Can a school deny a parent PLUS loan?

Can my school deny my loan

If you're wondering: can you be denied a federal student loan, the answer is yes. Even if you complete the Free Application for Federal Student Aid (FAFSA), approval is not always guaranteed.

Cached

Why would a parent PLUS loan be denied

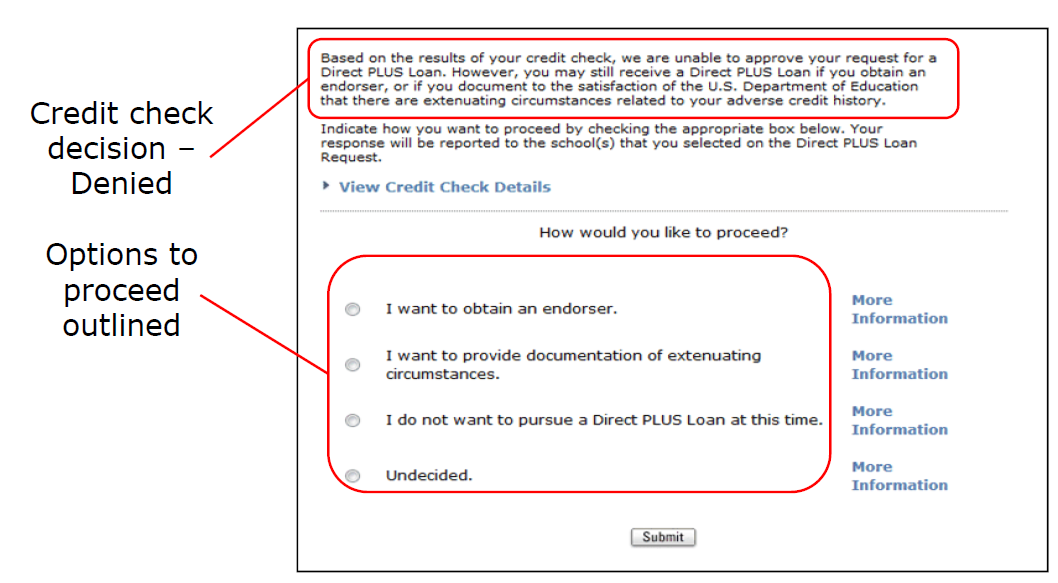

An applicant can be disqualified and denied a PLUS loan for credit problems like recent bankruptcies, large debts more than 90 days delinquent, a recent wage garnishment or a tax lien. READ: 4 Things Borrowers Don't Always Know About Parent PLUS Loans.

Cached

Can a school reject a parent PLUS loan

Parent PLUS Loans are federal loans available to parents of students. There are credit-related requirements in order to qualify for a PLUS loan, so in some cases, it is possible to be denied for a Parent PLUS Loan.

Do you have be approved for a parent PLUS loan

To be eligible for a Direct PLUS Loan for parents, you must be a biological or adoptive parent (or in some cases a stepparent), not have an adverse credit history, and meet the general eligibility requirements for federal student aid (which the child must meet as well).

What is the maximum amount for a parent PLUS loan

Unlike other types of federal student loans, Parent PLUS Loans have virtually no limits when it comes to borrowing. You can borrow up to the cost of attendance minus any other financial aid received.

What disqualifies you from student loans

You're not making satisfactory academic progress at your school. You've defaulted on an existing federal student loan. You owe a refund on any previous federal grants. You're enrolled in an academic program that makes you ineligible for funding.

What is the maximum parent PLUS loan amount

Additional Information

| Max Loan Length | 30 years, depending on amount borrowed and repayment plan chosen |

|---|---|

| Max Loan Amount | $2,625 to $8,500 |

| Payment Frequency | Monthly |

| Prepayment Penalties | None |

| Fees | Up to 4% of the loan |

Will parent loans be forgiven

If you're still making payments on your Parent PLUS Loan after 25 years of on-time payments (for a total of 300 payments), the remaining balance of your loan will be forgiven.

Can a parent PLUS loan be Cancelled

After your loan is disbursed, you may cancel all or part of your loan within certain time frames. Your promissory note and additional information you'll receive from the school will explain the procedures and time frames for canceling your loan. We're here to help.

How hard is it to get a parent PLUS loan

No minimum credit score is needed to get a parent PLUS loan. Federal loans aren't like private parent student loans, which use your credit score to determine whether you qualify and what interest rate you'll receive. But parent PLUS loans do have a credit check, and you won't qualify if you have adverse credit history.

What GPA do you need for a parent PLUS loan

Eligibility for Federal Parent PLUS Loans

Dependent student must be making satisfactory academic progress, such as maintaining at least a 2.0 GPA on a 4.0 scale in college. Parent and dependent student aren't in default on a federal student loan or grant overpayment.

Are parent PLUS loans forgiven after 10 years

Parent PLUS Loans can be forgiven when you retire

Parent PLUS Loan borrowers can have their debt forgiven after 10 years of working full-time for the government, nonprofit, or other qualifying employers.

What is the minimum payment on a parent PLUS loan

The monthly payment is set at 20% of your discretionary income, which is defined as the amount by which your income exceeds 100% of the poverty line. After 25 years of payments under income-contingent repayment, the remaining balance will be forgiven.

What is the highest income to qualify for financial aid

Did You Know There is no income cut-off to qualify for federal student aid. Many factors—such as the size of your family and your year in school—are taken into account.

What is not eligible for student loan forgiveness

What student loans are not eligible for forgiveness Private student loans, by definition, are private and are not eligible to be forgiven. These are loans the borrower owes to student loan providers and not the federal government.

What are disadvantages of PLUS loans

Cons of Parent PLUS LoansMultiple delinquent debts.Debt that's in default.Wage garnishment.Foreclosure or repossession.Tax lien.Debt discharge in bankruptcy.

Will Biden forgive parent plus student loans

Some parent PLUS loan borrowers would qualify for student debt cancellation under President Joe Biden's proposal, which remains in legal limbo. Single parents who earn up to $125,000 per year and married parents earning up to $250,000 per year stand to have $10,000 in debt erased.

How do I get rid of a parent PLUS loan

Can my loan ever be discharged Your Parent PLUS Loan may be discharged if you die, if you (not the student for whom you borrowed) become totally and permanently disabled, or, in rare cases, if you file for bankruptcy. Your Parent PLUS Loan may also be discharged if the child for whom you borrowed dies.

Will Biden cancel parent PLUS loan debt

Some parent PLUS loan borrowers would qualify for student debt cancellation under President Joe Biden's proposal, which remains in legal limbo. Single parents who earn up to $125,000 per year and married parents earning up to $250,000 per year stand to have $10,000 in debt erased.

What is the average payment for a parent PLUS loan

From 2009 to 2023, the amount of Parent Plus loan money flowing to public universities each year more than doubled, to $6.6 billion, and the average yearly loan taken increased by 45 percent, to more than $14,000.