Can I pay credit card bill through cash?

How much cash can you pay for credit card bill

Payments made of an amount adding to Rs 1 lakh or more in cash towards credit card dues must be reported, states CBDT. Further, if one pays Rs 10 lakh or more to settle credit card dues in a financial year (in any mode), these transactions too need to be reported to the income tax department.

Can I pay my Capital One bill with cash

You can pay your Capital One credit card with cash at a Capital One branch location or at an ATM. You may also make a payment at Money Services, Western Union, MoneyGram or through the PayNearMe platform.

Can you pay credit card bill with cash Chase

Here's how to pay your Chase credit card at an ATM:

Insert your Chase credit card and tap “Don't have your PIN”. Enter your ZIP code and choose “Pay with Cash”. See your balance and minimum payment due. Insert cash in any denomination and the machine will count it for you.

How do I pay a bill with cash

Many companies will allow you to pay your bills in-person. Your wireless phone bill, for instance, or utility bill can be paid by visiting the nearest branch and paying cash. When you visit to pay a bill in-person, make sure to bring your bill and ask for a receipt so you can verify that someone processed your payment.

Do credit card companies report cash payments to IRS

No, you do not have to file any tax forms for payments you make by credit card. The merchant acquiring bank will send vendors a 1099-K if one is required. However, if you pay suppliers or contractors with cash, check, or similar payments, you may need to file a 1099-NEC or 1099-MISC.

What cash transactions are reported to the IRS

A trade or business that receives more than $10,000 in related transactions must file Form 8300. If purchases are more than 24 hours apart and not connected in any way that the seller knows, or has reason to know, then the purchases are not related, and a Form 8300 is not required.

Can I pay credit card at post office

You can use this service any time your local Post Office branch or Payzone store is open. Go to your local Post Office branch or Payzone store and we'll take it from there. Just bring what you need and tell us how much you'd like to pay. You can pay by credit or debit card and we'll give you a receipt for your payment.

