Can I put my 7 year old on payroll?

At what age can I put my child on payroll IRS

Payments for the services of a child are subject to income tax withholding regardless of age. Payments for the services of a child under age 18 are not subject to social security and Medicare taxes.

CachedSimilar

Can I issue a 1099 to my child under 18

It is essential that you do not pay your minor child out of an S-Corp or issue a 1099 form. A W-2 is required to avoid self-employment tax issues. As with younger children, you still want to make sure your child is performing legitimate job services.

Cached

How much can I pay my child to work for my business 2023

As long as they're doing legitimate work for your business, you can hire your child tax free and pay each of them up to $12,000 per year tax-free.

Cached

How much can a child earn with 1099 without paying taxes

$12,950

A minor who earns less than $12,950 will not owe taxes but may choose to file a return to receive a refund of withheld earnings. A child who earns $1,150 or more (tax year 2023) in "unearned income,” such as dividends or interest, needs to file a tax return.

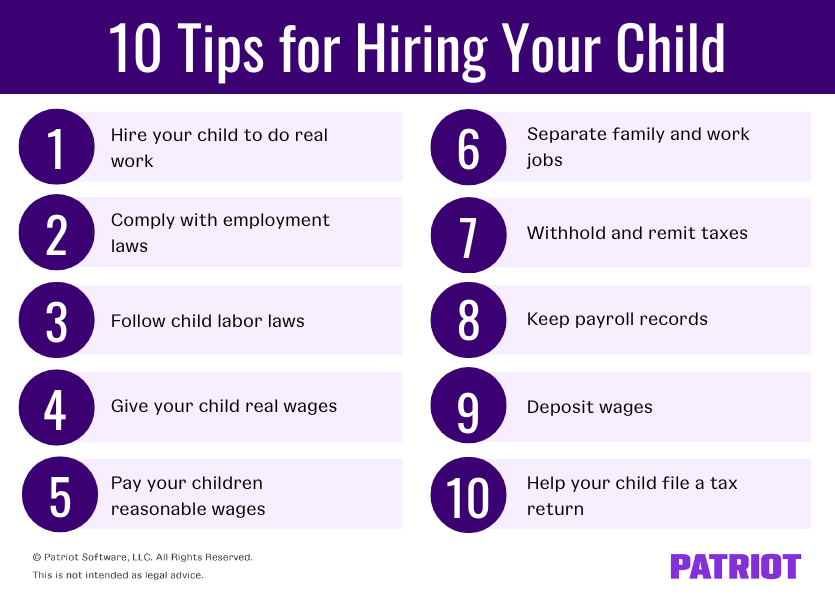

What are the rules for putting children on payroll

Here is the procedure: The IRS allows any sole proprietorship or partnership (LLC) that is wholly owned by a child's parents to pay wages to children under age 18 without having to withhold the payroll taxes and list it as “outside labor” as another expense. NOT Payroll. You do not have to issue a W-2.

What is the youngest age to pay taxes

Generally, a teenager is considered dependent on their parents' tax sheet and is not required to file separate taxes until the age of 19 if they have stopped their education. If they choose to pursue their education further, they can additionally be claimed as dependents until they reach 24.

Can I pay my kids a salary from my business

Here is the procedure: The IRS allows any sole proprietorship or partnership (LLC) that is wholly owned by a child's parents to pay wages to children under age 18 without having to withhold the payroll taxes and list it as “outside labor” as another expense.

Should I pay my kids W-2 or 1099

It is preferable to pay your child with a W-2. When paid on a W-2, neither you nor your child will be required to pay Social Security or Medicare taxes. Also, you will not have to pay unemployment taxes.

How much can a dependent child earn in 2023 without paying taxes

The IRS sets specific limits on the type of income and the tax rates. Earned income will be taxed at the child's rate above their applicable standard deduction, which is equal to their earned income plus $400 (or $1,250, whichever is greater), up to a maximum of $13,850 in 2023.

Why you should put your kids on payroll

Teaching them to file a tax return not only gives them experience managing their finances, but it also allows them to start establishing a credit history. And depending on your business structure, you may be able to save serious money on your child's payroll taxes, too.

Do minors get taxes taken out of their paycheck

Just like adults, teens have to pay federal and state income taxes once their income hits a certain threshold. If you're a teen working a part-time job, summer job, or side hustle, it's important to know when you're subject to tax and how you're expected to pay it.

Can business owners pay their kids

Wages as a Deduction from Taxable Income When Paying Children in a Family Business. The IRS allows you to pay children under the age of 18 for services to a trade or business owned by his or her parent. These wages are not subject to the usual Social Security or Medicare taxes – provided certain criteria are met.

Can parents take their child’s paycheck

It's not illegal to take money from your kids in most cases, although, of course, there are exceptions, like if the child's money is in a specific trust and you abuse the funds.

Do minors get taxed on paychecks

Just like adults, teens have to pay federal and state income taxes once their income hits a certain threshold. If you're a teen working a part-time job, summer job, or side hustle, it's important to know when you're subject to tax and how you're expected to pay it.

Do I have to claim my child’s income on my taxes

Share: If you have a dependent who's earning income, good news — you can still claim them as a dependent so long as other dependent rules still apply. Your dependent's earned income doesn't go on your return. Filing tax returns for children is easy in that respect.

How do I prove my child’s earned income

Ideally your child should have a W2 or a Form 1099 to show evidence of the earned income. However, there are some instances where this may not be possible so it's important to keep records of the type of work, when the work was done, who the work was done for and how much your child was paid.

Do I put my child’s W-2 on my tax return

You cannot report your child's Form W-2 on your tax return. If your child has earned income during the tax year, they must file a separate return to either receive a tax refund or pay any balance owed to the IRS.

Do parents have to report children’s income

Your dependent's earned income doesn't go on your return. Filing tax returns for children is easy in that respect. If you're the dependent in question, you might be asking, “Do I file taxes if I'm a dependent” Even if you're a child, filing a tax return might be necessary depending on your income and circumstances.

Can I run payroll for my kids

Here is the procedure: The IRS allows any sole proprietorship or partnership (LLC) that is wholly owned by a child's parents to pay wages to children under age 18 without having to withhold the payroll taxes and list it as “outside labor” as another expense. NOT Payroll. You do not have to issue a W-2.

How much should kids save from paycheck

The 10 Percent Rule

The general rule for saving is that a person should put at least 10 percent of their income away. Most financial experts accept this rule of thumb but point out that it is extremely general.