Can I add a child to my stimulus check?

Can you apply for stimulus check for newborn

Parents who gave birth to a newborn in 2023 may qualify for another $1,40S stimulus check.

Can I still get my stimulus for my child

[Updated Feb 5th, 2023] The IRS is still sending dependent stimulus payments but it's ONLY to the taxpayers whose payment got deposited into a wrong account or waiting to get it by check or debit card.

Can you add a baby to the Child Tax Credit

Claiming a newborn on your taxes and taking advantage of tax benefits, such as the child tax credit, is possible even if the baby was born late in the year. In fact, you can claim your newborn on taxes even if they were born the very last day of the year.

How do I add a dependent to the IRS

Taxes done right, with experts by your sideStep 1: Form 1040/1040A. Use either Form 1040 or Form 1040A to file your income taxes.Step 2: Provide dependent information.Step 3: Add the number of dependents claimed.Step 4: Child tax credit.

How much do babies get for stimulus check

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2023 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

How much do you get back in taxes for a newborn

For tax year 2023, the Child Tax Credit is increased from $2,000 per qualifying child to: $3,600 for each qualifying child who has not reached age 6 by the end of 2023, or. $3,000 for each qualifying child age 6 through 17 at the end of 2023.

What is the $450 per child

First Lady Casey DeSantis announced last week that $35.5 million in DeSantis' budget will "support nearly 59,000 Florida families with a one-time payment of $450 per child, which includes foster families."The American Rescue Plan Act created a $1 billion fund to assist needy families affected by the pandemic within the …

Can I still claim my stimulus check in 2023

You also may be able to claim missed stimulus checks through GetYourRefund.org which opens on January 31, 2023. If you didn't get your first, second, or third stimulus check, don't worry — you can still claim the payments as a tax credit and get the money as part of your tax refund .

What are the 6 requirements for claiming a child as a dependent

There are seven qualifying tests to determine eligibility for the Child Tax Credit: age, relationship, support, dependent status, citizenship, length of residency and family income. If you aren't able to claim the Child Tax Credit for a dependent, they might be eligible for the Credit for Other Dependent.

What is the new child tax credit for 2023

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,500 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

How do I add a dependent if I already filed

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

Who can I add as dependents

Dependents are either a qualifying child or a qualifying relative of the taxpayer. The taxpayer's spouse cannot be claimed as a dependent. Some examples of dependents include a child, stepchild, brother, sister, or parent.

