Can I get back paid for family tax benefit?

Who qualifies for FTB refund

Determine your eligibility

You are eligible if you: Filed your 2023 tax return by October 15, 2023[i] Meet the California adjusted gross income (CA AGI) limits described in the What you may receive section. Were not eligible to be claimed as a dependent in the 2023 tax year.

Cached

How long does it take to get Washington Working families Tax Credit

to 90 days

It can take up to 90 days to process your application and receive your credit.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

Do dependents get money back

Credit for other dependents: If you have a qualifying relative as a dependent on your return, you're entitled to claim a nonrefundable credit of up to $500. You can claim this for each qualifying relative you have on your tax return.

How much is the FTB refund

Background

| Married Filling Joint | ||

|---|---|---|

| $150,000 or less | $700 | $350 |

| $150,001 to $250,000 | $500 | $250 |

| $250,001 to $500,000 | $400 | $200 |

| All other individual |

How long does it take to get a refund from FTB

Allow at least 8 weeks to receive the new refund check.

How does the working families tax credit work

The Working Families Tax Credit is a new annual tax refund for Washington residents worth $50-$1,200 depending on your income level and how many qualifying children you have in your household.

Has anyone received ERC refund 2023

You could receive your refund 21 days after filing your 2023 taxes in 2023. This means you could receive your refund three weeks after the IRS receives your return. It may take several days for your bank to have these funds available to you.

How do I get a large refund

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Why did I get $800 from the IRS

You could be owed hundreds of dollars. The IRS says 1.5 million people are owed a median refund of more than $800 because they haven't filed their 2023 tax return yet.

Can I get a refund with no income

If you qualify for tax credits, such as the Earned Income Tax Credit or Additional Child Tax Credit, you can receive a refund even if your tax is $0. To claim the credits, you have to file your 1040 and other tax forms.

Can I get tax refund with no income

Yes, you can still file a tax return even if you have little to no income to report. You may even receive a refund if you qualify for any refundable tax credits.

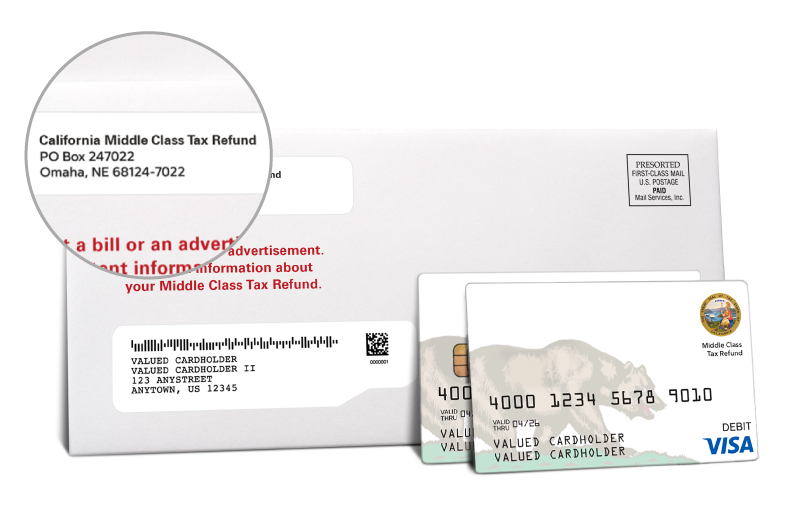

What happens if I never received my FTB refund

If you've moved and have not received your Middle Class Tax Refund payment, you should contact Money Network directly and update your address. Visit the Contact information section for Money Network's customer support number. Note you should also update your address with FTB through MyFTB or Contact us .

Why did I get 600 from FTB

This is a one-time $600 or $1,200 payment per tax return. You may receive this payment if you receive the California Earned Income Tax Credit (CalEITC) or file with an Individual Taxpayer Identification Number (ITIN).

Why is my FTB refund taking so long

Why Is My California Refund Taking So Long Some California state tax returns require extra reviews, leading to longer processing times. The FTB needs to review more complex returns for: Accuracy.

Can you get a tax refund if you have no income

Credits may earn you a tax refund

If you qualify for tax credits, such as the Earned Income Tax Credit or Additional Child Tax Credit, you can receive a refund even if your tax is $0. To claim the credits, you have to file your 1040 and other tax forms.

What is the average EITC refund

2023 EITC Tax Returns by State Processed in 2023

The average amount of EITC received nationwide was about $2,043.

How long does ERC refund take 2023

6-8 weeks

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

Why haven’t I received my ERC refund

The length of time it takes to receive the ERC refund will vary from business to business. Initially, it may have taken anywhere from four to six weeks to receive your employee retention tax credit reward. However, due to a backlog of claims submitted to the IRS, this has lengthened by a number of months.

How to get $7,000 tax refund

Below are the requirements to receive the Earned Income Tax Credit in the United States: Have worked and earned income less than $59,187. Have investment income less than $10,300 in tax year 2023. Have a valid Social Security number by the due date of your 2023 return.