Can I file amended 941 electronically?

Can you submit form 941 electronically

You can e-file any of the following employment tax forms: 940, 941, 943, 944 and 945. Benefits to e-filing: It saves you time. It is secure and accurate.

Cached

Can you file amended tax return electronically

Can I file my amended return electronically Yes. If you need to amend your 2023, 2023 or 2023 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

How to file 941 employer’s Quarterly federal tax Return Online

How to E-File Form 941 Online for 2023 Tax Year with TaxBandits1 Choose Tax Year & Quarter.2 Enter Social Security & Medicare Taxes.3 Enter Deposit Schedule & Tax Liability.4 Choose IRS Payment Methods.5 Review your Form 941.6 Transmit your Form 941 to the IRS.

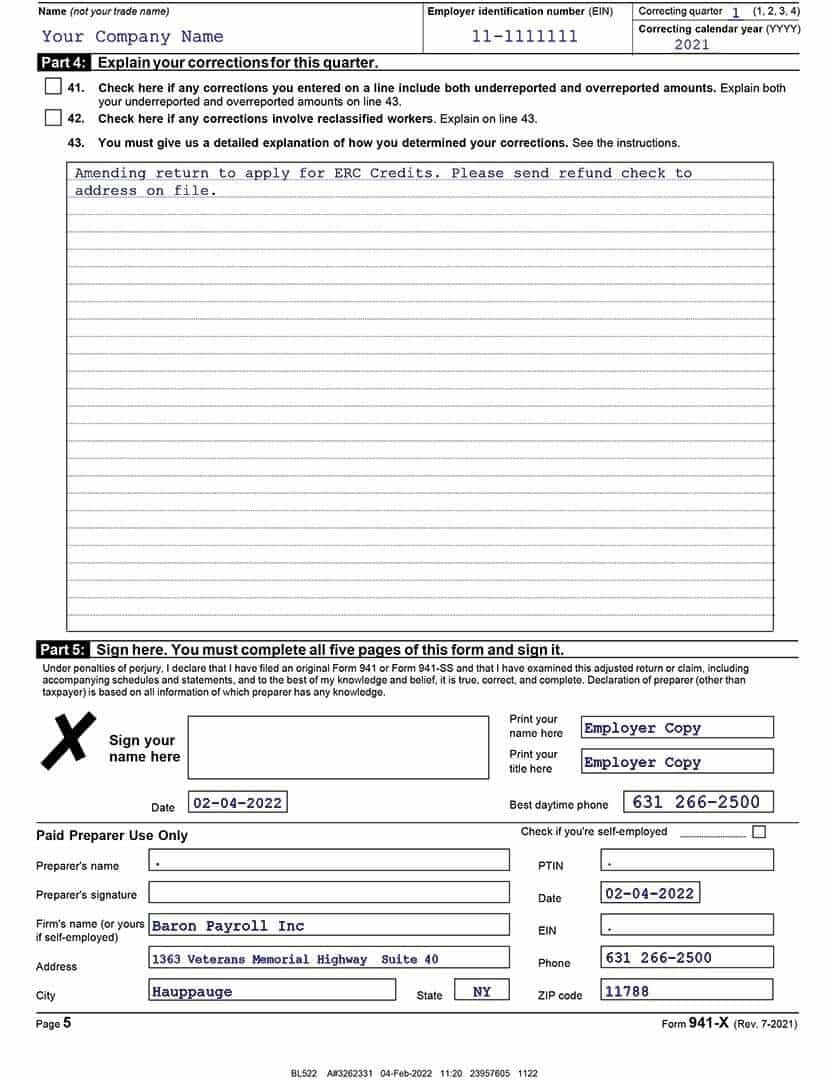

How do I amend my 941 tax return

For example, use Form 941-X, Adjusted Employers QUARTERLY Federal Tax Return or Claim for Refund, to correct errors on a previously filed Form 941. Taxpayers will continue to use Form 843 when requesting abatement of assessed penalties and interest.

Can you file 941 through EFTPS

Visit EFTPS.gov to enroll. Electronic Filing Options for Employment Taxes: Form 940, Employer's Federal Unemployment (FUTA) Tax Return; Form 941, Employer's Quarterly Federal Tax Return; Form 944, Employer's Annual Federal Tax Return.

Can you e file 941 through QuickBooks

In QuickBooks Desktop Payroll Enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. This is the fastest and easiest way to make sure you stay compliant with the IRS.

What is the easiest way to file an amended tax return

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

Where do I file an amended return electronically

If you have e-filed a 2023 Tax Return via eFile.com, you can prepare your amendment directly from your eFile.com account—amendments are free on eFile.com.

Can you file 941 through Eftps

Visit EFTPS.gov to enroll. Electronic Filing Options for Employment Taxes: Form 940, Employer's Federal Unemployment (FUTA) Tax Return; Form 941, Employer's Quarterly Federal Tax Return; Form 944, Employer's Annual Federal Tax Return.

Where do I file 941 Employer’s Quarterly federal tax Return

Department of the Treasury Internal Revenue Service; Ogden, UT 84201-0005—this address is used for any business that wishes to file without a payment attached. Internal Revenue Service PO Box 37941; Hartford, CT 06176-7941—this address is for businesses that wish to include a payment with their 941 tax form.

How long does it take the IRS to process an amended 941

Paper-filed original Form 941s are typically processed within 3-4 months. If your originally filed Form 941 claim has not been refunded, then it is time to reach out to the IRS or ask a professional to review the Form 941 for any potential errors on your claim.

How long does it take to file an amended 941

You have a limited amount of time to file Form 941-X. Generally, this form must be filed by the later of: 3 years from the date you filed your original return, or 2 years from the date you paid the tax.

What is the difference between IRS direct pay and EFTPS

What is the difference between Direct Pay and EFTPS EFTPS is used for most business payments. EFTPS may save you time if you are making quarterly estimated tax payments or making frequent payments. Direct Pay may be faster if you have an immediate payment deadline and have never used EFTPS.

How do I pay 941 without EFTPS

If you do not want to use EFTPS you can arrange for your tax professional, financial institution, payroll service, or other trusted third party, to make deposits on your behalf. Services provided by your tax professional, financial institution, payroll service, or other third party may have a fee.

Can you amend a 941 in QuickBooks online

Need to correct important tax entries You can file an amended tax form for both Federal 941 and 940. QuickBooks Desktop Payroll Enhanced allows you to file an amended tax return.

When must a company pay form 941 taxes electronically

File Form 941, Employer's QUARTERLY Federal Tax Return, if you paid wages subject to employment taxes with the IRS for each quarter by the last day of the month that follows the end of the quarter. If you timely deposited all taxes when due, then you have 10 additional calendar days to file the return.

How much does it cost to do an amended tax return

The caveat is that the amended return must be filed within either three years of the original filing date, or within two years of when the tax was paid, to be considered eligible. Federal: $50.95 to $94.95. Free version available for simple tax returns only.

Where can I file 1040X electronically

An IRS tax amendment for Tax Year 2023 can be prepared on eFile.com at no charge; see how to amend a tax return for any tax year here. If you filed your IRS accepted 2023 return on eFile.com, you can prepare your 1040-X for 2023 in your eFile.com account and print and mail it to the IRS for free.

How long does an amended tax return take electronically

As a reminder, amended returns take up to 16 weeks to process. It can take up to three weeks after filing it to show up in our system. There's no need to call the IRS during that three-week period unless the tool specifically tells you to do so.

What is the deadline to file the employers quarterly federal tax return form 941

Forms Filed Quarterly with Due Dates of April 30, July 31, October 31, and January 31 (for the fourth quarter of the previous calendar year)