Can an ITIN be verified?

How do I verify my ITIN number

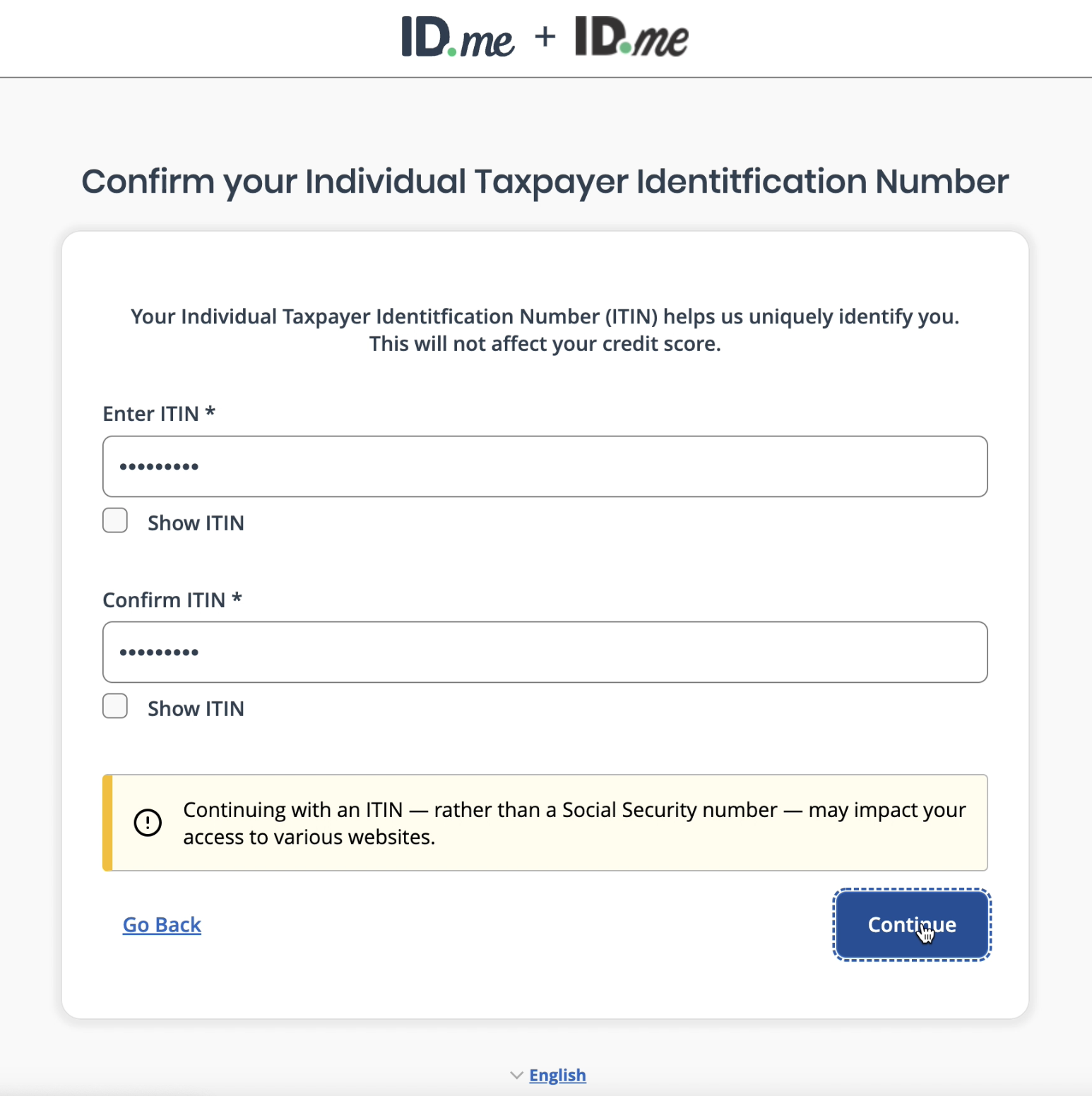

Verify with ITINWhen prompted to enter your SSN, select Continue by entering your Individual Taxpayer Identification Number (ITIN).Enter and confirm your ITIN, then select Continue and follow the prompts to complete your verification.Continue to verify over a video call.

Cached

Can you look up a TIN number

The IRS is the ultimate resource for looking up a tax ID number. There is a business and specialty department reachable Monday-Friday from 7 am – 7 pm EST. Their number is 800-829-4933.

