Can I cancel my Macy’s credit card online?

Can you cancel Macys credit card online

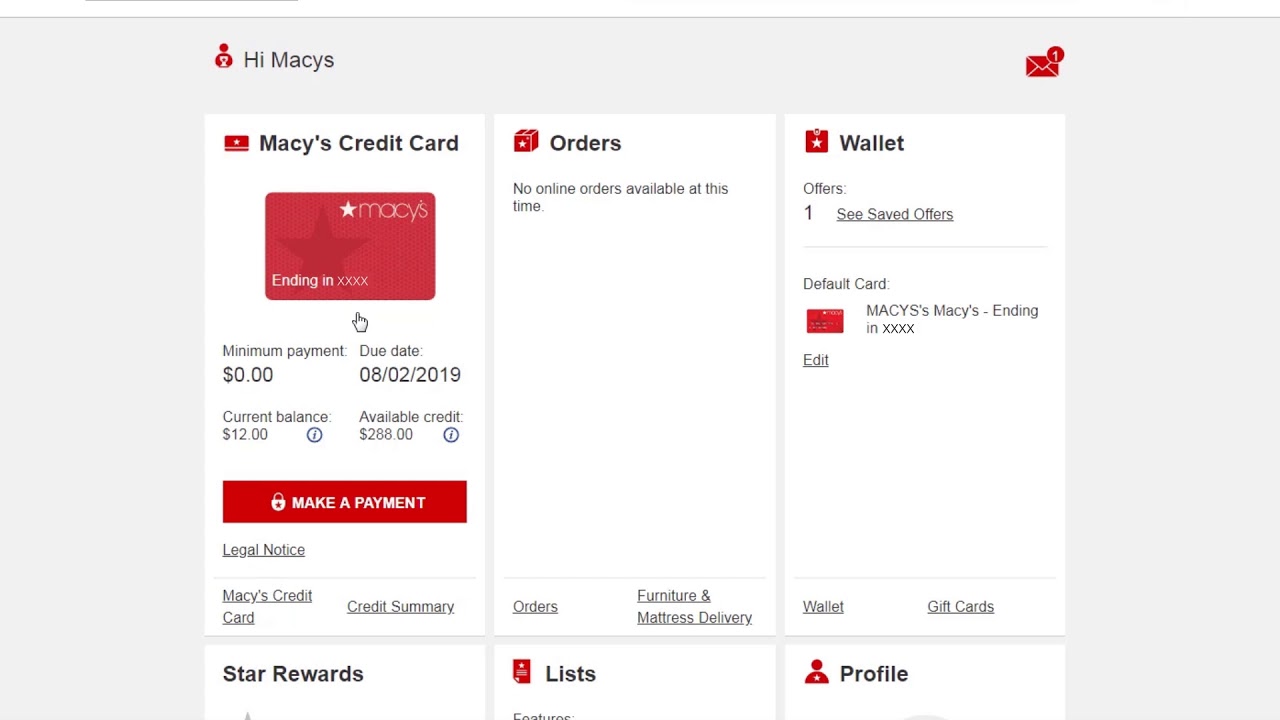

You can close your Macy's Credit Card account by calling customer service at (888) 257-6757. Just state your request and provide the information necessary to confirm your identity. This is the way to cancel your Macy's Store Card, too. At the moment, there is no way to cancel your Macy's Credit Card online.

Cached

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

How do I cancel my Macy’s account

How to cancel Macy'sLog into your account.Go to your profile in the top right corner.Select 'My Service' from the dropdown.Scroll down to the 'Service Options' area.Click on 'Cancel Your Service' and answer the prompt to confirm.

How do I cancel my Macys credit card application

You can cancel your Macy's Credit Card application by calling customer service at (888) 257-6757. If you applied online, you may have only a few minutes (or even less than a minute) to contact customer service. You can call the same phone number to cancel a Macy's Store Card application, too.

Cached

Does Cancelling a store credit card hurt your credit

Yes, closing credit cards, including a store credit card, can hurt your credit score. This is due to the fact that your score considers a few key factors, including your credit mix, credit utilization ratio and credit age.

Is it possible to cancel a credit card online

Go to your credit card's website.

Alternatively, if you don't want to speak with customer service over the phone, you might be able to cancel online after logging into your account.

Does Cancelling card hurt credit

A credit card can be canceled without harming your credit score. To avoid damage to your credit score, paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

Will it hurt my credit score if I don’t use my credit card

If you don't use your credit card, your card issuer can close or reduce your credit limit. Both actions have the potential to lower your credit score.

Does closing a credit card lower your score

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

What happens if you don’t use your credit card at all

Your Card May Be Closed or Limited for Inactivity

Without notice, your credit card company can reduce your credit limit or shut down your account when you don't use your card for a period of time. What period of time, you ask There's no predefined time limit for inactivity that triggers an account closure.

Can I cancel a credit card I just got approved for

The bottom line

If you decide you don't want to hold on to a credit card after applying and being approved by the issuer, you can still cancel your account. Think a bit about the consequences before you cancel. If you do decide to cancel, make sure to get a written confirmation of the account closing.

Is there a way to cancel a credit card online

Go to your credit card's website.

Alternatively, if you don't want to speak with customer service over the phone, you might be able to cancel online after logging into your account.

How to cancel a credit card without destroying your credit score

A credit card can be canceled without harming your credit score. To avoid damage to your credit score, paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

What happens if I stop using a store credit card

What Happens If You Never Use a Store Credit Card If you open but never use a store credit card, nothing will most likely happen. However, the issuer could close your card due to inactivity.

Does cancelling a credit card hurt my credit

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

How do I cancel my credit card without calling

Steps to cancel a credit cardPay the outstanding balance. Avoid closing a credit card with a balance.Transfer any reward points.Cancel direct debits.Cancel your credit card online.Cancel your card.Cancel your card in writing.Check for future statements.Destroy your credit card.

How many points will I lose if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points. Two-thirds of people who open a credit card increase their overall balance within a month of getting that card.

What happens when you close a credit card with zero balance

By closing a credit card account with zero balance, you're removing all of that card's available balance from the ratio, in turn, increasing your utilization percentage. The higher your balance-to-limit ratio, the more it can hurt your credit.

Is it OK if I never use my credit card

Your credit card account may be closed due to inactivity if you don't use it. You could overlook fraudulent charges if you're not regularly reviewing your account. If your credit card account is closed, it could impact your credit score.

Does it matter if you don’t use your credit card

If you don't use your credit card, the card issuer may close your account., You are also more susceptible to fraud if you aren't vigilant about checking up on the inactive card, and fraudulent charges can affect your credit rating and finances.