Can I close my Macy’s credit card online?

How do I close my Macy’s credit card online

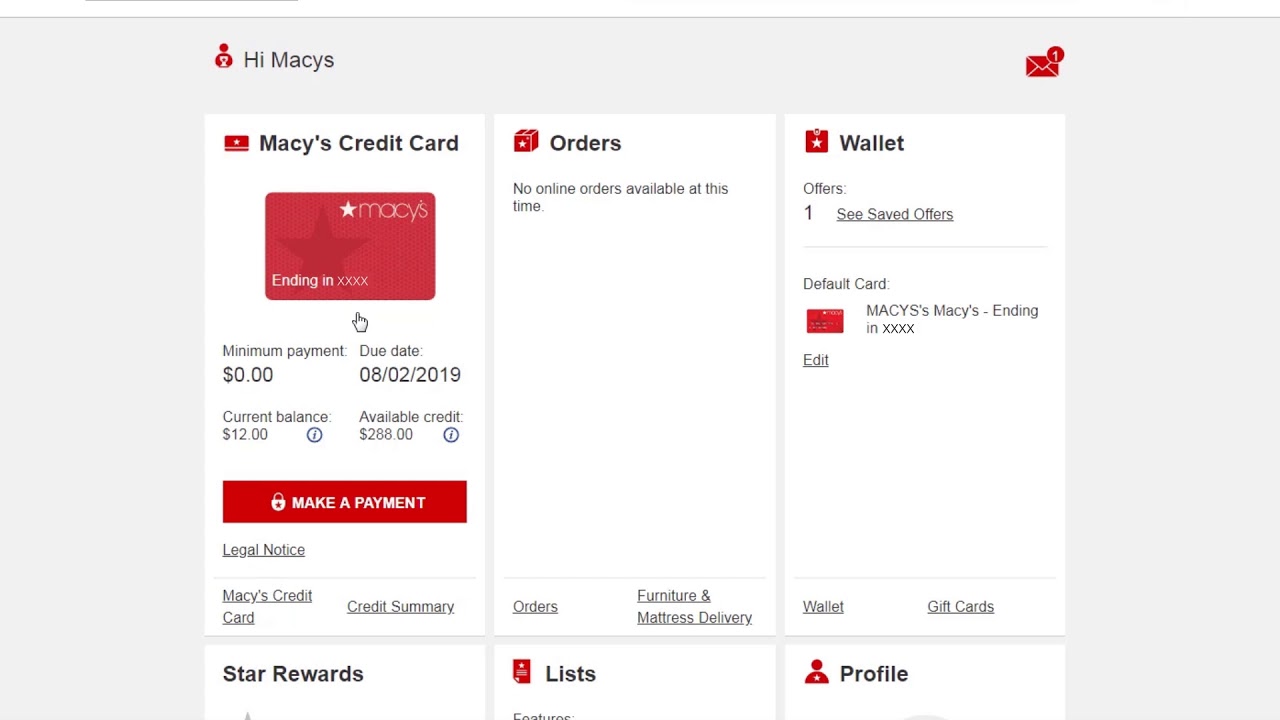

You can close your Macy's Credit Card account by calling customer service at (888) 257-6757. Just state your request and provide the information necessary to confirm your identity. This is the way to cancel your Macy's Store Card, too. At the moment, there is no way to cancel your Macy's Credit Card online.

Cached

Does closing a credit card lower your score

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

How do I close or deactivate my credit card

You can call the credit card customer care of the respective bank and request them to cancel the credit card that is in your name. Once the request has been raised with customer care, the bank will get back to you and discuss the details for the cancellation of the credit card.

What happens if you don’t use your credit card at all

Your Card May Be Closed or Limited for Inactivity

Without notice, your credit card company can reduce your credit limit or shut down your account when you don't use your card for a period of time. What period of time, you ask There's no predefined time limit for inactivity that triggers an account closure.

Is there a way to cancel a credit card online

Go to your credit card's website.

Alternatively, if you don't want to speak with customer service over the phone, you might be able to cancel online after logging into your account.

Does Macy’s credit card have an annual fee

The card has no annual fee, and you'll earn unlimited 1.5% cash back on every purchase.

Is it worse to close a credit card or never use it

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

What happens when you close a credit card with zero balance

By closing a credit card account with zero balance, you're removing all of that card's available balance from the ratio, in turn, increasing your utilization percentage. The higher your balance-to-limit ratio, the more it can hurt your credit.

Can I deactivate my credit card online

Online request – You can also place a credit card cancelation request online on the bank's official website. All you need to do is log in to the platform, and find the option to 'Cancel/Close your credit card'. You will be asked to fill the credit card cancelation form and submit it on the portal.

Is it better to close a credit card or let it go inactive

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Is it better to close a credit card or leave it open with a zero balance

In general, it's better to leave your credit cards open with a zero balance instead of canceling them. This is true even if they aren't being used as open credit cards allow you to maintain a lower overall credit utilization ratio and will allow your credit history to stay on your report for longer.

Does Macys credit card charge a monthly fee

The Macy's Credit Card is a good card that's worth applying for if you regularly shop at Macy's. Macy's Credit Card users enjoy a $0 annual fee and rewards of up to 5 points / $1 on Macy's purchases, plus a 20% discount on your first purchase.

Is it better to let a credit card close or to close it yourself

In general, it's best to keep unused credit cards open so that you benefit from a longer average credit history and a larger amount of available credit. Credit scoring models reward you for having long-standing credit accounts, and for using only a small portion of your credit limit.

Is it better to close a credit card or leave it open

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Is it better to close a credit card or leave it open with a zero balance UK

While closing credit cards could increase your credit utilisation rate, which could negatively impact your credit score, having multiple cards open increases the chance of you racking up large debts. Lenders will see this as a risk and may not lend to you because of it.

How long does it take to deactivate a credit card

If you stop using the card altogether, there's a chance that your account will be closed (typically after at least 12 months of inactivity). This will appear on your credit report and drop your score, so it's vital to keep your account active and make the payments needed to keep your account in good standing.

Do inactive credit cards hurt credit score

The short answer is yes. When your card remains unused for months or even years, the lender may close your account. And once your account closes your credit utilization rate increases, ultimately leading to a poor credit score. Your credit utilization accounts for 30% of your credit score.

Is it OK to close unused credit cards

Closing a credit card can hurt your credit utilization ratio, credit history and credit mix, all of which can impact your credit score. You may also lose out on valuable rewards and benefits, which could impact you financially in other ways.

Is it bad to close a credit card with zero balance

Canceling a credit card — even one with zero balance — can end up hurting your credit score in multiple ways. A temporary dip in score can also lessen your chances of getting approved for new credit.