Can I do 10% on an investment property?

Can I put down 10% on an investment property

A sizable down payment is standard when you take out investment property loans. But you may be able to buy an investment property with as little as 10%, 3.5%, or even 0% down. Loan programs like HomeReady and Home Possible make purchasing an investment property with 10% down or less a possibility.

Cached

What is the 10% rule for investment property

Say, for example, that you purchased a property for $150,000. Following the rule, you put $15,000 (10 percent) forward as a down payment. Think of that 10 percent as all the skin you have in the game. The bank took care of the rest, and you'll cover that debt when you sell the home.

Cached

Can you put less than 20 percent on an investment property

1. Make a sizable down payment. Since mortgage insurance won't cover investment properties, you'll generally need to put at least 20 percent down to secure traditional financing from a lender.

What is the least amount you can put down on an investment property

Most mortgage lenders require borrowers to have at least a 15% down payment for investment properties, which is usually not required when you buy your first home. In addition to a higher down payment, investment property owners who move tenants in must also have their homes cleared by inspectors in many states.

Cached

What is the 2 rule for investment property

2% Rule. The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

Can you put 15% down on an investment property

In most cases, the minimum amount for an investment property down payment is 15%. However, the down payment you're actually required to pay is determined by several factors, including your credit score, debt-to-income (DTI) ratio, loan program and property type.

What is the 50% rule in real estate investing

Like many rules of real estate investing, the 50 percent rule isn't always accurate, but it can be a helpful way to estimate expenses for rental property. To use it, an investor takes the property's gross rent and multiplies it by 50 percent, providing the estimated monthly operating expenses. That sounds easy, right

What is the 80% rule in real estate

The 80% rule means that an insurer will only fully cover the cost of damage to a house if the owner has purchased insurance coverage equal to at least 80% of the house's total replacement value.

What is the 1 rule for investment property

What Is The 1% Rule In Real Estate The 1% rule of real estate investing measures the price of the investment property against the gross income it will generate. For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price.

What is a good ROI on rental property

Generally, a good ROI for rental property is considered to be around 8 to 12% or higher. However, many investors aim for even higher returns. It's important to remember that ROI isn't the only factor to consider while evaluating the profitability of a rental property investment.

What is the 1% rule for investment property

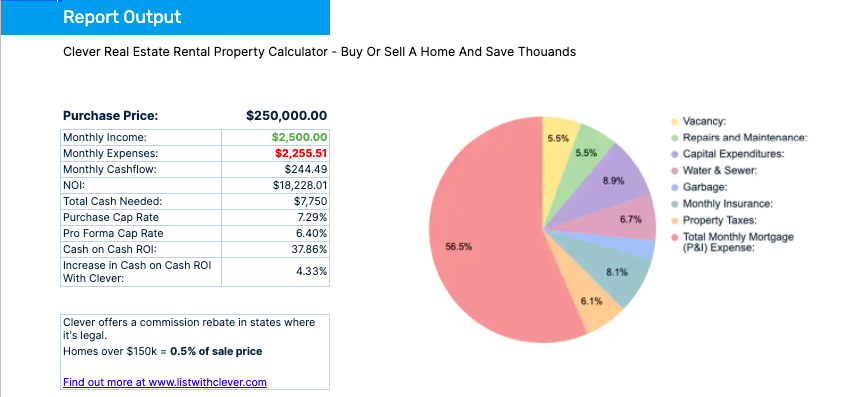

To calculate monthly rent using the 1 percent rule, simply multiply the home's purchase price by 1 percent. If repairs are needed, add the repair costs in with the purchase price. For example, let's say you're looking at a duplex home listed at $250,000 that's in good condition and doesn't need any immediate repairs.

What is the 70 percent rule in real estate

The 70% rule can help flippers when they're scouring real estate listings for potential investment opportunities. Basically, the rule says real estate investors should pay no more than 70% of a property's after-repair value (ARV) minus the cost of the repairs necessary to renovate the home.

What is the 70% rule in real estate investing

Basically, the rule says real estate investors should pay no more than 70% of a property's after-repair value (ARV) minus the cost of the repairs necessary to renovate the home. The ARV of a property is the amount a home could sell for after flippers renovate it.

What is the 50% rule in real estate

Like many rules of real estate investing, the 50 percent rule isn't always accurate, but it can be a helpful way to estimate expenses for rental property. To use it, an investor takes the property's gross rent and multiplies it by 50 percent, providing the estimated monthly operating expenses. That sounds easy, right

What is the 80% investment rule

The 80/20 rule can be effectively used to guard against risk when individuals put 80% of their money into safer investments, like savings bonds and CDs, and the remaining 20% into riskier growth stocks.

What is the 1% rule in rental investment

What Is The 1% Rule In Real Estate The 1% rule of real estate investing measures the price of the investment property against the gross income it will generate. For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price.

Is 6% return on rental property good

A good ROI for a rental property is typically more than 10%, but 5%–10% can also be acceptable. But the ROI may be lower in the first year, due to the upfront costs of buying a home.

What is the 70% investment rule

Basically, the rule says real estate investors should pay no more than 70% of a property's after-repair value (ARV) minus the cost of the repairs necessary to renovate the home. The ARV of a property is the amount a home could sell for after flippers renovate it.

What is Rule 69 in investment

The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result.

How much profit should you make on a rental property

The amount will depend on your specific situation, but a good rule of thumb is to aim for at least 10% profit after all expenses and taxes. While 10% is a good target, you may be able to make more depending on the property and the rental market.