Can cosigner see your credit score?

Does a cosigner see my credit report

A soft inquiry will show up on your credit report but will not impact your credit. If you're approved as a cosigner, you won't see a hit to your credit report unless your brother doesn't pay the car loan for more than 30 days. At that point, you might get a letter from the lender that says your car loan is delinquent.

Cached

What information does a cosigner see

The process of cosigning is similar to borrowing money for yourself. You'll have to provide an identification, your Social Security number and other personal details, as well as proof of income and assets. Using this information, the lender will then run a credit check to see if you meet the requirements.

Cached

Who gets the credit score if you have a cosigner

Co-signing a loan can help or hurt your credit scores. Having a co-signer on the loan will help the primary borrower build their credit score (as long as they continue to make on-time payments).

Cached

What does a cosigner need to show

To qualify as a cosigner, you'll need to provide financial documentation with the same information needed when you apply for a loan. This may include: Income verification. You may need to provide income tax returns, pay stubs, W2 forms or other documentation.

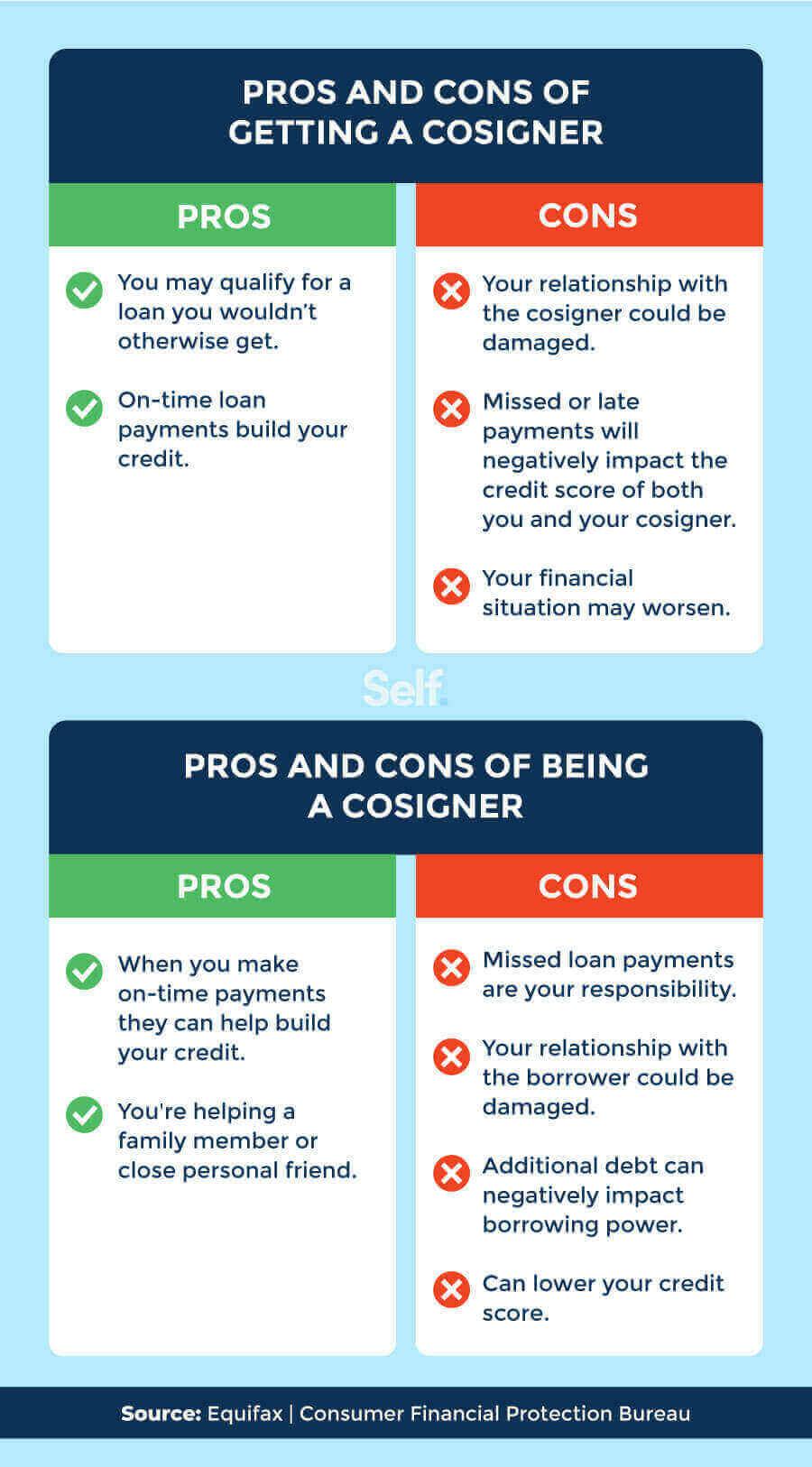

What risk does a cosigner take

If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

What are the risks of being a cosigner

If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

Can I cosign with a 650 credit score

Typically, a cosigner needs a credit score of 670 or better to be approved. This range is usually classified as very good to excellent credit.

How much credit does a cosigner get

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Can a cosigner be denied

Sometimes lenders will deny a loan if the person has too much debt. Cosigning on student loans, a car loan, or a mortgage could add a significant amount of debt for the cosigner. If the cosigner thinks that they will need to apply for a large loan soon after cosigning, the cosigner could be denied.

Do you always get approved with a cosigner

Yes, it may be easier to get a loan with a cosigner than without one as long as the person cosigning has a higher credit score and income than you do. Applying with a cosigner increases your chances of getting approved since they are promising to repay the loan if you are unable to.

Can a cosigner have worse credit than you

Cosigning a loan can affect the co-signer's credit score—for better or for worse. The loan will be added to the co-signer's credit history and impact their credit score.

Can a cosigner hurt you

Possible disadvantages of cosigning a loan

