Can I lease a car with 515 credit score?

What is the lowest credit score to lease a car

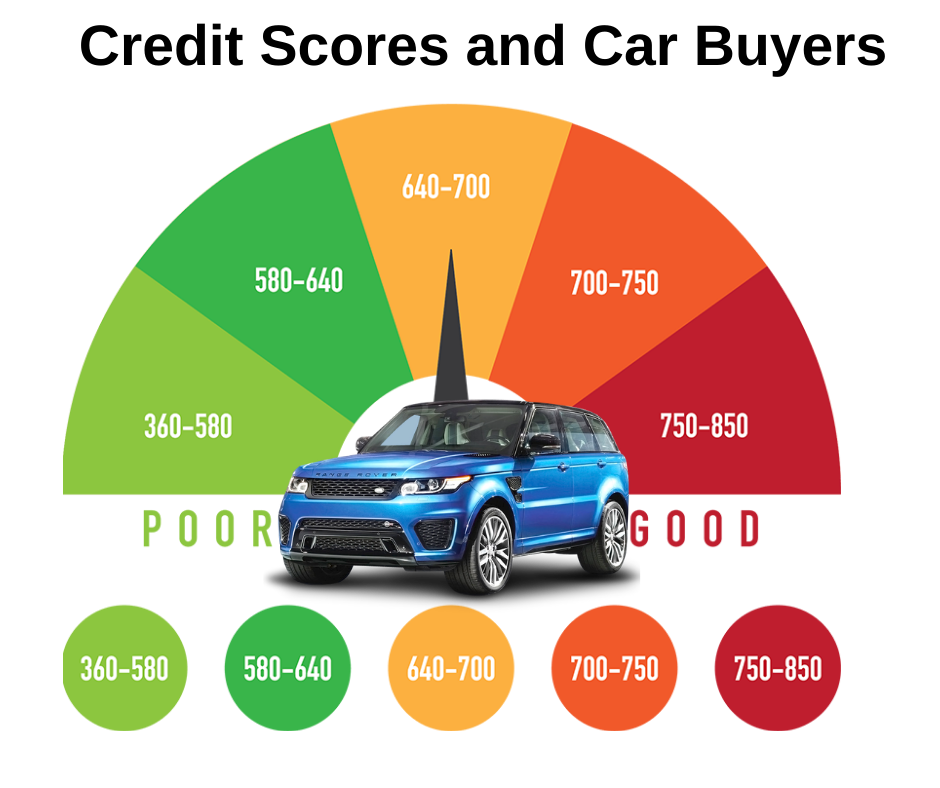

The typical minimum for most dealerships is 620. A score between 620 and 679 is near ideal and a score between 680 and 739 is considered ideal by most automotive dealerships. If you have a score above 680, you are likely to receive appealing lease offers.

Can I get a car loan with 515 credit score

Car Loans with a 515 Credit Score

People with credit scores below 540 receive less than 7% of all auto loans. As a result, your odds of getting approved for a decent car loan are slim.

Cached

Can I lease a car with 524 credit score

In general, a FICO Score of 700 or more is required to qualify for a lease. However, if you have a credit score of that rating, you are likely not reading this posting. If you have a credit rating that ranges from 599 to 699, you are categorized as a “subprime” credit holder.

Cached

Can I get a car with a 530 credit score

Can you finance a car with a 530 credit score You can finance a car with a 530 credit score. Lenders will charge a higher interest rate, but you can still get a vehicle.

Can I lease a car with a 500 credit score

Can I lease a car with a 500 credit score Yes. You can still lease a car with a credit score of 500. You may have to go through special channels to get approved, such as making a larger down payment or getting a co-signer.

What credit score is needed to lease a car without a cosigner

For the best shot of being approved for favorable lease terms, you should have a credit score of at least 700. Some companies may be willing to lease to you with a lower credit score, depending on the cost of vehicle, down payment, and other credit or contract terms.

How hard is it to get a car loan with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.

How much is a 30k car payment for 72 months

The total interest amount on a $30,000, 72-month loan at 5% is $4,787—a savings of more than $1,000 versus the same loan at 6%. So it pays to shop around to find the best rate possible.

How hard is it to get a car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023. But it'll take some nuancing and strategic planning to improve your chances.

How much is a lease on a $45000 car

How much is a lease for a $45,000 car Using our calculator, we input a $5,000 down payment, an assumed $25,000 residual value, an interest rate of 7% and a term of 36 months (three years). It resulted in monthly payment of $606 before taxes.

Can you lease a car with a 500 credit score

Can I lease a car with a 500 credit score It will be difficult to lease a new car with a credit score in the 500 range. If you put down a significant down payment or find a co-signer for your lease, you'll have a better chance of getting approved.

What can I do if my credit score is 550 and I need a car

You can still qualify for a car loan with such a score, but you may notice a higher interest rate compared to what can be normally expected. Depending on how long the loan period is, a 550 credit score will get your interest rates between 15% to 20%.

Can I get a brand new car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.

How much is a $25,000 car payment a month

Example 2: A $25,000.00 secured personal loan financed for 60 months at an interest rate of 8.500% would yield an APR* (Annual Percentage Rate) of 8.496% and 59 monthly payments of $512.87 and 1 final payment of $513.24. *These examples are for illustrative purposes only.

How much is a $40,000 car payment for 72 months

If you take a car loan of $40000 at an interest rate of 4.12% for a loan term of 72 months, then using an auto loan calculator, you can find that your monthly payment should be $628. When the loan term changes to 60 months, the monthly payment on a $40000 car loan will be $738.83.

How to get a 700 credit score from 500 to 700

Pay all your dues on time and in full if you wish to increase your credit score from 500 to 700. Missing a repayment or failing to repay the debt will significantly impact your credit score.

Why leasing a car is smart

Lower monthly payments

Instead of paying for the entire value of the car, your monthly payments cover the vehicle's depreciation (plus rent and taxes) over the lease term. Since you're only financing the depreciation instead of the purchase price, your payment will usually be much lower.

How much should I save before leasing a car

It's recommended you spend no more than about $2,000 upfront when you lease a car. In some cases, it may make sense to put nothing down and roll all of your fee costs into the monthly lease payment.

Can I finance a car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.

What will my APR be with a 550 credit score

Credit Score of 550: Credit Cards

| Card Type | Score | Rate |

|---|---|---|

| 700-719 | 6% | |

| Gold | 675-699 | 8% |

| 620-674 | 10% | |

| Standard | 550 Credit Score | 16% |