Can I do transfer of equity myself?

What do I need to do to transfer equity

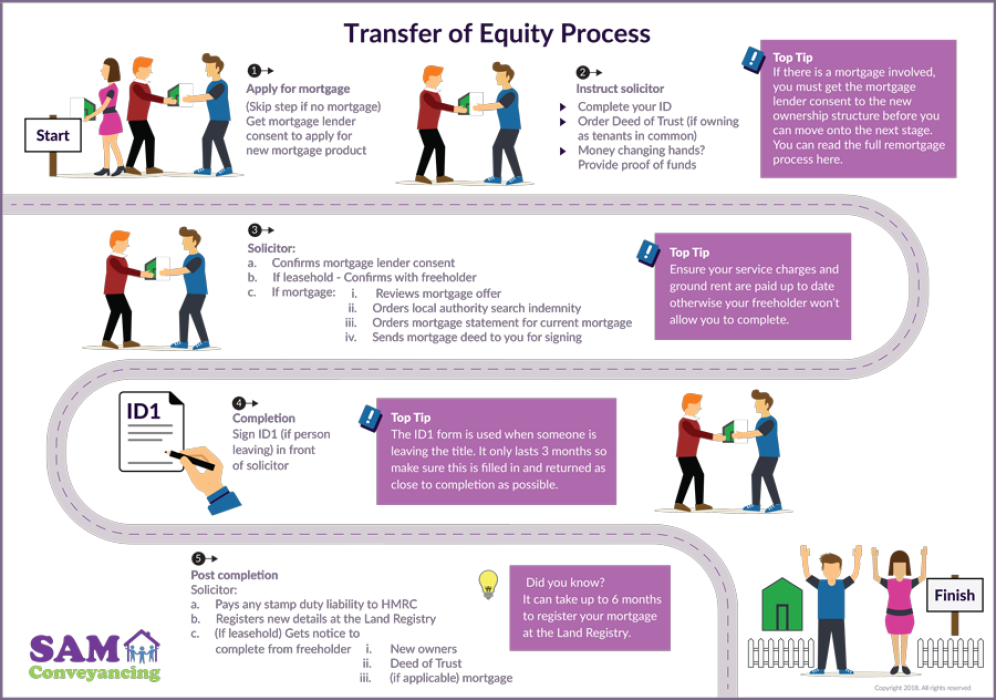

Transfer of equity: step by stepApply for a remortgage/new mortgage (if you need one).Instruct a conveyancer.All parties will need to provide thorough identification.Let your conveyancer take care of the legal work.Complete.

Can you do a transfer of equity

A transfer of equity can happen in any situation in which someone wishes to either leave or join a property deed. You can transfer equity to a new partner or another family member, or gift it to your children. You can also transfer equity to an existing partner if you are separating or divorcing.

Can I transfer my home equity loan

To refinance a HELOC with a new lender, you'll need to take out another home equity line of credit. You can then use those funds to pay off your current line. If you've already tapped into most of your home's equity with your first HELOC, you may not qualify for a new line of credit secured by your home.

How do I transfer my mortgage to another person

How to Transfer a MortgageReview Your Mortgage Documents. It's a good idea to double-check your loan agreement to see if you're allowed to transfer the mortgage.Request a Transfer. Contact your lender to initiate the transfer.Consider Extra Help.Complete the Transfer.

Does equity require payment

A home equity loan is a second mortgage on your home. It doesn't replace your current mortgage; it's a second mortgage that requires a separate payment.

How do you receive money from equity

Select the payout option (cash pickup, Bank Deposit or Mobile Money). Key in the receiver's details as prompted. To receive money via WorldRemit from abroad, request for the transaction reference number from the sender and visit any Equity Bank Branch to collect the cash.

How do you transfer money from equity to equity

The sender should be registered with PesaLink. Ask the sender to simply send the funds to your Equitel Number or Equity Bank Account Number and the money will be deposited straight into your Bank Account.

How much does it cost to remove someone from a mortgage

If the lender won't change the existing loan, your co-borrower will need to refinance the home into a new mortgage. Does it cost to remove a name from a mortgage Yes. Refinancing to remove a name requires closing costs, typically ranging from 2% to 5% of the loan balance.

Can I take equity out of my house without refinancing

Sale-Leaseback Agreement. One of the best ways to get equity out of your home without refinancing is through what is known as a sale-leaseback agreement. In a sale-leaseback transaction, homeowners sell their home to another party in exchange for 100% of the equity they have accrued.

What is the monthly payment on a $50000 HELOC

Loan payment example: on a $50,000 loan for 120 months at 7.50% interest rate, monthly payments would be $593.51. Payment example does not include amounts for taxes and insurance premiums.

How hard is it to transfer a mortgage to another person

In general, transferring a mortgage is difficult. If you have an assumable mortgage, the new borrower would be able to pay a flat fee to assume the existing mortgage and all debt. Most government-backed loans, such as VA or FHA loans, are usually assumable. However, most other loans will not be assumable.

Can you take someone off a mortgage without refinancing

Yes, it is possible to take sole responsibility for a home that you're currently sharing without refinancing, even if your ex-spouse or another co-borrower or cosigner is currently on the mortgage. As long as both names are on the mortgage, both parties will continue to be financially responsible for repaying the loan.

Is equity just cash

What Is the Difference Between Cash and Equity The difference between cash and equity is that cash is a currency that can be used immediately for transactions. That could be buying real estate, stocks, a car, groceries, etc. Equity is the cash value for an asset but is currently not in a currency state.

Do you get paid if you own equity

Yes. Companies aren't required to offer their employees equity as compensation. Therefore, if they are in full control over who they offer equity to and when. For example, a company may offer you equity as compensation, but there may be specific requirements regarding when you can have access to it.

Can you convert equity to cash

A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. A new mortgage is taken out for more than your previous mortgage balance, and the difference is paid to you in cash.

How do I withdraw money from my equity account

Withdrawing from an ATMPress the Equity Button on an Equity Bank Atm machine.Enter your Equitel phone number.Select/Type amount of money you want to withdraw from an ATM machine.You will receive a pop-up message on your phone asking you to confirm that you want to withdraw the amount requested.

How long does it take to transfer money from equity to equity

You can transfer money directly from your bank account to checking/current, savings and business accounts with Equity Bank. All bank transfers to Equity Bank will be available on the next working day. The advantage of this service is that you can send Kenyan Shillings (KES) and US Dollars (USD) to your recipient.

Can you remove a person from a mortgage without refinancing

If you can't refinance your existing mortgage, your lender may require you to pay off the loan in full in order to remove someone from a mortgage. This closes out the loan and removes your name as well as any co-borrower or co-signer from the mortgage.

Can you remove someone from a mortgage without having to refinance

Can I remove someone's name from a mortgage without refinancing A loan assumption or modification could release a co-borrower from your mortgage without refinancing into a new loan. However, lenders aren't required to grant assumptions or modifications, so be willing to negotiate.

What is the cheapest way to get equity out of your house

HELOCs are generally the cheapest type of loan because you pay interest only on what you actually borrow. There are also no closing costs. You just have to be sure that you can repay the entire balance by the time that the repayment period expires.