Can I pay monthly for Apple products?

How do I buy Apple products and pay monthly

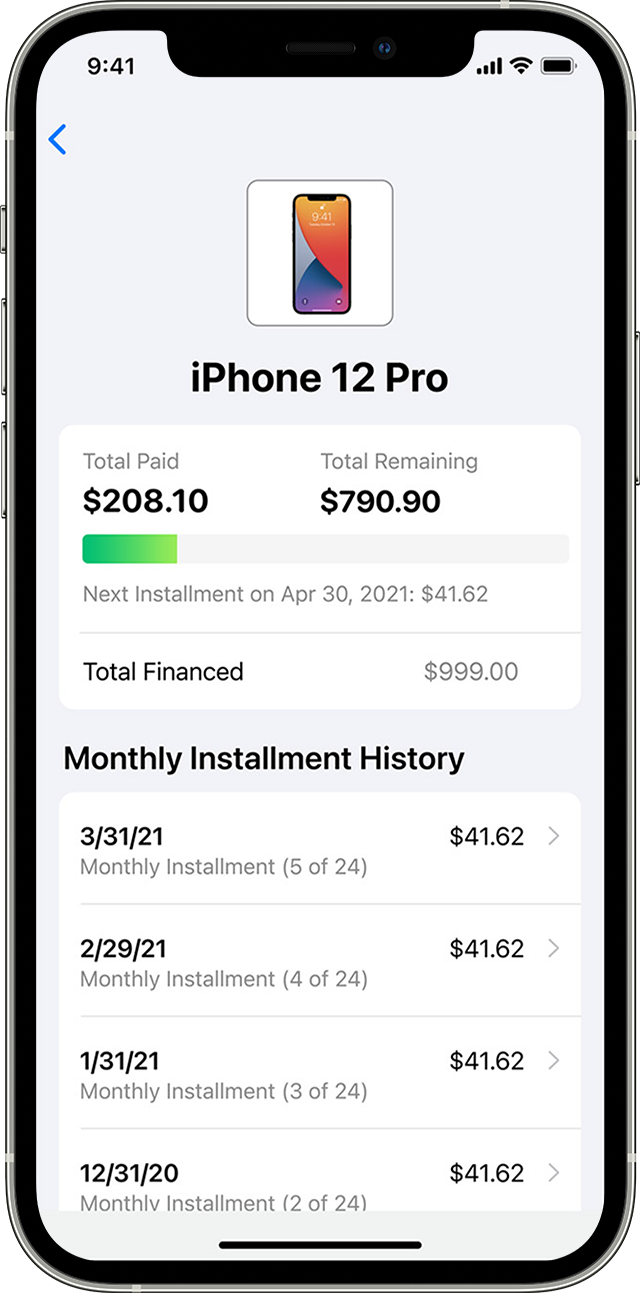

Choose Apple Card Monthly Installments when you shop at Apple. Whether you shop on apple.com, on the Apple Store app, or at an Apple Store, simply choose Apple Card Monthly Installments as your payment option when you make your purchase.

Cached

Can you pay off Apple products monthly

Apple Card Monthly Installments is an easy payment option. You can choose to pay for a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Monthly Installments — instead of paying all at once — in order to enjoy interest-free, low monthly payments.

Cached

Can I buy iPhone from Apple and pay monthly

iPhone Payments is available to qualified customers and consists of the purchase of an eligible iPhone under a monthly installment loan, and the wireless service activation with an eligible carrier.

Cached

Can you make monthly payments on Apple products without Apple Card

Apple Pay Later isn't restricted to Apple products, nor does it require the use of the Apple Card. With Apple Pay Later, you can finance any purchases from $50 to $1,000 using a debit card, as long as it's connected to Apple Wallet.

Cached

Does Apple Store accept Afterpay

Sleek, innovative and one of the global market leaders in consumer technology, Apple keeps you connected with the latest tech gadgets. Shop our fantastic range of Apple devices, mobile phones, laptops, and accessories with Afterpay today and save on upfront purchases so you can buy now, pay later.

What credit score do you need for an Apple Card

What Credit Score Do You Need for the Apple Card Applicants with scores above 660 are "considered favorable for credit approval," according the Apple Card's website. In other words, those with at least a "good" score have a chance at getting the card.

Do I get 3% back on all purchases Apple or only monthly pay

Apple Card gives you unlimited 3% Daily Cash back on everything you buy at Apple — whether it's a new Mac, an iPhone case, games from the App Store, or even a service like Apple Music or Apple TV+. You also get 3% Daily Cash back on purchases you make at select merchants when you use Apple Card with Apple Pay.

Does Apple financing do a hard credit check

If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score.

Is it better to pay iPhone in full or monthly

Paying off early does not really save you anything, since the loan is at 0% interest. You don't have to trade the phone at 12 months, you can keep it and pay the entire 24. Either way, you are paying the same for the phone if you purchased it all at once, or make the 24 month payments.

Does Apple have pay in 4

Apple introduces Apple Pay Later to allow consumers to pay for purchases over time. Designed with users' financial health in mind, Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees.

How do I get Apple Pay later

Set up in Apple WalletOn your iPhone, open the Wallet app.Tap Add.Tap Set up Apple Pay Later, then tap Continue.Follow the onscreen instructions to apply for an Apple Pay Later loan.Tap Next, then verify your name, date of birth, and address.Review your personal information, then tap Agree & Apply.

Is Apple Card hard to get approved for

Yes, it is hard to get the Apple Card because it requires at least good credit for approval. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for the Apple Card.

What is the minimum income for Apple Card

There is no minimum income limit you need to have.

How long are Apple payment plans

Designed with users' financial health in mind, Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees.

What credit score do I need for an Apple Card

660

There are multiple FICO Score versions available for lenders to use. Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

What credit score do u need for Apple

700+

You need a credit score of 700+ to get the Apple Card. This means at least good credit is required for approval.

What credit score is needed for Apple Finance

Apple Financing uses Experian and other credit bureaus to evaluate your Apple Pay Later application. If your credit score is low — for example, if your FICO9 score is less than 6206 or Lift Premium score is lower than 5807 — Apple Financing might not approve your application.

What is the average iPhone bill per month

How much is an average iPhone bill per month An iPhone is part of your cell phone bill, but it's not the bill as it doesn't include any service. If you'd like to finance an iPhone with AT&T, T-Mobile or Verizon, expect to pay $30 to 50 per month for the newest iPhone.

Is it a good idea to pay monthly for a phone

Financing a cellphone could help you build credit: Financing a cellphone can help build credit if you pay on time, consistently. Improving your credit score makes it easier to qualify for other types of credit and be approved for favorable interest rates.

Can I buy Apple with Afterpay

Once you've set up Afterpay Card, it's a simple process to use it to purchase items in-store with Apple Pay.