Can I get a debit card at 17 without my parents?

Can a 17 year old open a debit card

Teaching Your Teen to Use a Debit Card

If the teen is under 18 years of age, there typically needs to be a joint account holder (parent or guardian) who is at least 18 years old to sign up for an account.

Cached

Can I get a debit card without parent permission

No, it's not possible to have a debit card at 16 without parents. A debit card is linked directly to a bank account. If you are 16, you will need to have a parent as a joint account holder. When you are 18, you can open your own bank account and, subsequently, your own debit card.

Cached

Can a 17 year old open a bank account without a parent bank of America

To open an account, you'll need a co-applicant over 18, like a parent or guardian.

Cached

How to get a card at 17

Getting a credit card before 18

Kids younger than 18 typically can't open their own credit card. But they may be able to access credit in other ways. One is by becoming an authorized user on someone else's credit card account. An authorized user is a person a cardholder has granted access to use their account.

How much money should a 17 year old have saved

“A good rule to live by is to save 10 percent of what you earn, and have at least three months' worth of living expenses saved up in case of an emergency.” Once your teen has a steady job, help them set up a savings program so that at least 10 percent of earnings goes directly into their savings account.

What is the minimum age for a debit card

You have to be 18 to open an individual checking account in the US. However, prepaid debit cards like GoHenry are available to children from age six. These work just like a traditional bank debit card and can be used for in-store and online purchases, and make withdrawals at ATMs.

What do you need as a minor to get a debit card

Both you and the minor must provide a valid primary ID, such as a state ID card, driver's license, or passport. It must have a photo and cannot be altered or expired. You may both be asked to provide a secondary form of ID, such as a student ID or a major credit card.

How can I open a debit card without my parents knowing

If you are not over 18 years old, it is possible to open up a bank account with another relative, such as an aunt or uncle, or older sibling. As long as you have a valid, US-issued photo identification, opening up a bank account should be a fairly simple process.

What banks let you open an account at 17

Best Teen Checking Accounts Of June 2023

| Company | Forbes Advisor Rating | For Ages |

|---|---|---|

| Chase First Banking℠ | 4.3 | 6 to 17 |

| Alliant Credit Union Teen Checking | 4.0 | 13 to 17 |

| Connexus Credit Union Teen Checking | 3.7 | 10 to 17 |

| Copper Banking | 3.7 | 13+ |

Can a 17 year old open a bank account without a parent at Wells Fargo

Can a minor open a bank account without a parent Minors 13 years or older can open an account individually or with an adult co-owner. Minors under 13 must have an adult co-owner. Minors under 18 must open an account at a Wells Fargo branch.

