Can a US citizen have a Swiss bank account?

Is it legal for a US citizen to have a Swiss bank account

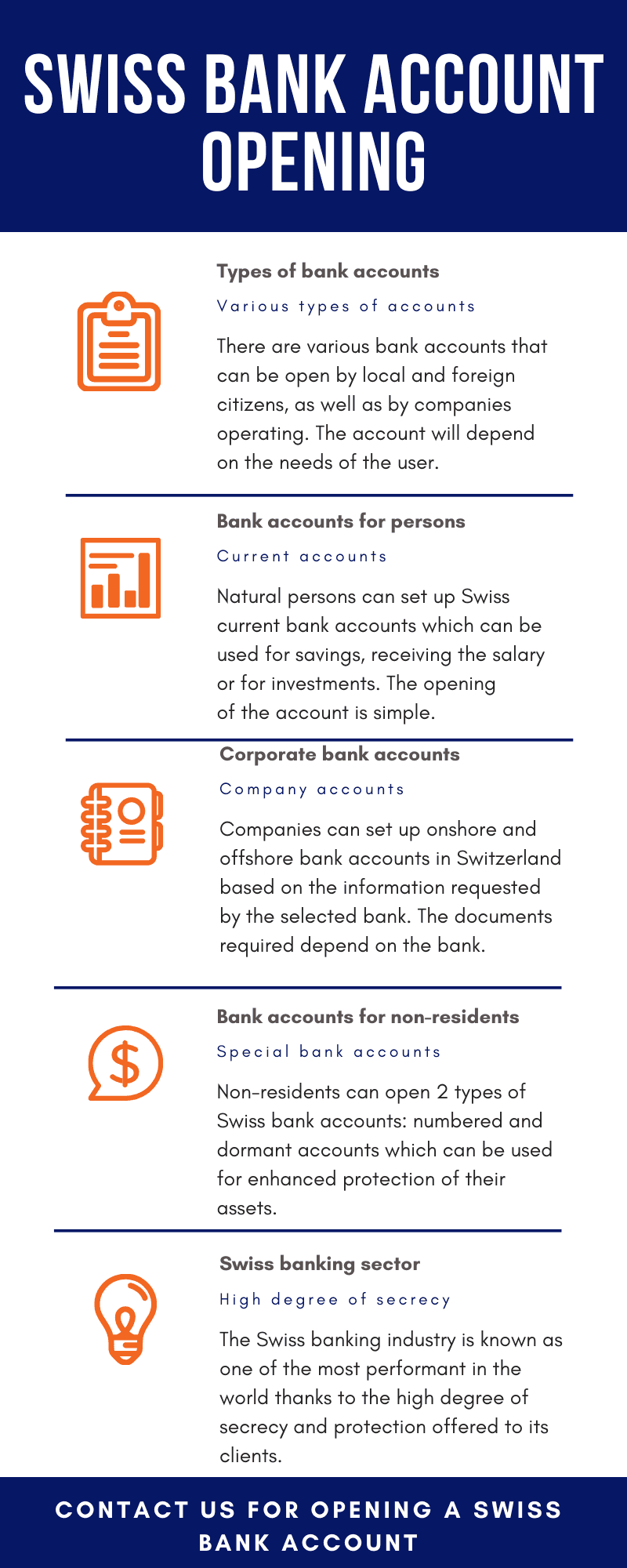

Residents of almost any country worldwide can open Swiss bank accounts and Switzerland is indeed one of the most renowned countries when it comes to opening accounts for foreign nationals. A Swiss bank account still offers security and privacy.

How much money do you need to open a Swiss bank account

If you're interested in opening a personal Swiss bank account, please note that the bank requires a minimum deposit of CHF 5,000 to accept your application for consideration.

Which Swiss bank is best for US citizens

Best Banks in SwitzerlandUBS Group AG. UBS Group AG was founded in 1998 after merging the Union Bank of Switzerland with the Swiss Bank Corporation.Julius Baer.Raiffeisen Switzerland.Banque Cantonale de Genève (BCGE)Credit Suisse Group AG.EFG International.Bank J.Zurich Cantonal Bank.

