Can I get credit report from American Express?

What is Amex on my credit report

AMEX/DSNB is code for American Express/Department Stores National Bank, which issues Macy's and Bloomingdale's American Express credit cards. If you applied for one of these cards or were added as an authorized user to someone else's account, this could explain why it's showing up on your credit reports.

Cached

Does credit One American Express report to credit bureaus

Yes, the Credit One Amex card reports to all three major credit bureaus. This factor is ideal for your credit building efforts.

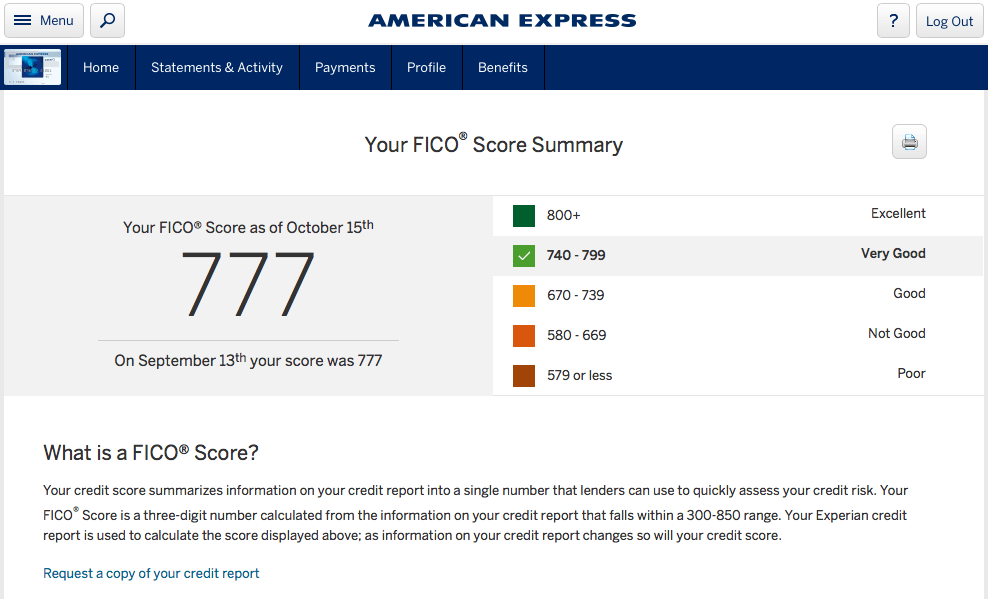

Does American Express check FICO

According to the score ranges from FICO, that means American Express applicants typically have at least a 670 score: Exceptional. 800 and above.

How long do a Amex takes to post on credit report

American Express reports to credit bureaus once per month, typically updating Experian, Equifax, and TransUnion within 5 days of a card's billing cycle ending.

What credit score is good for Amex

between 661 and 780

As a guideline, American Express' VantageScore tool considers a credit score between 661 and 780 to be a good score, anything below 661 to be fair or poor and anything above 780 to be excellent.

How is Amex different from a credit card

What makes American Express different is that it is both a card issuer and a card network. Unlike card issuers such as Chase or Bank of America and card networks such as Visa or Mastercard, American Express serves both the role of servicing accounts and processing transactions.

Why is my Amex not on my credit report

The reason your card is not reporting is likely that it is a Charge card as opposed to a Credit card. With a Charge card one must pay the balance in full prior to the expiration of the grace period. With a Credit card one may pay only a portion of the balance on or prior to the due date.

What’s the difference between American Express and Credit One American Express

No, Credit One American Express is not the same as American Express. Credit One Bank is a separate financial institution that issues Credit One American Express cards. These cards may have the American Express logo, but they are not the same as traditional American Express cards issued by American Express.

Is Amex good for building credit

American Express can help your credit score if you are the primary accountholder or an authorized user aged 18 or older on an American Express credit card or charge card account. For an Amex card to be good for your credit score, the account must be kept in good standing with on-time monthly bill payments.

What credit score type does American Express use

As a guideline, American Express' VantageScore tool considers a credit score between 661 and 780 to be a good score, anything below 661 to be fair or poor and anything above 780 to be excellent.

Why does Amex not show on credit report

Those cards have no pre-set spending limit, so credit bureaus would generally not consider about your credit utilization on them. Other banks will consider them as credit cards. Chase includes such cards in the 5/24 rule.

How long does it take to get an 800 credit score

Most people with an 800 credit score have a long credit history, just a little under 22 years. Credit history length does not represent how long you've used credit. Rather, it represents the average age of the open accounts on your credit report. If you close an old credit card, it can shorten your credit history.

Is Amex the hardest to get

There are no American Express credit cards that are easy to get. They all require good credit or better. Compared to other American Express cards, the Amex Blue Cash Everyday card is easier to get if you have good credit or better and you meet all other criteria in order to qualify for it.

What are the disadvantages of American Express card

Disadvantages of AmEx cards

One disadvantage of AmEx cards is that they charge both the seller and the buyer for processing a transaction. Since they do not rely on financial companies, such as Rupay, Mastercard or Visa, and have their own payment network, they charge additional fees on the transactions.

Why Amex is better than Visa

For example, American Express cards are accepted in more than 160 countries worldwide, which lags behind Visa and Mastercard that are both accepted in more than 200 countries. While it's easier to find places in countries like Canada or Australia that accept American Express, it is harder across Europe and Asia.

Why American Express credit cards are hard to get

Yes, it's hard to get an American Express card because you will need a good or excellent credit score for approval, along with enough income for monthly bill payments. The easiest American Express cards to get are those that require a minimum of good credit for approval, as opposed to excellent credit only.

What are the disadvantages of American Express

Disadvantages of AmEx cards

Since they do not rely on financial companies, such as Rupay, Mastercard or Visa, and have their own payment network, they charge additional fees on the transactions. This is one of the primary reasons, small businesses generally do not accept these cards.

What is the hardest Amex card to get

the Centurion® Card from American Express

The hardest Amex card to get is the Centurion® Card from American Express. Also known as the “Black Card,” this Amex card is hard to get because it is available by invitation only, and potential candidates are rumored to need an annual income of at least $1 million.

Can I get an Amex with 500 credit score

The American Express credit score requirement is of at least 700, depending on the card. That means people with good to excellent credit are eligible to get approved for an American Express credit card.

Does Amex report pay over time to credit bureaus

Unlike your spending on credit cards, your Pay Over Time balances and Limit utilization are not reported to credit bureaus. This allows you to take full advantage of your Pay Over Time feature. *No Preset Spending Limit1 means your spending limit is flexible.