Can fees earned be a debit?

Is fee earned a debit or credit

Fees earned (Income) are Credited (Cr.) As per the golden rules of accounting for (nominal accounts) incomes and gains are to be credited. So, fees earned are credited to the financial books.

Cached

What type of account is fees earned

revenue account

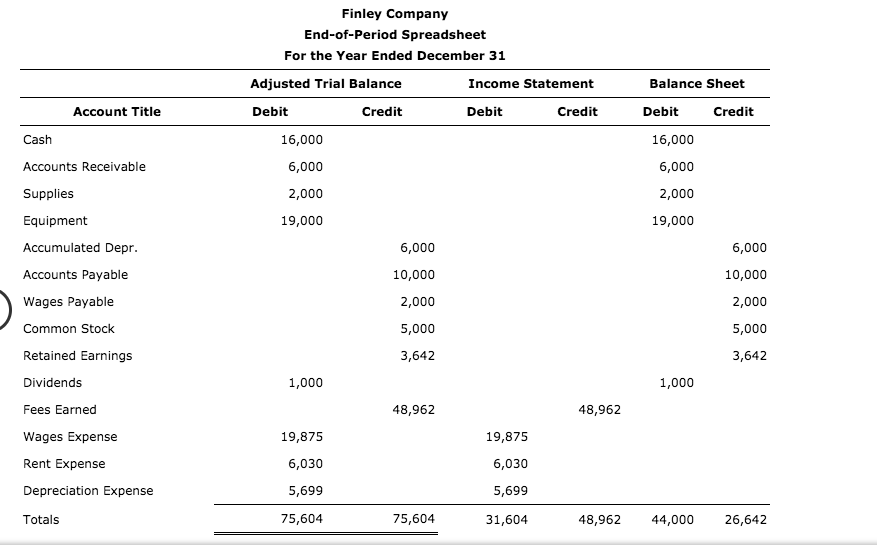

Fees earned is a revenue account that appears in the revenue section at the top of the income statement.

Cached

How would you record the billing of fees earned

The correct answer to this question is a) Debit accounts receivable and credit rental fees. When the services are performed, the fees are earned, however, the receipt of payment against the services may be on a later date. Under accrual accounting, revenues are recorded when earned whether received or not.

Is fees earned an asset or liability

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.

Is legal fees earned a normal debit or credit balance

According to the "golden rules" of accounting, expenses are recorded as nominal accounts and have a debit balance. Legal expenses are costs incurred by a company in relation to its business operations, such as fees paid to lawyers for their services. Therefore, legal expenses should be recorded as a debit.

Is fees earned an accrual

(Under the accrual basis of accounting, fees earned are reported in the time period in which they are earned and not in the period in which the company receives payment.)

Is fees earned a liability or asset

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.

What is the journal entry to record fees earned on account

The journal entry for fees earned on account is an increase to Accounts Receivable and an increase to Fees Earned and would be posted to these accounts in the ledger.

Is service fees earned a current asset

No, service revenue is not a current asset for accounting purposes. A current asset is any asset that will provide an economic value for or within one year. Service revenue refers to revenue a company earns from performing a service.

What is the normal balance of fees earned

The classification and normal balance of the fees earned account will determined how it is increased or decreased. It is either debit or credit, depending on the type of the account, and the balance is maintained to ensure that the debit balance equals the credit balance.

Is fees earned a liability account

Answer and Explanation: In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity.

Are accrued fees an asset or liability

Since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities.

Are fees considered an expense

Operating expenses are the expenses related to the company's main activities, such as the cost of goods sold, administrative fees, office supplies, direct labor, and rent. These are the expenses that are incurred from normal, day-to-day activities.

What is a debit entry to an expense account

A debit to an expense account means the business has spent more money on a cost (i.e. increases the expense), and a credit to a liability account means the business has had a cost refunded or reduced (i.e. reduces the expense).

Is fees earned an asset or a liability

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.

Is service fees earned an asset or liability

No, service revenue is not an asset. Assets are defined as resources with economic value that a business owns. Whereas service revenue is a business' earnings from providing goods and services to its customers. So, service revenue is considered a revenue (or income) account and not an asset.

Is fees unearned an asset or liability

liability

Unearned revenue is recorded on a company's balance sheet as a liability. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer.

Is accrued expenses a debt

Accrued expenses are an unpaid expense, an amount that a business owes for a product or service already received. This is an expense that must be accounted for when the product or service is received, rather than when it is billed. Accrued expenses are considered to be a short-term debt.

What is the journal entry for accrued expenses

Journal Entry For Accrued Expenses. An accrued expense journal entry is passed on recording the expenses incurred over one accounting period by the company but not paid actually in that accounting period. The expenditure account is debited here, and the accrued liabilities account is credited.

Is fees earned an asset or expense

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.