Can I borrow money from my emerald card?

Can I get another advance on my emerald card

OBTAINING ADVANCES

If you enroll in our optional automatic payment plan (described below) at the time of your application, you may schedule a second draw on your Emerald Advance at that time.

How much money can you get with Emerald Advance

between $350-$1,000

^ If approved for an H&R Block Emerald Advance®, your credit limit could be between $350-$1,000.

CachedSimilar

How long does the Emerald Advance take

in 30 minutes or less. Learn more here: https://hrblock.

Can I get money off my emerald card at Walmart

MoneyPass® is one of the largest surcharge-free ATM networks in the nation, with over 33,000 ATMs, including those found in over 2,000 Walmart stores, and over 8,000 7-Eleven convenience stores. MoneyPass® now offers an ATM locator app for your smartphone.

Why did I get denied for refund advance

You will not be eligible for the loan if: (1) your physical residence is located outside of the United States, a US territory, a PO box or a prison address, (2) your physical residence is in one of the following states: IL, CT, NE, or NC, (3) you are less than 18 years old, (4) the tax return filed is on behalf of a …

Does H&R Block give an advance

If you are filing with H&R Block and are expecting a refund, you may be eligible to apply for a Refund Advance. The Refund Advance at H&R Block is a no interest loan of up to $3,500 that is repaid from your tax refund. That's money you could receive the same day you file to pay bills or unexpected expenses.

How much can I get on a cash advance

Cash advances are typically capped at a percentage of your card's credit limit. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

How does the cash advance from H&R Block work

If you are filing with H&R Block and are expecting a refund, you may be eligible to apply for a Refund Advance. The Refund Advance at H&R Block is a no interest loan of up to $3,500 that is repaid from your tax refund. That's money you could receive the same day you file to pay bills or unexpected expenses.

How long does it take to get a loan from H&R Block

If approved, you could receive your loan proceeds within minutes after you file with H&R Block. Refund Advance applicants also apply for and leave our office with an H&R Block Emerald Prepaid Mastercard® 110. Scroll to bottom of page. on which the loan funds will be loaded if approved.

Why would you get denied for a refund advance

Your approval is based on the size of your federal refund and your tax information, along with other factors. You may not receive the Refund Advance if one of these factors doesn't meet the qualifying standards of the lender.

How do I transfer money from my H&R Block Emerald card to cash App

Can I transfer money from my emerald card to Cash App You currently can't use a prepaid card on Cash App to add funds to your account. Cash App accepts linked bank accounts and credit or debit cards backed by Visa, American Express, Discover, or MasterCard.