Can I pay my Amex with cash

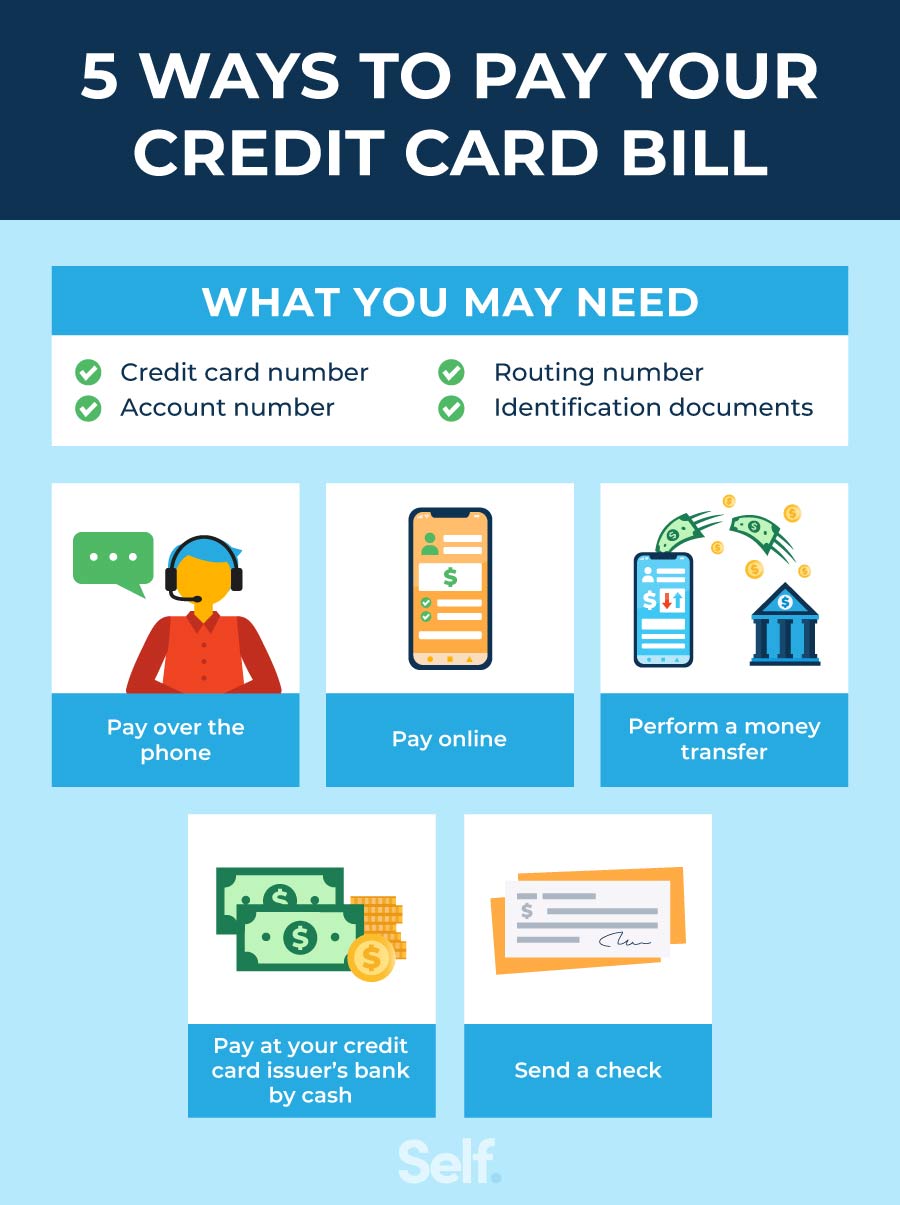

You can pay your credit card with cash by either visiting your card issuer's branch location or at the issuer's ATM. Most major credit card companies currently accept cash payments for credit card bills, including Chase, Capital One, Citibank, Bank of America, Wells Fargo, and U.S. Bank.

Can IRS track credit card payments

A 2008 law, known as the Housing and Economic Recovery Act, mandated that debit and credit card payments be tracked by banks and reported to the IRS.

Can the IRS track cash payments

Although many cash transactions are legitimate, the government can often trace illegal activities through payments reported on complete, accurate Forms 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF.

Does IRS track cash payments

Although many cash transactions are legitimate, the government can often trace illegal activities through payments reported on complete, accurate Forms 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF.

What bills can you pay at Post Office

Pay your utility bills, rent or top up, buy transport tickets and more. It's easy with our 24,000 Post Office and Payzone locations nationwide.

Can you pay off Amex with cash

You can pay your credit card with cash by either visiting your card issuer's branch location or at the issuer's ATM.

Does the IRS know how much money I have in the bank

The IRS probably already knows about many of your financial accounts, and the IRS can get information on how much is there. But, in reality, the IRS rarely digs deeper into your bank and financial accounts unless you're being audited or the IRS is collecting back taxes from you.

What is the $3000 rule

Rule. The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000. 40 Recommendations A set of guidelines issued by the FATF to assist countries in the fight against money. laundering.

Can I pay a credit card bill at the Post Office

You can use this service any time your local Post Office branch or Payzone store is open. Go to your local Post Office branch or Payzone store and we'll take it from there. Just bring what you need and tell us how much you'd like to pay. You can pay by credit or debit card and we'll give you a receipt for your payment.

Does USPS take cash as payment

Go to any Post Office location. Take cash, a debit card, or a traveler's check. You cannot pay with a credit card.

Can I pay Discover card with cash

Discover does not accept cash payments. Be sure to write your account number on the “memo” line.

Does the IRS look at your credit cards

The short answer is YES. The IRS accepts credit card statements as proof of tax write-offs (here are the best apps to track receipts for taxes).

How much cash can I deposit without being flagged

Banks must report cash deposits totaling $10,000 or more

When banks receive cash deposits of more than $10,000, they're required to report it by electronically filing a Currency Transaction Report (CTR). This federal requirement is outlined in the Bank Secrecy Act (BSA).