable to make satisfactory arrangements with a consumer after a few months, the individual debt may be bundled with many others and sold to another collection agency. That process can be repeated many times over, even beyond the applicable statute of limitations for the consumer's debt.

Does disputing a collection restart the time

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

How much will my credit score increase if a collection is removed

Generally, the boost to scores can range from 50 to 100 points or more. However, this does not happen overnight and may take a few months to reflect. To further improve scores over time, it is important to keep up with smart credit habits such as making payments on time and having a low credit utilization ratio.

Why didn t my credit score go up after a collection was removed

It is not uncommon for credit scores to drop after paying off a collection account. There are several factors as to why your credit score dropped. The first is to look at the age of the debt. The older the date of the debt, the less impact it has on your credit score.

What happens if all debt is Cancelled

In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must pay, the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs.