Can I get my own credit card after being an authorized user?

Can you get a credit card if you are already an authorized user

Being an authorized user on a credit card won't hinder that person from applying for their own version as long as they are under the 5/24 rule.

Cached

Does removing an authorized user hurt their credit

Will removing an authorized user hurt their credit It depends on the situation. If the card in question has been well maintained with on-time payments and low credit utilization, removing the authorized user from the account will effectively erase that positive payment history from their credit report.

Does being an authorized user make it easier to get a credit card

Being an authorized user on a credit card can help get you on the credit radar and may even help give you an impressive credit score—but it may not be enough for you to qualify for credit in your own name.

Can an authorized user become the primary card holder

So, can an authorized user become the primary cardholder Ultimately, the actions an authorized user can and cannot take will depend on the card issuer's policies as well as permissions granted by the primary account holder. In other words, authorized users can't become the primary card holder.

Cached

How much will my credit score increase as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

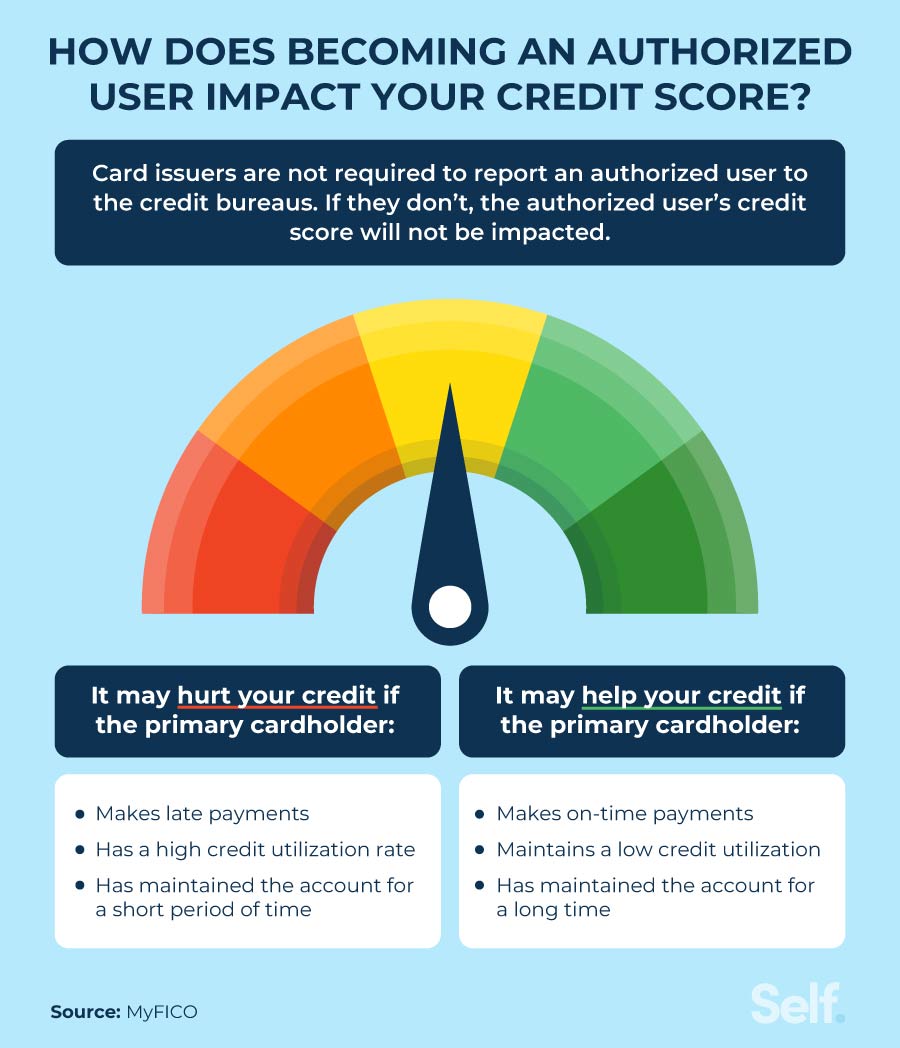

Why did my credit score drop when I was added as an authorized user

If you've added an authorized user to your credit card account, they'll typically get a credit card linked to your account and can use it to make charges, but they're not responsible for paying the balance. Any charges the authorized user makes can increase your credit utilization, which can lower your credit scores.

What happens if I remove myself as an authorized user

Summary. Removing yourself as an authorized user can lower your credit utilization ratio and the age of your credit history, both of which can have a negative impact on your credit score.

Why did my credit score drop when I was removed as a authorized user

Your credit score may either improve or drop slightly when you are removed as an authorized user on a credit card. That is because the account history for the credit card will automatically drop off your credit reports upon removal.

What is the downside of authorized user

Cons of becoming an authorized user

The primary account holder is ultimately responsible for repaying all charges made with the credit card. So if you charge a substantial amount and struggle to pay your portion of the bill, the primary cardholder will have to cover it.

How soon will an authorized user build credit

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

How quickly does adding an authorized user affect their credit

If the card issuer reports to the bureaus, then the account will typically show up on your credit reports within 30 to 45 days. But keep in mind that not all issuers report to all three bureaus — and if they do, the timing of when issuers report to credit bureaus can vary.

How long does it take to be removed as an authorized user

If you discover the primary cardholder isn't making on-time bill payments, you may decide that cutting ties is the best way to go. Call the issuer and ask to have your name removed as an authorized user. It should take only a few days, and the issuer will cease making reports under your name to credit bureaus.

What happens if you stop being an authorized user on a credit card

When you're removed as an authorized user, you no longer have the privilege of using the account, and the credit card issuer will stop updating the account on your credit report.

How long does it take for an authorized user to fall off

If you discover the primary cardholder isn't making on-time bill payments, you may decide that cutting ties is the best way to go. Call the issuer and ask to have your name removed as an authorized user. It should take only a few days, and the issuer will cease making reports under your name to credit bureaus.

What are the effects of being removed as an authorized user

When you're removed as an authorized user, you no longer have the privilege of using the account, and the credit card issuer will stop updating the account on your credit report.

When should I stop being an authorized user

There are a few reasons you'd want to be removed as an authorized user. If having the account on your credit report is hurting your credit score and your ability to be approved for other credit cards and loans, removing yourself from the credit card allows you to have the account removed from your credit report.

How much will my credit score go up as an authorized user

For instance, for those with bad credit (a credit score below 550), becoming an authorized user improved their credit score by 10% — in just 30 days. Fast forward to 12 months, and that figure jumps to 30%.

Will my credit score go up as an authorized user

Being an authorized user on someone else's account can allow you to build and improve your credit score. Before you become an authorized user, make sure the primary account holder has good credit and responsibly manages their account.

What happens when I stop being an authorized user

The account will no longer appear on your credit report, and its activity will not be factored into your credit scores. That also means that your length of credit history, which constitutes 15% of your FICO® Score, will be affected.

Is there a downside to being an authorized user

Just know that becoming an authorized user comes with some risk, since you don't control the account. If the primary account holder doesn't pay their bill, has too high of a balance or closes their account altogether, your credit can be negatively impacted.