How do I get my babies stimulus check

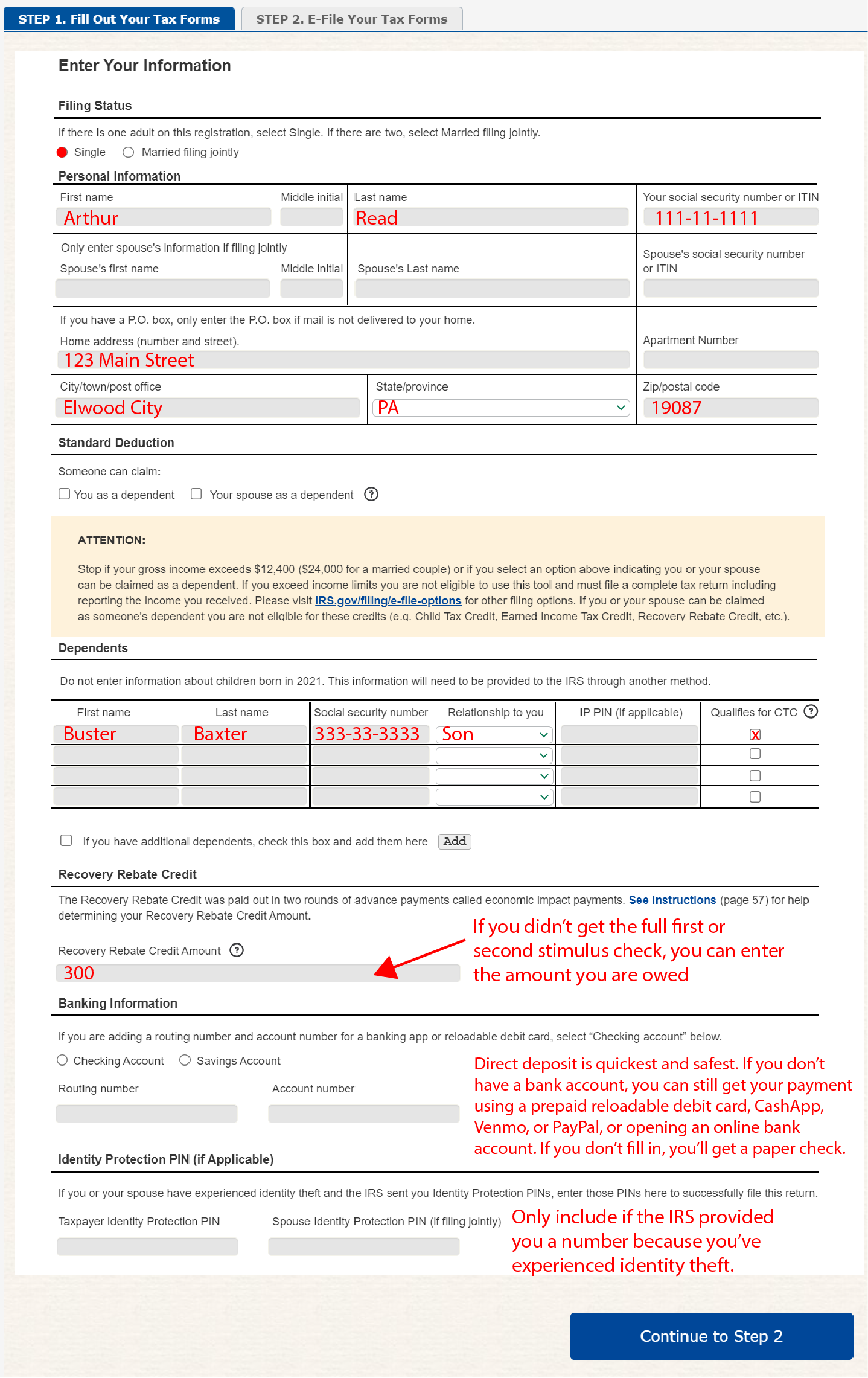

If you had a child born in 2023, you will need to claim the Recovery Rebate Credit to get the 3rd stimulus payment on your 2023 tax return. The IRS has already sent 3rd round stimulus checks based on 2023 returns, and had until December 31, 2023 to issue all of the Third Economic Impact Payments.

How to get $5,000 tax refund

The IRS says if you welcomed a new family member in 2023, you could be eligible for an extra $5,000 in your refund. This is for people who had a baby, adopted a child, or became a legal guardian. But you must meet these criteria:You didn't receive the advanced Child Tax Credit payments for that child in 2023.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Are single mothers getting the $450 from the government

First Lady Casey DeSantis announced during a visit in Tampa on Friday that foster families, adoptive families, and single mothers are eligible for the checks.

What is the extra $300 a month per child

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

Who qualifies for stimulus check 2023

Stimulus Check 2023 Requirements

The objective is to determine if a person received money or used the state system during the previous fiscal year. Under the $75,000 cap for single people or $112,000 for married people. If you meet this requirement, your stimulus payment will arrive in 7 to 8 weeks.

What is the stimulus check for 2023

California. In-state residents can get a payment of $200 to $1,050, depending on their eligibility criteria, such as income, marital status, and number of dependents.

What are the IRS rules for claiming dependents

To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a "student" younger than 24 years old as of the end of the calendar year. There's no age limit if your child is "permanently and totally disabled" or meets the qualifying relative test.