Can I pay my bills through a credit card?

Is it OK to pay bills with a credit card

Generally speaking, paying your monthly bills by credit card can be a good idea as long as you adhere to two rules. Always pay your balance in full and on time each month. Never put bills on a credit card because you can't afford to pay them.

Cached

What can I not pay with a credit card

Avoid placing the following expenses on credit cards:Mortgage or rent.Household Bills/household Items.Small indulgences or vacation.Down payment, cash advances or balance transfers.Medical bills.Wedding.Taxes.Student Loans or tuition.

Is paying bills with a credit card considered a cash advance

Paying a bill using a credit card or line of credit is treated the same as getting a cash advance. You'll be charged interest from the time you make the payment, just like you would for a cash advance.

Is it safer to pay bills with a credit card or debit card

A credit card is one of the safest forms of payment. Since a credit card is not linked with your personal account, it provides a layer of security between your transactions and personal finance management.

Does paying bills with a credit card hurt your credit score

Paying monthly bills with a credit card can affect your credit score positively or negatively, depending on how you handle it. Using a credit card could hurt your credit score if: You run up a balance and don't pay it off.

Does it hurt your credit to pay a credit card with a credit card

Paying off a credit card doesn't usually hurt your credit scores—just the opposite, in fact. It can take a month or two for paid-off balances to be reflected in your score, but reducing credit card debt typically results in a score boost eventually, as long as your other credit accounts are in good standing.

When should you not use a credit card

What are the worst times to use a credit cardWhen you haven't paid off the balance.When you don't know your available credit.When you're just doing it for the rewards (but you haven't done the math)When you're afraid you have no other choice.When you're in a heightened emotional state.When you're suspicious of fraud.

How to stop using credit cards to pay for normal living expenses

Here are three ways to break the cycle of relying on credit.Stop Using Your Credit Card Completely. The first step to getting off the cycle of spending on credit is the most important: You have to stop using your credit cards completely.Build a Budget.Transfer the Remaining Credit Card Balance.

What are two negatives of using your credit card for a cash advance

Higher interest rate: Many cards charge a higher APR for cash advances than for regular purchases. No grace period: Your credit card usually gives you a grace period of at least 20 days to pay off your purchase before you're charged interest. Cash advances, though, start to accrue interest from day one.

Can you use a line of credit to pay bills

You can also pay bills or withdraw cash from your line of credit.

Is it smart to use your credit card for everything

You can use a credit card for everyday purchases to build credit and to earn rewards for the spending you already do. But remember that you should only use a credit card for purchases you can afford to pay back and make on-time payments to avoid damaging your credit.

