Can I pay bills using credit card?

What can I not pay with a credit card

Avoid placing the following expenses on credit cards:Mortgage or rent.Household Bills/household Items.Small indulgences or vacation.Down payment, cash advances or balance transfers.Medical bills.Wedding.Taxes.Student Loans or tuition.

Is it safer to pay bills with a credit card or debit card

A credit card is one of the safest forms of payment. Since a credit card is not linked with your personal account, it provides a layer of security between your transactions and personal finance management.

Is paying bills with a credit card considered a cash advance

Paying a bill using a credit card or line of credit is treated the same as getting a cash advance. You'll be charged interest from the time you make the payment, just like you would for a cash advance.

Can you autopay bills with a credit card

You can set up autopay with your credit card issuer over the phone or online. The payment may come out of your bank account on the bill due date or your credit card issuer may allow you to choose another payment date. You can discontinue the feature at any time.

When should you not use a credit card

What are the worst times to use a credit cardWhen you haven't paid off the balance.When you don't know your available credit.When you're just doing it for the rewards (but you haven't done the math)When you're afraid you have no other choice.When you're in a heightened emotional state.When you're suspicious of fraud.

How to stop using credit cards to pay for normal living expenses

Here are three ways to break the cycle of relying on credit.Stop Using Your Credit Card Completely. The first step to getting off the cycle of spending on credit is the most important: You have to stop using your credit cards completely.Build a Budget.Transfer the Remaining Credit Card Balance.

Does paying bills with a credit card hurt your credit score

Paying monthly bills with a credit card can affect your credit score positively or negatively, depending on how you handle it. Using a credit card could hurt your credit score if: You run up a balance and don't pay it off.

Is it smart to use your credit card for everything

You can use a credit card for everyday purchases to build credit and to earn rewards for the spending you already do. But remember that you should only use a credit card for purchases you can afford to pay back and make on-time payments to avoid damaging your credit.

Is it good to pay utilities with credit card

Generally speaking, paying your monthly bills by credit card can be a good idea as long as you adhere to two rules. Always pay your balance in full and on time each month. Never put bills on a credit card because you can't afford to pay them.

What are two negatives of using your credit card for a cash advance

Higher interest rate: Many cards charge a higher APR for cash advances than for regular purchases. No grace period: Your credit card usually gives you a grace period of at least 20 days to pay off your purchase before you're charged interest. Cash advances, though, start to accrue interest from day one.

Is it better to use a credit card for automatic payments

Using a credit card for automatic payments helps ensure that your payments go through even if your checking account balance is in the single digits. Just be sure to pay the balance when you get your credit card bill.

What is the safest way to auto pay bills

Set it up as online bill pay through either your bank or credit card. Do NOT use automated debit transactions. Set up alerts in advance of your bill due dates to make sure you have money to cover the bills. Always check your statements carefully for incorrect, duplicate or fraudulent transactions.

What are 3 disadvantages of using a credit card

Here are a few disadvantages of using a Credit Card:Habit of Overspending. Although credit cards provide you with adequate credit for a long time, you must be prudent when spending the money.High Rate of Interest.Deception.Hidden Costs.Restricted Drawings.Minimum Due.

Is it okay to use your credit card for everything

You can use a credit card for everyday purchases to build credit and to earn rewards for the spending you already do. But remember that you should only use a credit card for purchases you can afford to pay back and make on-time payments to avoid damaging your credit.

Is it OK to live in credit card debt

There isn't a recommended maximum limit for credit card debt cardholders can live by—the key to maintaining a good credit score is keeping credit utilization below 30% and paying off balances on time.

What is the best way to pay bills

How to pay bills on timeGet organised. Get a folder and keep your bills in it.Choose a payment method that suits you.Check your bills regularly.Don't let your bills get on top of you.Make sure you're not paying too much.Pay online or phone banking.Other payment methods.

What bills go towards credit score

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

What is the smartest way to use a credit card

6 Credit card tips for smart usersPay off your balance every month.Use the card for needs, not wants.Never skip a payment.Use the credit card as a budgeting tool.Use a rewards card.Stay under 30% of your total credit limit.

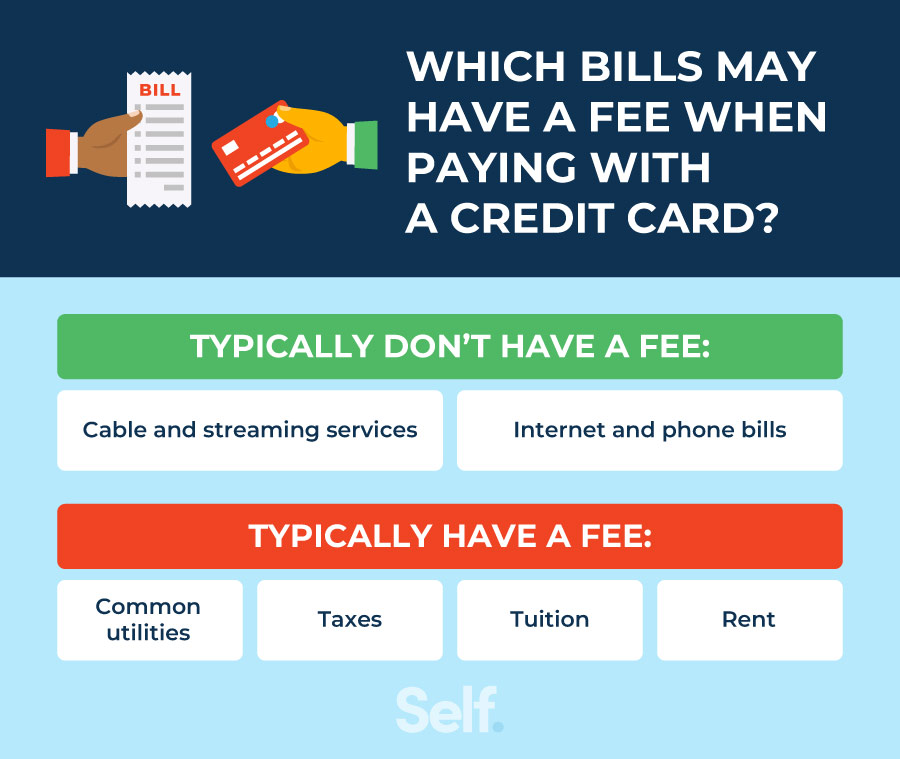

Should I pay utility bills with credit card or debit card

The bottom line. Be aware of any convenience fees you'll incur by paying your bills with credit cards. It's best to use credit only for products and services that won't charge a fee, and using cash, debit or bank transfer for the rest.