Can I get a credit card with 590 score?

Can I get a credit card with a 590 score

Yes, you can, but you'll need to apply for specific cards that accept applicants with low credit scores.

What can I get with a 590 credit score

Best Personal Loans for a 590 Credit Score

| Lender | Loan Amounts | APRs |

|---|---|---|

| Upstart | $1,000 – $50,000 | 5.35% – 35.99% |

| Oportun | $300 – $15,400 | 10.07% – 35.95% |

| OneMain Financial | $1,500 – $20,000 | 18% – 35.99% |

| RISE | $500 – $5,000 | 60% – 299% |

What’s the lowest credit score to get a credit card

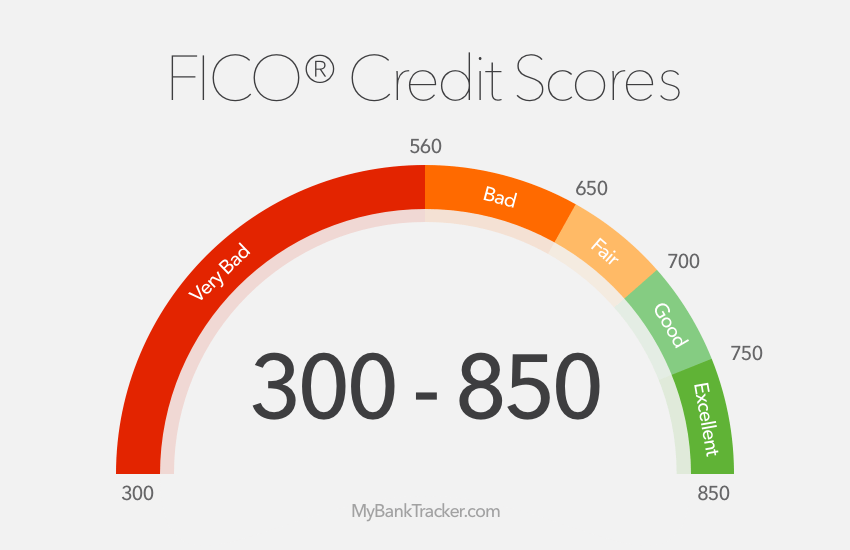

There is no minimum credit score needed for a credit card. Even borrowers with poor credit (a score of 300) or no credit card at all can qualify for some credit cards. However, options for bad-credit borrowers are limited and usually come with a high annual percentage rate (APR) and fees.

Can I get a credit card with a 500 credit score

To be eligible for a credit card, the applicant should have a good credit score. Usually, any credit score above 750 and as close to 900 is considered good by financial institutions. Several Banks do accept a credit score between the range of 700-750 for credit card approval.

Which card is easiest to get approved for

FULL LIST OF EDITORIAL PICKS: EASIEST CREDIT CARDS TO GETOpenSky® Plus Secured Visa® Credit Card. Our pick for: No credit check and no bank account required.Chime Credit Builder Visa® Credit Card.Petal® 2 "Cash Back, No Fees" Visa® Credit Card.Mission Lane Visa® Credit Card.Self Visa® Secured Card.Grow Credit Mastercard.

Can I buy a house with 590 credit score

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

What is the easiest card to get with bad credit

Best Credit Cards For Bad CreditNavy FCU nRewards® Secured Credit Card * [ jump to details ]Tomo Credit Card * [ jump to details ]OpenSky® Secured Visa® Credit Card.Discover it® Secured Credit Card.Credit One Bank® Platinum Visa® for Rebuilding Credit *Bank of America® Customized Cash Rewards Secured Credit Card *

Can I get a Walmart credit card with a 600 credit score

The Walmart Credit Card credit score requirement is 640 or higher, which means people with fair credit or better have a shot at getting approved for this card. The Walmart® Store Card also requires at least fair credit for approval.

Can I get a Walmart credit card with a 520 credit score

The Walmart Credit Card credit score requirement is 640 or higher, which means people with fair credit or better have a shot at getting approved for this card. The Walmart® Store Card also requires at least fair credit for approval.

Can I get a credit card with a 517 score

The best type of credit card for a 517 credit score is a secured credit card. Secured cards give people with bad credit high approval odds and have low fees because cardholders are required to place a refundable security deposit.

How to increase credit score from 590 to 700

Pay all your dues on time and in full if you wish to increase your credit score from 500 to 700. Missing a repayment or failing to repay the debt will significantly impact your credit score.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What credit score do you need for an Amazon card

Typically, you can qualify for Synchrony's Amazon store cards with a fair credit score (580 to 669). On the other hand, you'll likely need at least a good credit score (670 to 739) to qualify for one of the Amazon Visa cards from Chase.

What score do you need for Kohls card

640 or higher

The Kohl's Credit Card approval requirements include a credit score of 640 or higher; this means you need at least fair credit to get approved for this card.

Can I get a Capital One credit card 500 credit score

Yes, you can get a credit card with a 500 credit score, though your options will be limited to secured credit cards and unsecured credit cards for bad credit. The best credit card for a 500 credit score is the Capital One Quicksilver Secured Cash Rewards Credit Card.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

Can a person with a 500 credit score buy a 45k house

Anyone with a minimum credit score of 500 can apply for an FHA loan. But if you already have a 620 or higher credit score, it makes more sense to go for a conventional mortgage.

How much does a couple need to make to buy a $200 K house

What income is required for a 200k mortgage To be approved for a $200,000 mortgage with a minimum down payment of 3.5 percent, you will need an approximate income of $62,000 annually.

What credit score do you need for Walmart card

640 or higher

You need a credit score of 640 or higher to qualify for a Capital One Walmart Rewards® Mastercard®. This implies that those with average to exceptional credit are more likely to get approved for the Walmart Credit Card.