Can I claim my medical bills on my taxes?

What medical expenses can be tax deductible

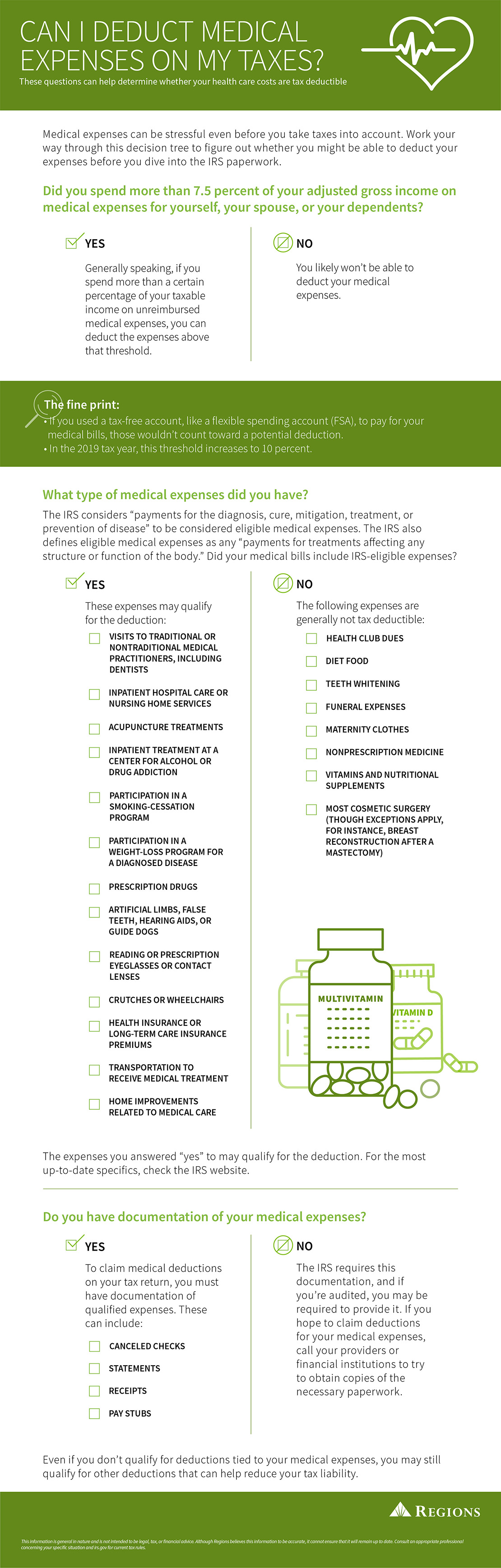

You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). This publication also explains how to treat impairment-related work expenses and health insurance premiums if you are self-employed.

What percentage of medical bills can be claimed on taxes

7.5%

You can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI), found on line 11 of your 2023 Form 1040.

Cached

Can the IRS take my tax refund for medical bills

Federal law allows only state and federal government agencies (not individual or private creditors) to take your refund as payment toward a debt.

Can you write off health insurance

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

Can I write off cosmetic surgery on my taxes

In order for your plastic surgery to be covered by health insurance and tax deductible, you will need thorough documentation stating that your procedure was medically needed. There are many plastic surgery procedures that can be considered medically necessary, while also improving your appearance.

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

What are unreimbursed medical expenses

Unreimbursed Medical (URM)

Out-of-pocket expenses are those expenses that are not covered by insurance or any other third party. They include: Deductibles. Co-Pays. Vision Care.

What is the maximum amount the IRS can garnish from your paycheck

between 25-50%

This means that they can choose how much to garnish from your wages each month, depending on how much you owe and how much you earn. The limit is typically between 25-50% of your disposable earnings after deductions are made. However, this could be more if you have a higher salary.

What debts can be taken from federal taxes

You Owe Federal Income Taxes.You Owe State Income Taxes.You Owe State Unemployment Compensation.You Defaulted on a Student Loan.You Owe Child Support.You Owe Spousal Support.Other Ways the Government Can Collect.FAQs.

Do employers get a tax write off for health insurance

Health insurance tax deductions for employers

When an employer offers a formal health benefit, the expense can generally be written off as a business expense. The Internal Revenue Service (IRS) allows employers to deduct a few different healthcare benefits.

Can you claim a tummy tuck on taxes

Plastic surgery (unless medically necessary)

The IRS says you can deduct the cost of plastic surgery if it is necessary to improve or correct a deformity resulting from a congenital abnormality, an injury incurred in an accident, trauma or a disfiguring disease.

Can you use Botox as a tax write off

Expenses related to cosmetic surgery are tax deductible, but only if required by a doctor. If the cosmetic procedure is elective, then the medical expense is not tax deductible. Botox is generally considered elective unless your doctor says that it will improve your physical health or clear up respiratory issues.

What happens if you are audited and don’t have receipts

The Internal Revenue Service may allow expense reconstruction, enabling taxpayers to verify taxes with other information. But the commission will not prosecute you for losing receipts. The IRS may disallow deductions for items or services without receipts or only allow a minimum, even after invoking the Cohan rule.

Can you deduct medical expenses without itemizing

To claim the medical expense deduction, you must itemize your deductions. Itemizing requires that you don't take the standard deduction. Normally, you should only claim the medical expenses deduction if your itemized deductions are greater than your standard deduction (TurboTax can also do this calculation for you).

What is a qualified medical expense

Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly income tax return. Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services.

Can the IRS take your whole paycheck

Yes, the IRS can take your paycheck. It's called a wage levy/garnishment.

What qualifies as an IRS hardship

An economic hardship occurs when we have determined the levy prevents you from meeting basic, reasonable living expenses. In order for the IRS to determine if a levy is causing hardship, the IRS will usually need you to provide financial information so be prepared to provide it when you call.

Does debt affect your tax return

Personal debt, like credit cards and unpaid loans, does not affect your tax return, but the IRS is able to seize your refund if you owe federal or state taxes, child support, or student loan debt.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Does health insurance affect tax return

You may be eligible to receive a premium tax credit if you obtain your health insurance from the Marketplace. This credit is to assist with monthly premium payments and is determined by the information on your tax return.