Can I run payroll myself?

How do I process my own payroll

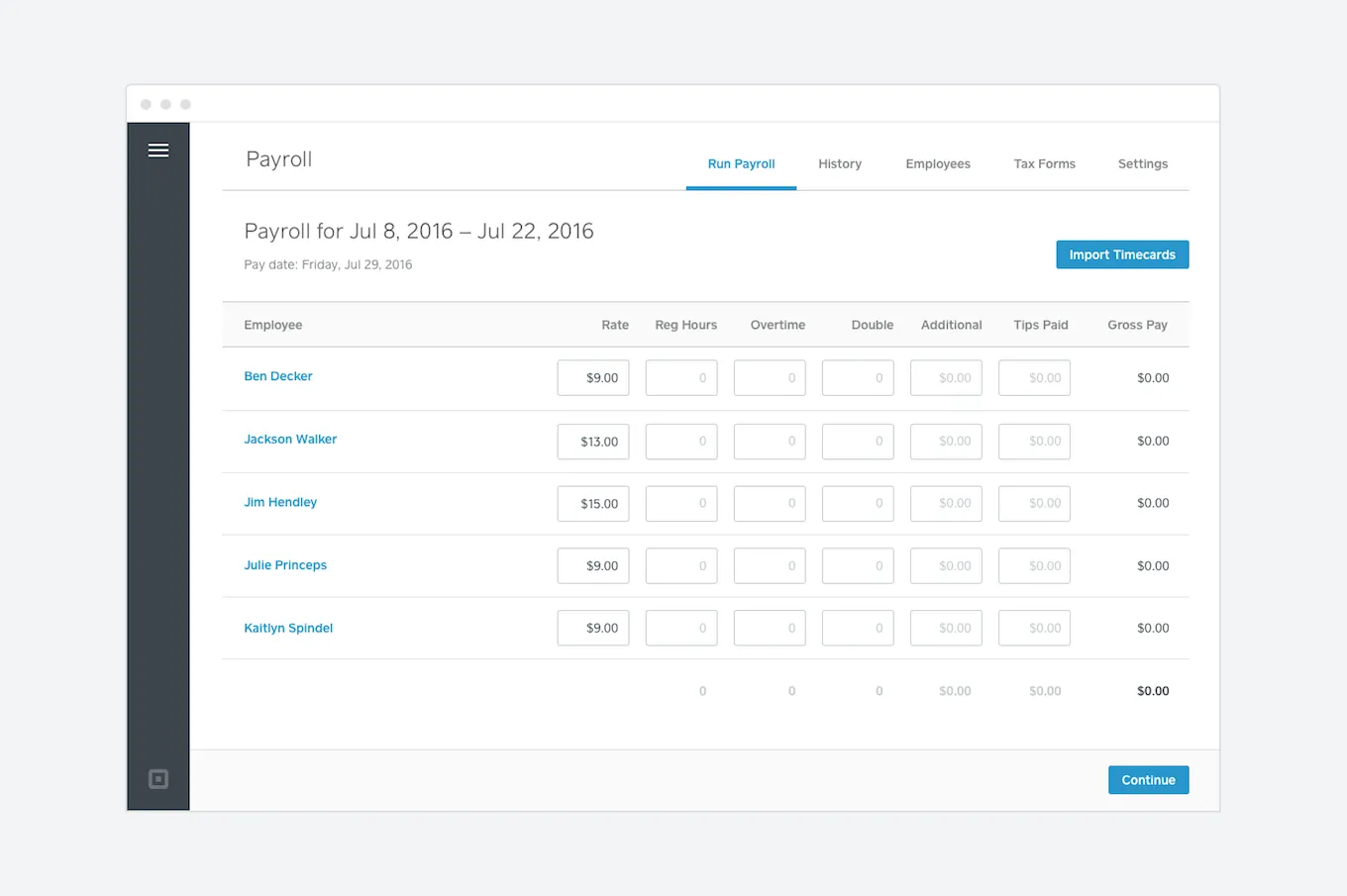

To get started:Step 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.

