Can I balance transfer from Amex to Amex?

Can I transfer balance from Amex to Amex

Before we dive in, note that you cannot transfer a balance from one American Express card to another American Express card. You can only transfer a card balance from another issuer to an Amex card, or vice versa.

Cached

Do Amex offer balance transfers

0% intro APR on purchases and balance transfers for 15 months from the date of account opening, then a variable APR, 17.99% to 28.99%.

How do I transfer credit from one Amex card to another

Log in to your American Express account online and select the card that you are transferring credit out of. Click on the “Account Services” menu, then click on “Payment & Credit Options” and select “Transfer Available Credit to Another Card.” Choose the account that you want to transfer from and to.

Can I use my Amex card to pay off another credit card

You can use your American Express credit card to pay off another credit card by doing a balance transfer, getting a cash advance, buying a money order or using a mobile payment service. It is not possible to use an American Express card as the primary payment method for another credit card account.

Why can’t I do a balance transfer on my Amex

American Express does not let you transfer balances from other credit cards to any of its credit cards. While you may choose to get a balance transfer card from a different issuer, you may also apply for a personal loan or consider using a debt management program to pay off your debt.

Does transferring balances hurt your credit score

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Why can’t i balance transfer from Amex

Since Amex does not currently allow balance transfers, finding zero interest credit cards with no transfer fees is not possible. However, you can choose from a few 0% APR cards with no annual fees.

Does switching Amex cards affect credit score

Providing you use credit responsibly, switching credit card issuers shouldn't have any serious effect on your credit score. Remember to keep your old cards open and active if at all possible, and if you're still looking for a change, use our credit card comparison tool to find the perfect card for you.

Is it illegal to use a credit card to pay off another credit card

The short answer is no. Credit card companies don't allow you to make minimum monthly payments, or to pay off an outstanding balance, with another credit card from a different company. Often, the fees for these types of transactions are too high for credit card companies to allow it.

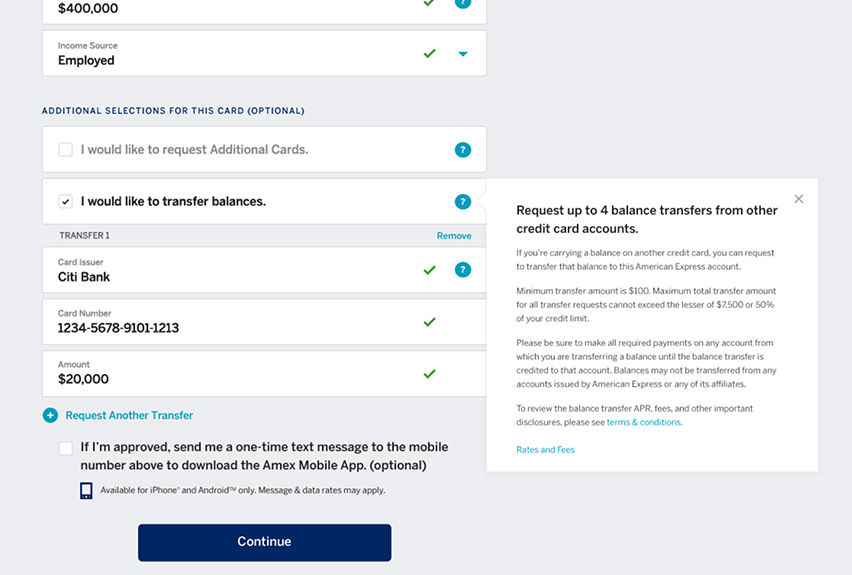

What is the balance transfer limit for American Express

The maximum balance transfer amount is $10,000 or 70% of your approved credit limit, whichever is the lesser amount. The minimum balance transfer amounts is $50. Transfer amounts will be rounded up to the nearest dollar.

What is the downside of a balance transfer

A balance transfer generally isn't worth the cost or hassle if you can pay off your balance in three months or less. That's because balance transfers typically take at least one billing cycle to go through, and most credit cards charge balance transfer fees of 3% to 5% for moving debt.

What is the catch to a balance transfer

But there's a catch: If you transfer a balance and are still carrying a balance when the 0% intro APR period ends, you will have to start paying interest on the remaining balance. If you want to avoid this, make a plan to pay off your credit card balance during the no-interest intro period.

Does it make sense to have multiple Amex cards

Because each card offers different benefits and earning power, it makes sense to carry more than one card. By using the AmEx Trifecta of cards, you'll earn maximum points on travel, dining, groceries and other purchases.

Does cancelling an Amex card hurt your credit

Open card accounts can help your credit score in two different ways: credit utilization and length of credit history. Closing a credit card account can negatively affect both of those components of your credit score.

Why can’t you use a credit card to pay off a credit card

The short answer is no. Credit card companies don't allow you to make minimum monthly payments, or to pay off an outstanding balance, with another credit card from a different company. Often, the fees for these types of transactions are too high for credit card companies to allow it.

Can I transfer credit limit between Amex cards

American Express

Credit limits can be transferred between personal cards and from personal to business cards, but not from business to personal cards. Also, charge cards are not eligible because they don't have a pre-set spending limit.

Do balance transfers hurt credit score

In some cases, a balance transfer can positively impact your credit scores and help you pay less interest on your debts in the long run. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run.

Do balance transfers hurt

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Does it hurt my credit to transfer a balance

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Do balance transfers negatively affect your credit

In some cases, a balance transfer can positively impact your credit scores and help you pay less interest on your debts in the long run. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run.