Do Swiss banks report to the IRS

As of 2023, information about your Swiss bank account must be handed over to the IRS in the United States. The IRS is responsible for collecting taxes and assessing the wealth of Americans, even wealth held in Swiss bank accounts must be accounted for.

Cached

Why can’t Americans get Swiss bank accounts

Any adult U.S. citizen is legally allowed to open a Swiss bank account. However, you can't do that anonymously. Even though there aren't taxes for accounts in Switzerland, American citizens must report their Swiss bank accounts to the Internal Revenue Service.

Why can’t Americans have Swiss bank accounts

As a US expat, you may face restrictions when seeking to open a Swiss bank account, even if you have a residence permit. Since the Foreign Account Tax Compliance Act (FATCA) was brought in, US citizens in Switzerland have been facing strict regulations in terms of the Internal Revenue Service.

What are the benefits of owning a Swiss bank account

The main benefits of Swiss bank accounts include low levels of financial risk and high levels of privacy. Swiss law prevents the bank from disclosing any information regarding an account (even its existence) without the depositor's permission, except in cases where severe criminal activity is suspected.

How do I qualify for a Swiss bank account

If you're looking to open a bank account in Switzerland, the documentation you'll need is:A valid passport,Verification of the origin of your income (this could be a statement from your last bank),Confirmation of the address you listed (they might choose to send some mail to your address to verify this).

Why can’t Americans open Swiss bank account

Any adult U.S. citizen is legally allowed to open a Swiss bank account. However, you can't do that anonymously. Even though there aren't taxes for accounts in Switzerland, American citizens must report their Swiss bank accounts to the Internal Revenue Service.

Why do Americans want Swiss bank accounts

The main benefits of Swiss bank accounts include low levels of financial risk and high levels of privacy. Swiss law prevents the bank from disclosing any information regarding an account (even its existence) without the depositor's permission, except in cases where severe criminal activity is suspected.

Why do the rich have Swiss bank accounts

After the Banking Law of 1934 was passed, Swiss bankers traveled across Europe to advertise the country's banking secrecy during World War II. As European countries began to increase taxes to finance the war, wealthy clients moved their holdings into Swiss accounts to avoid taxation.

Do Swiss banks pay interest

The average interest rate across all Swiss savings accounts for adults is currently 0.5 percent. But the actual annual interest rates at individual banks range between 0 and 1.65 percent.

Why is getting a Swiss bank account hard

Personal eligibility: Swiss banks value integrity and reputation, so they want to avoid association with scandals such as deposits for money laundering purposes. Even if you meet nationality and age requirements, having a criminal background could make you ineligible to open an account.

Should I put my money in a Swiss bank account

Investing your savings in countries with a well-functioning legal system, such as Switzerland, is a great way to diversify your political risks legitimately and legally. Doing this will help ensure your money is invested in solid, well-capitalized institutions. Tax evasion makes Swiss bank accounts illegal.

Can you cash a US check in Switzerland

Most Swiss banks will only cash or deposit personal checks for their own customers. In addition to fees, you should also pay attention to currency exchange rates if you cash or deposit a USD check in Swiss francs (or withdraw CHF from a Swiss USD account).

What are the disadvantages of a Swiss bank account

High Fees Charged by Swiss Banks

That's because banks here tend to charge much higher fees than elsewhere. The fees that you might encounter in Switzerland include fees for opening accounts, initial due diligence, account maintenance, sending and receiving transactions, and foreign exchange.

Is your money safe in a Swiss bank

Swiss banks are some of the safest banks in the world. There are banks with over $300 billion in assets and banks that are over 300 years old. Very strict laws ensure that the bank hold assets in proportion to the deposits on hand. The asset-to-deposit requirements are some of the most heavily enforced.

Why is a Swiss bank account so special

The main benefits of Swiss bank accounts include low levels of financial risk and high levels of privacy. Swiss law prevents the bank from disclosing any information regarding an account (even its existence) without the depositor's permission, except in cases where severe criminal activity is suspected.

Why would someone have a Swiss bank account

Most foreigners don't use Swiss banks for everyday accounts. You may get debit and credit cards for spending, but the main benefits of private Swiss accounts are the stability of the banking system and privacy.

What is the safest Swiss bank

UBS is now 'the world's safest bank' for depositors because Switzerland has made it too big to fail, analyst says | Business Insider India.