If the borrower is responsible in their repayment habits, there should be no negative impact on you, but if you find that is not the case, you could be seriously affected: It could limit your borrowing power.

Is it ever a good idea to cosign

The bottom line is this: co-signing on a loan for anyone is never a good idea. If you feel compelled, lend them some money with a written agreement on how it is to be repaid. But never put your credit on the line by co-signing documents with a lender.

Can I get a loan with a 500 credit score with a cosigner

Apply with a cosigner

The cosigner's credit and income impact the lender's decision more than those of the primary applicant, so it can help people with a credit score of 500 get approved for loans they might not normally qualify for.

Can I cosign for a car with a 500 credit score

So, if someone has a bad credit score, there is still a chance that they can be a cosigner. If the credit score is in the 500s, then it is relatively easier to get a loan, but that will come at a high-interest rate, but getting the loan will still be possible.

Can I cosign with a 580 credit score

Cosigning does have some limitations. If your credit score is lower than the 620 minimum for conventional and the 580 for FHA, a cosigner can't help. A cosigner also can't make up for a recent bankruptcy or foreclosure. You still need a down payment—in most cases, at least 3 to 5%, depending on the loan type.

Can I cosign with a 500 credit score

If you're planning to ask a friend or family member to co-sign on your loan or credit card application, they must have a good credit score with a positive credit history. Lenders and card issuers typically require your co-signer to have a credit score of 700 or above.

Is it risky to be a cosigner

Whatever you cosign will show up on your credit report as if the loan is yours, which, depending on your credit history, may impact your credit scores. Cosigning a loan doesn't necessarily mean your finances or relationship with the borrower will be negatively affected, but it's not a decision you should make lightly.

Do you build credit faster with a cosigner

A co-signer can also help you improve your credit score if it is low due to past financial missteps. Payment history accounts for 35 percent of your credit score, so keeping current on the auto loan payments over the loan term could help boost your score — assuming you manage all other debts responsibly.

Why is it risky to be a co-signer

The lender can sue the cosigner for interest, late fees, and any attorney's fees involved in collection. If the primary borrower falls on hard times financially and cannot make payments, AND the cosigner fails to make the payments, the lender may also decide to pursue garnishment of the wages of the cosigner.