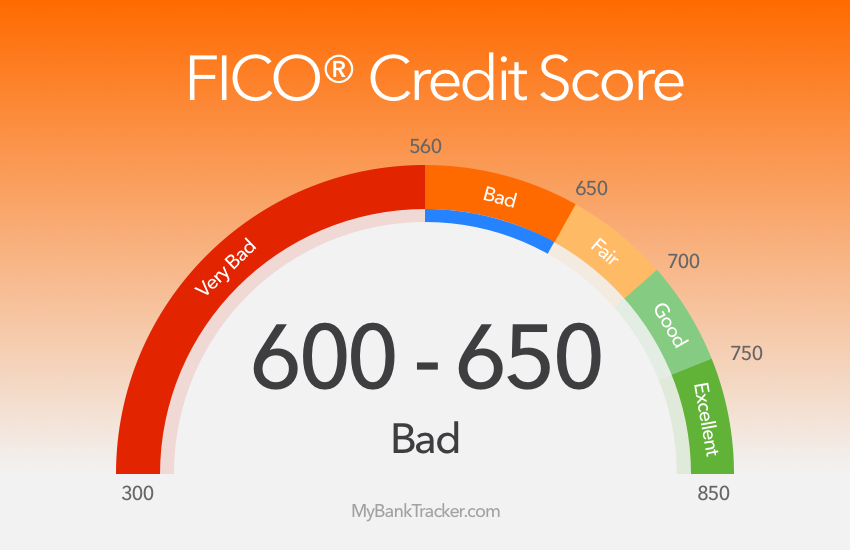

Can I get a conventional loan with a credit score of 600?

How big of a loan can you get with a 600 credit score

The amount you can borrow will vary by lender, but you can typically take out a loan between $1,000 and $50,000 with a 600 credit score. Keep in mind that the more you borrow, the more you'll pay in interest.

Cached

What kind of home loan can I get with a 600 credit score

FHA home loan

Mortgage loans that allow a 600 credit score

FHA home loan: These are government loans insured by the Federal Housing Administration (FHA). FHA loans are intended for people with lower credit; they allow a minimum credit score between 500 and 580. If your FICO score is below 580, you'll need a 10% down payment.

Cached

What is the lowest credit score for conventional financing

620 or higher

Conventional Loan Requirements

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Cached

What can I get approved for with a 600 credit score

What Does a 600 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

| Auto Loan | MAYBE |

How to go from 600 to 700 credit score

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

What APR can I get with 600 credit score

Better credit means lower costs

| Credit score | Average APR, new car | Average APR, used car |

|---|---|---|

| Nonprime: 601-660. | 8.12%. | 12.08%. |

| Subprime: 501-600. | 10.79%. | 17.46%. |

| Deep subprime: 300-500. | 13.42%. | 20.62%. |

| Source: Experian Information Solutions. |

How much of a down payment do I need with a 600 credit score

The government backing removes some of the risk for lenders, so people with lower credit scores and smaller down payments may qualify. If you have a credit score of 580 or more, you'll only need to put down 3.5% of the home's purchase price, while a score of 500 to 579 requires at least 10% down.

What is the minimum credit score for home credit

There is no minimum CIBIL score mentioned by lenders for approving the home loan application. However, a Credit Score above 750 is usually considered good for availing a home loan.

What is the minimum FICO score for conventional

620

Credit score: In most cases, you'll need a credit score of at least 620 to qualify for a conventional loan.

Is it harder to get a conventional loan

Even though a conventional loan is the most common mortgage, it is surprisingly difficult to get. Borrowers need to have a minimum credit score of about 620 in order to qualify—the highest minimum score of all mortgage products—and have a debt-to-income ratio of 43% or less.

How fast can I go from 600 to 700 credit score

How Long Can It Take to Build a Credit Score Of 800-850

| Initial Score | Avg. time to reach 700* | Avg. time to reach 750* |

|---|---|---|

| 350 – 400 | 2+ years | 2-3 years |

| 450 – 500 | 18 months – 2 years | 2 – 3 years |

| 550 – 600 | 12-18 months | 1-2 years |

| 650 – 700 | – | 3 months – 1 year |

How long does it take to go from 600 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Is a 600 credit score enough to buy a house

A 600 credit score is high enough to get a home loan. In fact, there are several mortgage programs designed specifically to help people with lower credit scores. However, you'll need to meet other lending requirements too.

How accurate is credit karma

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

What’s the lowest credit score to buy a house

Generally speaking, you'll need a credit score of at least 620 in order to secure a loan to buy a house. That's the minimum credit score requirement most lenders have for a conventional loan. With that said, it's still possible to get a loan with a lower credit score, including a score in the 500s.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What is the minimum FICO to buy a house

around 620

The minimum credit score needed for most mortgages is typically around 620. However, government-backed mortgages like Federal Housing Administration (FHA) loans typically have lower credit requirements than conventional fixed-rate loans and adjustable rate mortgages (ARMs).

Is it hard to get approved for a conventional loan

Even though a conventional loan is the most common mortgage, it is surprisingly difficult to get. Borrowers need to have a minimum credit score of about 620 in order to qualify—the highest minimum score of all mortgage products—and have a debt-to-income ratio of 43% or less.

Is conventional better than FHA

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option. These are only general guidelines, though.