Cached

Can you do payroll without a program

Doing payroll by hand is the least expensive payroll option. You don't have to pay a professional or purchase a program. When you manually run payroll, you have full control over your payroll. You know when and how your payroll is completed.

Cached

Can you run payroll manually

To do payroll manually, you need to calculate each of your employees' gross pay for the pay period, and then determine the dollar amount of all taxes/benefits that must be deducted. Once you have done this, you can find their net pay and pay them via check or direct deposit.

Cached

How do I do payroll for a single employee

How do I do payroll manuallyAgree upon a salary or hourly wage.Use a time clock or other means to track hours worked.Calculate gross wages.Deduct health care and any other pre-tax benefits you offer.Withhold income tax, FICA taxes and any state taxes that apply.

Cached

Can you do payroll without a payroll company

Yes, you can run your own small business payroll, but it is not always the best idea. Running payroll without services can save you a few hundred dollars today, but it could cost you in the long run. In order to save money, many small business owners do payroll manually rather than using payroll software or services.

Can I do my own payroll in QuickBooks

With QuickBooks Online Payroll Elite, you can opt to do the payroll setup yourself or have a payroll expert set up some or all of it for you as part of your plan.

Is it hard to learn how to do payroll

For business owners who want to manage payroll themselves, they must become familiar with the terminology, options, and basics of running payroll, as well as payroll tax laws to avoid making mistakes. So while you can certainly figure out the process, processing payroll can be difficult when you do it on your own.

What is the best way to pay employees in a small business

Checks and direct deposits are the most popular ways to pay an employee. If you use direct deposit, refer to the bank information your employees gave you. Alternatively, you can have your bank or payroll provider cut checks for employees.

Can I do my own payroll with QuickBooks

If you'd like to do your payroll manually, you can track it in QuickBooks Desktop. Just remember, you'll need to calculate and enter payroll taxes, and file your tax forms yourself. Need help running payroll Sign up for a new QuickBooks Desktop Payroll subscription or reactivate an old account.

Is payroll difficult to learn

Learning how to do your own payroll can be very daunting. There's so much that can go wrong and if you make a mistake, it not only affects you, but the well-being of your employees and you can risk getting penalized by the IRS.

How much does one employee payroll cost

The cost of payroll services can range anywhere from $30 to $200 per month for a base account. In addition to a base account fee, payroll processing is usually charged per employee on average $10 to $25 per month.

Can I pay myself direct deposit

Can I pay myself via direct deposit Yes, but those who are self-employed must be sure to reconcile the funds in both their business and personal banks accounts at the end of each month.

How do I pay my employees without payroll

Employers have a few options besides paying in cash when it comes to paying employees. They can write checks, use direct deposit, or give employees payroll cards.

Can I run payroll in QuickBooks without subscription

If your client only needs payroll services, you can offer them QuickBooks payroll service (Core, Premium, or Elite) without a QuickBooks Online accounting software subscription. This means that even without QuickBooks Online, you can still manage payroll-only clients, right on the QuickBooks platform.

Does QuickBooks charge to run payroll

QuickBooks Online Payroll terms: Each employee is an additional $5/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $5/month for Core, $8/month for Premium, and $10/month for Elite.

How many hours does it take to do payroll

Businesses with payroll processing solutions typically finish internal processes in one to two days. After payroll is submitted to the bank, it takes two to three days for wages to be deposited into employee bank accounts. So, employees receive their paychecks, on average, within five days of the pay period end date.

Is payroll a stressful job

Yes, payroll is a stressful job.

Factors such as payroll deadlines and high costs associated with making mistakes can cause stress.

Is it OK to pay employees cash

It is illegal. This practice may result in a large unplanned liability, including substantial penalty and interest charges for failing to comply with reporting requirements. You could also face criminal prosecution.

What are the 3 common methods employers use to pay employees

What types of payment can an employer use to pay employeesChecks. Physical checks can be handwritten or printed and require only that your business have a checking account with a bank.Direct Deposit.Pay Cards.

Is QuickBooks payroll free

There is a monthly fee (currently $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be added automatically to each monthly Intuit invoice at the then-current price until you cancel.