Can I get my credit score for free from my bank?

Will my bank give me my credit score

Many credit card companies, banks and loan companies have started providing credit scores for their customers. It may be on your statement, or you can access it online by logging into your account.

Cached

How can I get my actual credit score for free

You may request your reports:Online by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

Which banks offer free FICO score

Which credit card issuers offer free scores

| Issuer | Free Credit Score Type | Who Can Get It |

|---|---|---|

| Bank of America | FICO | Cardholders |

| Barclaycard US | FICO | Cardholders |

| Capital One | VantageScore 3.0 | Anyone |

| Chase | VantageScore 3.0 | Anyone |

How much does it cost to check my credit score

You are entitled to get a free credit report annually from each of the nationwide credit reporting companies. It's a good idea to review your credit reports for free every 12 months. Most or all of the information that goes into a credit score comes from your credit report.

Where is the best place to check your credit score

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

How accurate is Credit Karma

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Is A 650 A good credit score

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

What is the best way to check my credit score

There are a few ways to check your credit scores:Visit a free credit scoring website. Numerous websites offer free credit scores; just pay attention to the terms before you sign up.Check with your credit card issuer or lender.Visit a nonprofit credit counselor.

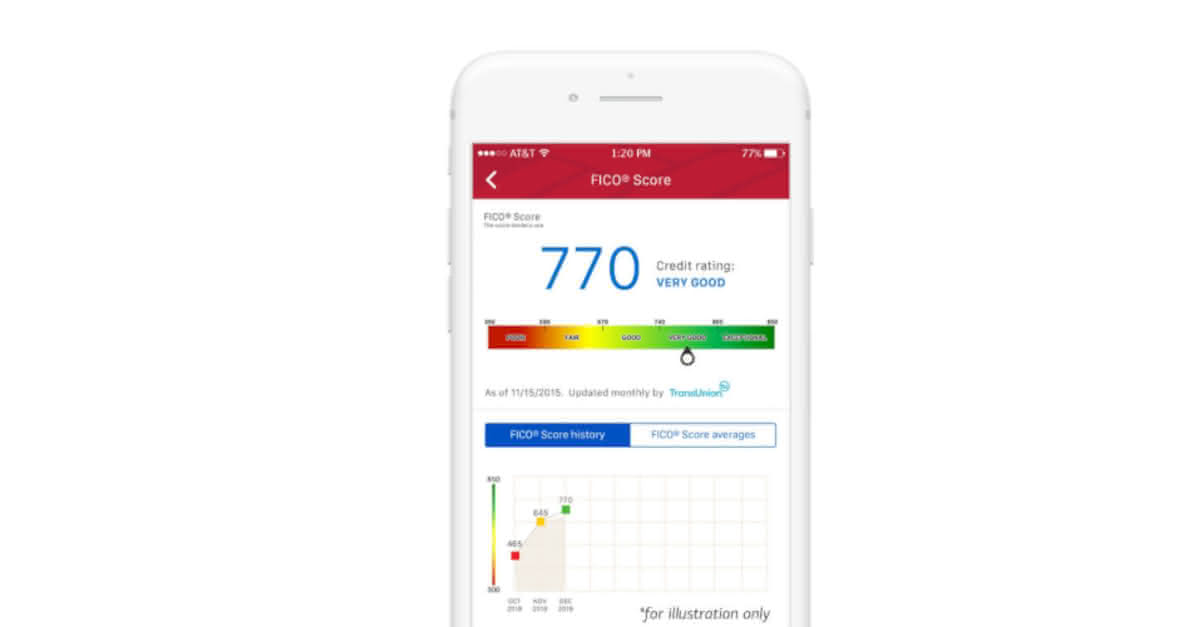

What is a good FICO score

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What is a legit way to check your credit score

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. 4 You'll have to pay them if you want your credit score.

What is the safest way to check your credit score

There are a few ways to check your credit scores:Visit a free credit scoring website. Numerous websites offer free credit scores; just pay attention to the terms before you sign up.Check with your credit card issuer or lender.Visit a nonprofit credit counselor.

Which credit score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

How many points is Credit Karma usually off

In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

How long does it take to go from 650 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How to go from 650 to 750 credit score

Here are some of the best ways.Pay on Time, Every Time.Reduce Your Credit Card Balances.Avoid Taking Out New Debt Frequently.Be Mindful of the Types of Credit You Use.Dispute Inaccurate Credit Report Information.Don't Close Old Credit Cards.

Can I check my own credit score without affecting it

Good news: Credit scores aren't impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

What is a FICO score and what is a good one

Your FICO score is a number typically on a 300-850 range used by lenders to determine your ability to pay back borrowed debt. A score of 690-719 is generally considered good credit. There are 5 main factors that impact your FICO score calculation; payment history and amounts owed hold the most sway.

Is Credit Karma your true credit score

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

What is the most accurate free credit score site

Best Overall AnnualCreditReport.com

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus—Equifax, Experian, and TransUnion—at no cost.

What is the most damaging to a credit score

5 Things That May Hurt Your Credit ScoresHighlights:Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.