Can I pull a credit report on a business?

Can anyone pull a business credit report

Business credit reports provide a variety of information about a company that can be useful to prospective lenders and other parties. Unlike consumer credit reports, business credit reports are public and available to anyone.

Cached

Can you pull a business credit report without permission

The bottom line. Your credit report can't be obtained by just anyone. The FCRA lays out in what situations a credit reporting agency can provide others access to your report. Even those who want access to your report can only ask for it if they have a legally permissible reason to do so.

Is there a way to check business credit score

You can check your Paydex score (and three other ratings) for free with Dun & Bradstreet's CreditSignal package, which includes alerts for score changes and business credit inquiries.

Do small businesses have their own credit score

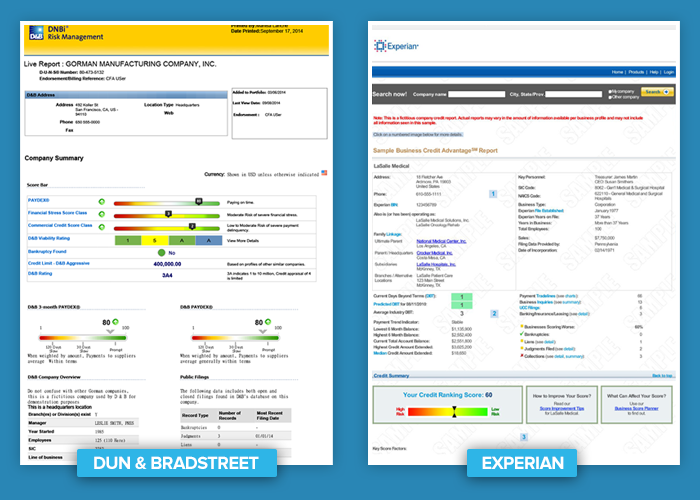

Businesses don't have one credit score; they have several. Each of the three major business credit bureaus — Dun & Bradstreet, Equifax, and Experian — calculates and issues unique business credit scores based on their own criteria and algorithms.

How do I request a company’s credit report

Contact one of the major business credit agencies: Experian Business, Equifax Business or Business Credit. You can call or go to the agency's website and order the report. Provide the business name, tax identification number and address to properly identify the company and obtain the correct report.

Does an LLC have a business credit score

Does an LLC Have Its Own Credit Score With The Rating Agencies Yes, a business has its own credit score and credit report. When you start your business and start applying for credit, your personal credit history and score will be taken into account.

Are business credit reports restricted by law

How long can negative information remain on business credit reports Since no federal law governs business credit, there are no restrictions on how long information can appear in your business credit history. Each bureau has its own policies. Some information may be reported for more than ten years!

Does my LLC have a credit score

Does an LLC Have Its Own Credit Score With The Rating Agencies Yes, a business has its own credit score and credit report. When you start your business and start applying for credit, your personal credit history and score will be taken into account.

Is business credit score linked to personal

Is a business credit score different to a personal credit score Yes, the two scores are separate and they measure different things. Your personal credit score measures your ability to pay back a debt, and a business credit score looks at the ability of your company to do so.

Does starting an LLC affect credit score

Does starting an LLC affect your credit score Starting an LLC will not directly affect your personal credit score unless you decide to personally guarantee or cosign a loan for your company.

What companies can show you a credit report

Nationwide consumer reporting companies

There are three big nationwide providers of consumer reports: Equifax, TransUnion, and Experian. Their reports contain information about your payment history, how much credit you have and use, and other inquiries and information.

What companies can you get a credit report from

By law, you can get a free credit report each year from the three credit reporting agencies (CRAs). These agencies include Equifax, Experian, and TransUnion.

How do I build credit under my LLC

How to Build Business Credit Quickly: 5 Simple StepsStep 1 – Choose the Right Business Structure.Step 2 – Obtain a Federal Tax ID Number (EIN)Step 3 – Open a Business Bank Account.Step 4 – Establish Credit with Vendors/Suppliers Who Report.Step 5 – Monitor Your Business Credit Reports.

What credit score does an LLC start with

You're aiming for a score of at least 75 in order to start getting favorable terms and taking advantage of having a strong business credit rating. The basic steps to start the process of establishing credit for your LLC are as follows: Get an EIN from the IRS. Register for a D-U-N-S number.

What shows up on a business credit report

It includes background information and payment history about the company, as well as information pulled from public records, such as liens and judgments filed against the company. It may be used to screen potential partners and vendors and may be a factor when applying for a business loan or line of credit.

Does an LLC have its own credit score

Does an LLC Have Its Own Credit Score With The Rating Agencies Yes, a business has its own credit score and credit report. When you start your business and start applying for credit, your personal credit history and score will be taken into account.

Is LLC credit separate from personal credit

Since business and personal credit files are separate, it's possible to establish strong business credit even if you have a low personal credit rating. The trick is to firmly distinguish your business credit from your personal credit before you start trying to build your business credit score.

Are company credit scores public

Unlike personal credit scores, business credit scores are publicly available. Anyone can go to one of the reporting agencies and look up your business's score — though they may have to pay to do so. Several business credit reporting agencies track business credit scores.

Does personal credit affect LLC credit

Lenders will use your personal credit history in determining the terms of any credit they offer your LLC. Over time, however, your LLC will be able to put separation between your personal credit history and and that of your business.

Does LLC debt count as personal debt

Limited Liability Company (LLC): LLCs operate as separate legal entities, meaning the shareholder's personal credit is not associated with the business. Unless shareholders personally guarantee the loan, they are not liable for the business' debts.