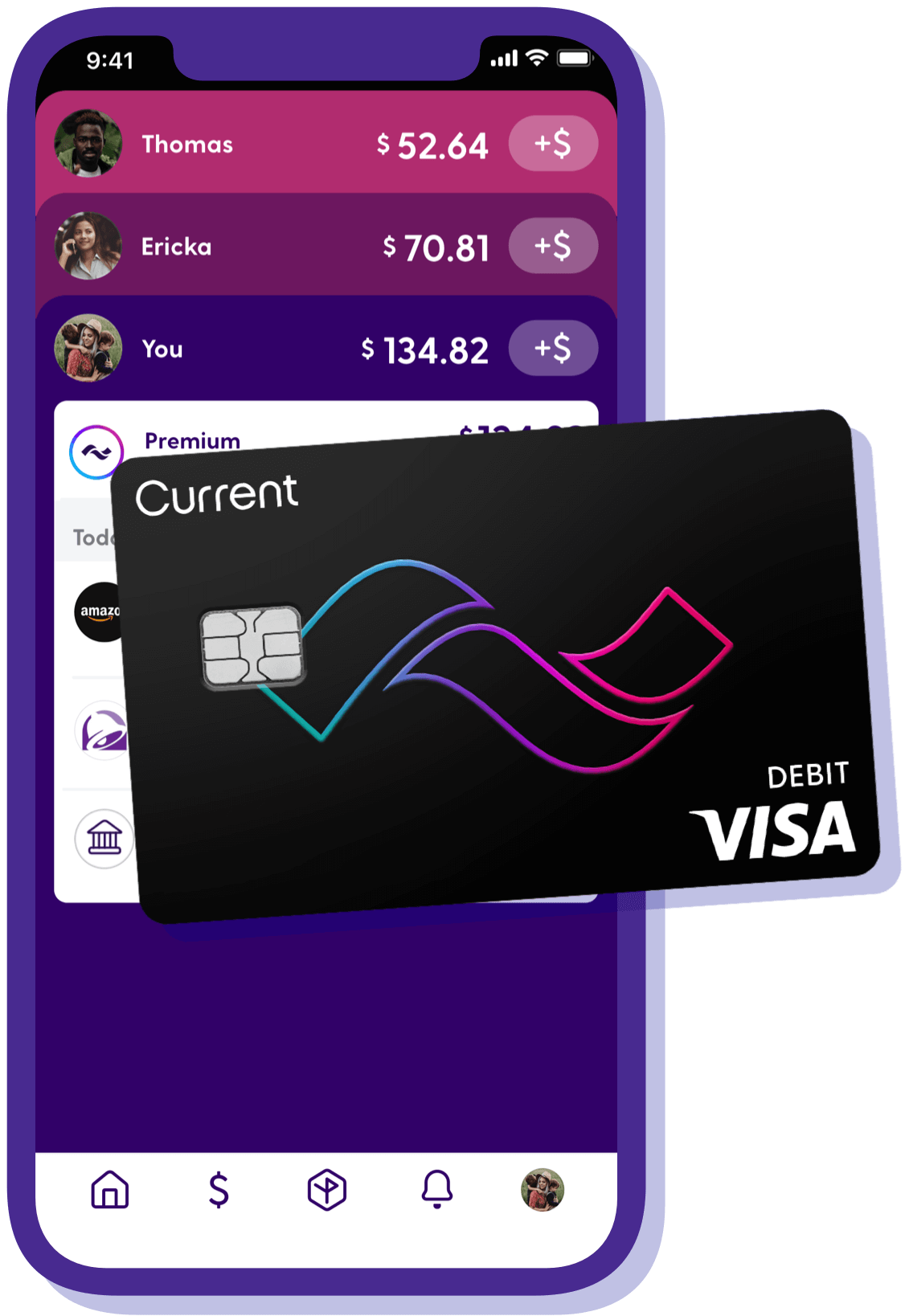

What card can I get at 17

Visa Buxx is a prepaid, reloadable Visa card created especially for teens. Visa Buxx makes it easy for parents to teach teens how to create a budget, manage money, and shop wisely. The card can be used everywhere that accepts Visa debit cards – that's millions of locations worldwide.

Do I have a credit score at 17

Typically, only people over the age of 18 have a credit score — but it is possible for minors to have a credit report. A person under 18 can have a credit report if : Their identity was stolen and used to open one or more credit accounts.

How much money does the average 17 year old spend

Teen Spending Habits (Top Picks)

An average American teen spends $2,331 per year. Teens spend most money on clothing (20%) and food (19%). On average, a US teen spends $44.8 per week ($26.9 from parents and $17.9 from part-time work).

How much money does average 18 year old have

How Much Money Does an Average 18-Year-Old Have In Their Bank Account Now that assumes full-time work and little to no financial responsibility. In reality, the average teen likely has far less than 1,000 in their savings. For comparison, the average adult has around 5,300 in savings³.

How to get debit card under 18

For all bank accounts:Both you and the minor must provide a valid primary ID, such as a state ID card, driver's license, or passport.You may both be asked to provide a secondary form of ID, such as a student ID or a major credit card.You must provide proof of address, such as a utility bill or financial statement.

Is there a debit card for under 18

IDBI Bank Kids debit card is designed for the youngest segment of our customers; it is designed to instill some confidence in kids when it comes to handling money and savings. We strongly believe that Indian kids are the smartest in the world and will use their hard earned savings in the best possible manner.

Can a minor get a debit card with their name on it

Typically, a child becomes eligible for a debit card when they turn 13 and their parent or legal guardian can open a joint checking account with a teen. That said, many banks, credit unions and online financial companies allow kids as young as 6 to get debit cards.

What is the minimum age to get a debit card

13

You can get a debit card from the age of 13 at most US banks when a parent or guardian opens a joint checking account on the child's behalf. These typically come with a contactless debit card or a cash card they can use to make ATM withdrawals.

How much should a 17 year old have in the bank

How much money should a 17-year-old have in the bank It depends on your lifestyle. It could range from $0 to 6 months of living expenses. At that age, some people are living with parents or in college with parents covering expenses, in which case you don't need anything, maybe pocket change.

Can you be 17 with your own bank account

Opening bank accounts requires you to be of an eligible age. You need to be at least 18 years old to open an account by yourself, or the age of majority in your state of residence. One way around this requirement comes from opening a joint account with at least one of the account holders being the age of majority.