What banks can I use my emerald card

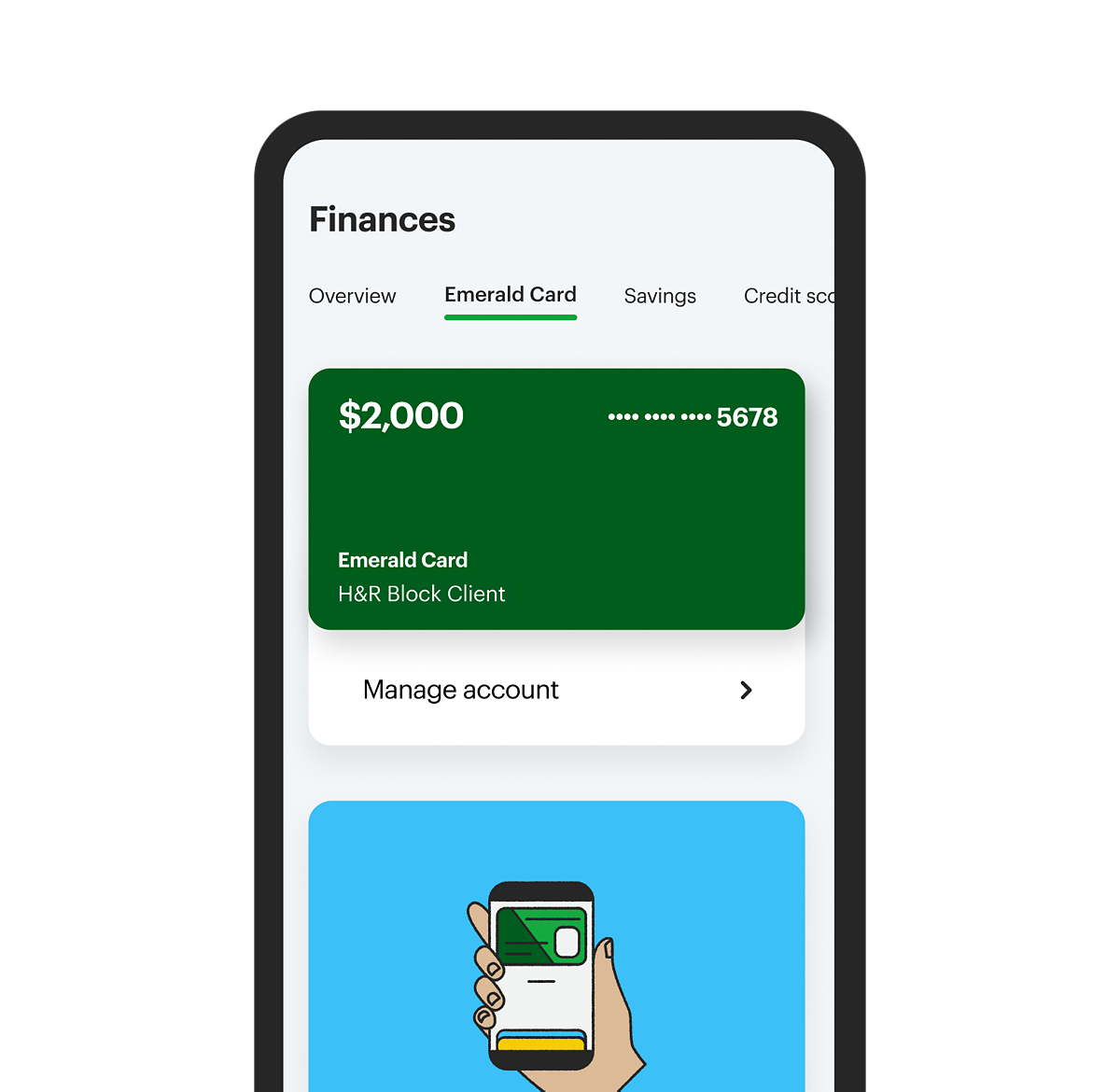

The Emerald Card can be used anywhere Debit Mastercard is accepted.

What qualifies you for a refund advance

To be eligible for a tax refund loan, you must have your taxes prepared by the company offering the loan, and that might mean you'll pay a tax preparation fee. Tax preparers have a minimum refund amount requirement to qualify, which can vary by company, and you may get only a portion of your expected refund in advance.

Does everyone get approved for refund advance

Fact – While not everyone is approved, the Refund Advance loan program at H&R Block has high approval rates. To be approved, you must apply and meet certain eligibility requirements, (such as ID verification and a sufficient refund amount), as well as the lender's underwriting requirements.

How do you qualify for refund advance

If you are receiving a federal refund of $500 or more, you could be eligible for a Refund Advance, a loan provided by First Century Bank, N.A., Member FDIC, not affiliated with MVB Bank, Inc., Member FDIC. Refund Advance is a loan based upon your anticipated refund and is not the refund itself.

Where can I get a loan against my tax refund

Tax refund loan alternatives

| Lender | Loan amount | Time to funding |

|---|---|---|

| LendingPoint | $2,000 – $36,500 | As soon as one business day |

| OneMain Financial | $1,500 – $20,000 | As soon as one day |

| Prosper | $2,000 – $50,000 | As soon as one business day |

| Upgrade | $1,000 – $50,000 | As soon as one day |

How much is a cash advance for $1,000

The Costs of a $1,000 Cash Advance

Cash advance fee: The fee for a $1,000 cash advance would be $38.4, based on the current average cash advance fee. But it could be even higher, depending on the card. Some credit card companies charge a 3% fee, while others charge up to 5%.

How much cash advance can you get at Walmart

Another Way to Get a Walmart Credit Card Cash Advance

You can also use the Quick Cash feature at Walmart to get a cash advance. This allows you to get up to $20 per day at a Walmart register when you make a purchase.

How much can I get cash advance

Cash advances are typically capped at a percentage of your card's credit limit. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

Is it hard to get approved for H&R Block loan

Fact – While not everyone is approved, the Refund Advance loan program at H&R Block has high approval rates. To be approved, you must apply and meet certain eligibility requirements, (such as ID verification and a sufficient refund amount), as well as the lender's underwriting requirements.