Can I get a car with a 683 credit score?

Is 683 a good credit score to buy a car

A 683 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 683 Credit Score. Lenders like to do business with borrowers that have Good credit because it's less risky. It gets even better.

Cached

What is the interest rate on a car loan with a 683 credit score

According to MyFICO, as of November 2023, the average APR on a 60-month new auto loan for someone with a FICO Score of 720 or higher is 5.64%. With a score in the 690-719 range, it's 6.83%. And for a borrower with a score in the 660-689 tier, the average APR is 9.19%.

Cached

What credit cards can I get with a 683 credit score

Compare Cards Table for Best Credit Cards for Good Credit

| Annual Fee | Regular APR | |

|---|---|---|

| Discover it® chrome | $0 | 16.74% – 27.74% (Variable) |

| Blue Cash Everyday® Card from American Express | $0 | 18.74%-29.74% (Variable) |

| BankAmericard® credit card | $0 | 15.74% – 25.74% (Variable) |

| Chase Sapphire Preferred | $95 | 20.74% – 27.74% (Variable) |

Is a 683 credit score good enough to buy a house

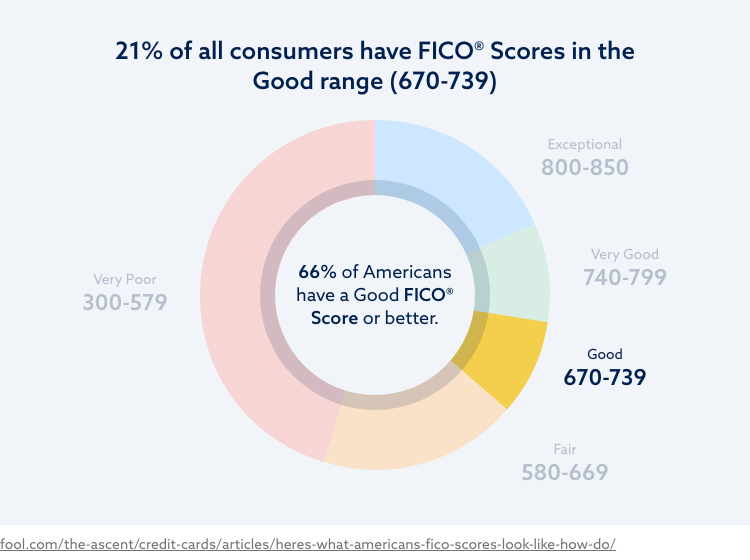

740–850: Excellent credit – Borrowers get easy credit approvals and the best interest rates. 670–740: Good credit – Borrowers are typically approved and offered good interest rates. 620–670: Acceptable credit – Borrowers are typically approved at higher interest rates.

Is 683 a bad FICO score

A 683 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian.

What credit score do you need to buy a 50k car

A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.40% or better, or a used-car loan around 8.75% or lower.

What is the average APR for a car loan with a 680 credit score

These are interest rates you can expect to be with credit scores: 680 and below: 6.5% – 12.9% (on average) 739 – 680: 4.5% interest rate (on average)

Is a 630 credit score good for a car loan

You should be able to get a car loan with a 630 credit score without a problem. Truthfully, people can get a car loan with almost any credit score—the difference will be what kind of interest rate you can secure. A score of 630 may get you an interest rate of between 11.92 percent and 4.68 percent on a new car loan.

What can a 630 credit score get you

What Does a 630 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Secured Credit Card | YES |

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

How accurate is credit karma

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

What kind of loan can I get with a 680 credit score

Credit Rating: 680 is still considered a fair credit score. Borrowing Options: Most borrowing options are available, but the terms may not be very attractive. For example, you should be able to qualify for unsecured credit cards and personal loans, but the interest rate may be fairly high.

What is the strictest FICO score

Most credit scores that lenders use in the United States range from 300 to 850. And when people talk about achieving the “highest” credit score possible, they're usually talking about the ever-elusive 850 FICO® Score. Earning a perfect 850 FICO Score isn't common, but it's certainly possible.

How good is a 630 FICO score

Your score falls within the range of scores, from 580 to 669, considered Fair. A 630 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

What credit score do I need to buy a $30 000 car

There's no set minimum credit score required to get an auto loan. It's possible to get approved for an auto loan with just about any credit score, but the better your credit history, the bigger your chances of getting approved with favorable terms.

What credit score do I need to buy a $20000 car

Key Takeaways. Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.

Can I get a 20k loan with 680 credit score

You will likely need a credit score of 660 or higher for a $20,000 personal loan. Most lenders that offer personal loans of $20,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.

What can I get approved for with a 680 credit score

What Does a 680 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Unsecured Credit Card with No Annual Fee | YES |

| Unsecured Credit Card with Rewards | YES |

| Home Loan | YES |

| Auto Loan | YES |

What is the car APR with a 630 credit score

Average auto loan interest rates by credit score

| Credit score | Average interest rate for new car loans | Average interest rate for used car loans |

|---|---|---|

| 781 to 850 | 3.84% | 3.69% |

| 661 to 780 | 4.9% | 5.47% |

| 601 to 660 | 7.25% | 9.81% |

| 501 to 600 | 10.11% | 15.86% |

Is 630 a good credit score to buy a car

Can I get an auto loan with an 630 credit score The short answer is yes, but you're likely to get a significantly higher-than-average interest rate. To put it into perspective, as of November 2023, the typical borrower with prime credit (720 or higher FICO score) got an APR of 5.34% on a 60-month new auto loan.

What is the average interest rate on a car loan with a 630 credit score

Average auto loan interest rates by credit score

| Credit score | Average interest rate for new car loans | Average interest rate for used car loans |

|---|---|---|

| 781 to 850 | 3.84% | 3.69% |

| 661 to 780 | 4.9% | 5.47% |

| 601 to 660 | 7.25% | 9.81% |

| 501 to 600 | 10.11% | 15.86% |