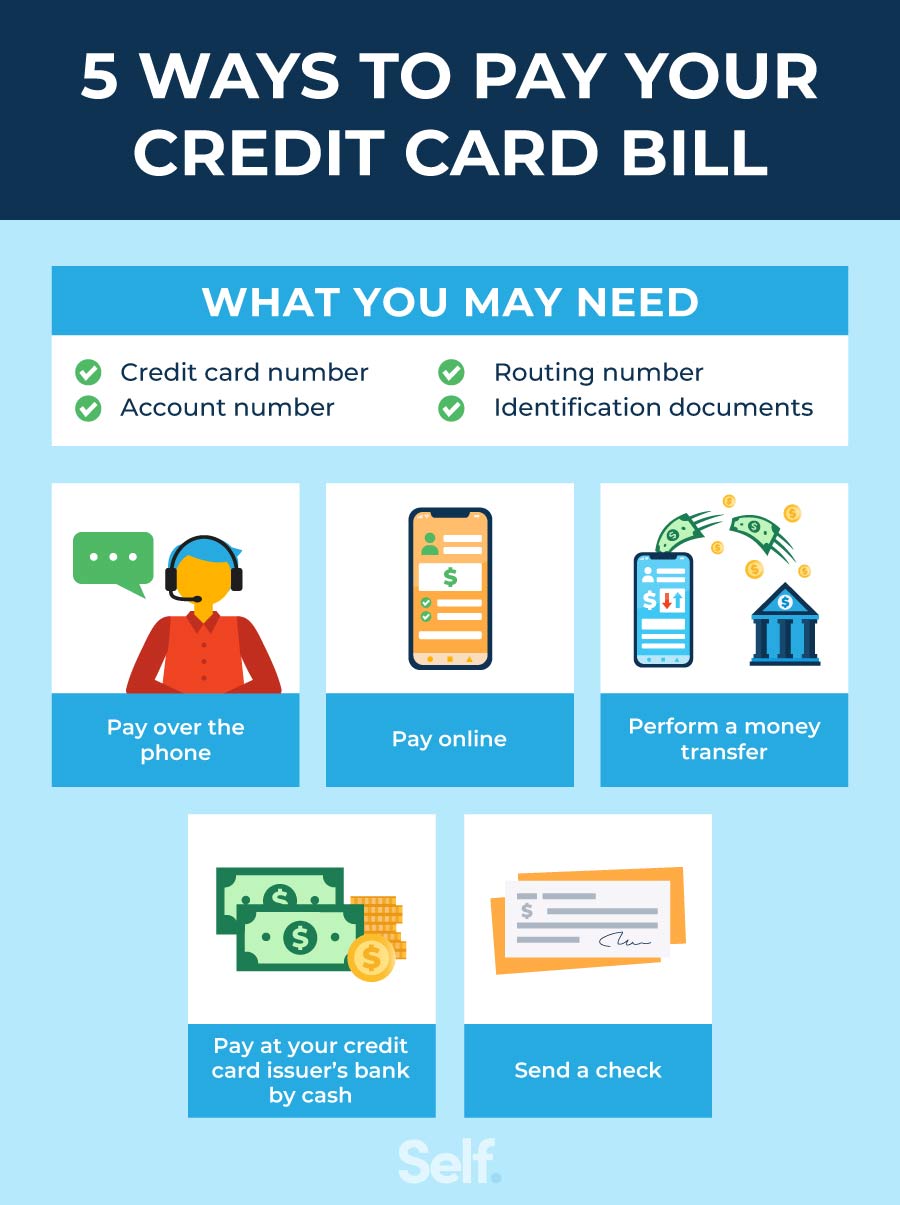

What is the best way to pay bills

How to pay bills on timeGet organised. Get a folder and keep your bills in it.Choose a payment method that suits you.Check your bills regularly.Don't let your bills get on top of you.Make sure you're not paying too much.Pay online or phone banking.Other payment methods.

Can I pay my monthly car loan with a credit card

Whether you can make your car payment with a credit card will depend on your auto loan lender. Some lenders will accept credit card payments with no problem. Other lenders will accept credit cards, but will charge a hefty processing fee.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Is it smart to pay off a credit card with a credit card

And there are some immediate benefits to paying off a credit card using another card, including: Lower APR and interest savings: If you're transferring a balance from a card with a high APR to one with a lower APR, you'll save money in interest.

Is it okay to use your credit card for everything

You can use a credit card for everyday purchases to build credit and to earn rewards for the spending you already do. But remember that you should only use a credit card for purchases you can afford to pay back and make on-time payments to avoid damaging your credit.

Is it bad to use your credit card for everything if you pay it off

Downsides of using credit cards for everything

Paying interest on a credit card balance will usually negate any rewards you've accumulated, and then some, given the high ongoing interest rates that credit cards tend to charge.

What is the biggest problem with using your credit card for a cash advance

Credit card companies often charge higher rates for cash advances than for purchases for two reasons: Cash advances are a credit card convenience service a lot of people are willing to pay more for. Using cash advances can potentially reflect desperation or and greater financial risk for the credit card company.

Why shouldn’t you withdraw cash from a credit card

Withdrawing cash with your credit card

It's generally better to withdraw cash using your debit card rather than your credit card. This is because credit card companies will typically charge an additional fee. You might also end up paying interest on the cash withdrawal, even if you pay it back on time.

Can I use a line of credit for whatever I want

Also similar to a credit card, a line of credit is essentially preapproved, and the money can be accessed whenever the borrower wants for whatever use. Lastly, while a credit card and a line of credit may have annual fees, neither charges interest until there is an outstanding balance.