Can an employer hire someone with an ITIN

Do not accept an ITIN in place of an SSN for employee identification or for work. An ITIN is only available to resident and nonresident aliens who are not eligible for U.S. employment and need identification for other tax purposes.

What can someone do with a ITIN number

ITINs do not serve any purpose other than federal tax reporting. An ITIN does not: Authorize work in the U.S. Provide eligibility for Social Security benefits.

How do I verify a TIN

Follow the steps below to check the TIN Match status for your entity:Login to your Tax1099 account.Enter the Business Name, TIN Number, and submit the TIN verification data.View the TIN Match report and check the TIN Number search status.

Can I verify my identity for IRS online

Enter your current address when verifying your identity with ID.me, even if this isn't the same address that you used on your tax return. ID.me must be able to verify your address as part of the identity verification process. After verifying your identity, you must also answer IRS questions about your tax return.

How do I verify someone’s TIN

If the legal name and the TIN/EIN provided by the payee match the IRS TIN and legal name records, then it's a TIN Match. If the payee/vendor provides an incorrect TIN, the IRS TIN match system would notify you that the entered information is incorrect.

Can I verify a tax ID number online

Anyone can access this information directly from the IRS. As such, a nonprofit must provide you the EIN upon request, and you can verify this directly with the IRS on the Exempt Organization page of the IRS website. The site not only verifies EINs but advises you if organizations are in good standing with the IRS.

How do I hire an employee with an ITIN number

An Individual Taxpayer Identification Number (ITIN) is insufficient for verifying an individual's right to work. If you've hired workers who don't have a Social Security Number, you can file them as a 1099 contractor using their Individual Taxpayer Identification Number (ITIN).

Can I work at Walmart with an ITIN number

Can you work in the U.S. with an ITIN number Employers cannot legally hire individuals as employees unless they have a valid SSN.

What does an ITIN number do for illegal immigrants

While undocumented individuals may not qualify to file and pay taxes with a social security number, they can obtain an Individual Taxpayer Identification Number (ITIN). An ITIN works like a social security number for the purpose of filing taxes only.

Can ITIN number be used instead of SSN

The ITIN cannot be used in place of an SSN (if eligible for the latter) for tax and wage reporting. How do I apply for an ITIN Submit a completed IRS Form W-7 Application for IRS Individual Taxpayer Identification Number, along with documentation to substantiate your foreign status and true identity, to the IRS.

Can I verify a TIN number online

There are two TIN matching options offered through e-Services: Interactive TIN Matching – verify up to 25 name/TIN combinations and results will be received immediately. The user can input name/TIN combinations in groups of 25; there is a limit of 999 requests during a 24 hour period.

What is the fastest way to verify my identity with the IRS

Go to Identity and Tax Return Verification Service to verify your identity and tax return, if you filed one. It's quick, secure, and available 24 hours a day. You must register on the website before verifying your identity. Be sure to check the website and prepare all the documents needed to complete the registration.

What happens if IRS can’t verify identity

The return will be rejected and investigated as identity theft/tax fraud if: Verification fails to confirm your identity or that you filed the return. If the verification process is not completed, or can't be completed.

Does an ITIN number expire

If you use an ITIN, it will expire unless you used it at least once during the previous three-year period. Even certain ITIN holders who have used their taxpayer identification number in the past three years may need to get a new ITIN if it's older.

How do I know if my TIN ID is legit

If you don't have access to the eReg system or don't know anyone who does, don't worry. There is another way to check your TIN number online using the BIR Mobile TIN Verifier app. The BIR Mobile TIN Verifier app is a mobile application that provides real-time responses to taxpayers' TIN-related inquiries.

Can you hire someone who is not a US citizen

United States Citizenship and Immigration Services (USCIS) regulations require that non-citizens apply for and obtain work authorization before they can be lawfully employed. This process often takes several months and may be delayed even longer by diplomatic complications.

Can you employ someone without a Social Security number

Employers in the United States are sometimes faced with the prospect of onboarding young and/or foreign workers who don't have Social Security Numbers (SSNs). While there's a commonly-held belief that it's illegal for an employer to pay an employee who does not have an SSN, there are no laws prohibiting this.

Can you work at Chick Fil A with a ITIN number

Employers cannot accept an ITIN as a valid employee identification for work eligibility. The IRS will penalize companies and resident and non-resident aliens who use ITINs for U.S. employment verification purposes. Anyone assigned an ITIN who becomes eligible to work in the U.S. must apply for a social security card.