Can I take a loss on a delisted stock?

How do you book capital loss in delisted stocks

Any loss incurred on extinguishment of share capital becomes long term if held for more than 24 months, else the loss is be treated as short term. In case such shares were treated as stock in trade, the loss of value of your investments can be debited in your profits and loss account.

Can you claim a tax loss on worthless stock

Worthless securities can include stocks or bonds that are either publicly traded or privately held. To declare a capital loss from worthless securities, the Internal Revenue Service (IRS) suggests investors treat them as if they were capital assets sold or exchanged on the final day of the tax year.

How do I report a delisted stock on my taxes

Report the valueless stock in either Part I or Part II of Form 8949, depending on whether it was a short-term or long-term holding. If an asset became worthless during the tax year, it is treated as though it were sold on the last day of the year.

Cached

How do you take losses on worthless stocks

Worthless securities also include securities that you abandon. To abandon a security, you must permanently surrender and relinquish all rights in the security and receive no consideration in exchange for it. Treat worthless securities as though they were capital assets sold or exchanged on the last day of the tax year.

Do I lose my money if a stock is delisted on Robinhood

If a stock that you own delists, you'll be able to sell it in the market, but you won't be able to purchase additional shares. Once a stock delists, the in-app market data will no longer reflect the current trading price.

How much of a stock loss can you write off

$3,000

If your net losses in your taxable investment accounts exceed your net gains for the year, you will have no reportable income from your security sales. You may then write off up to $3,000 worth of net losses against other forms of income such as wages or taxable dividends and interest for the year.

How do you get rid of a stock that no longer trades

The security is under a long-term cease trading order. If the security cannot be sold in the market, it may be possible to dispose of the worthless security by gifting it to another person who can be related or unrelated to you. You will need to ensure that the person is not your spouse or minor child.

At what point do you cut your losses on a stock

A good rule of thumb that most investors live by is to cut losses anytime a stock falls 5-8% below the price you purchased it at. The most important thing to remember is that the earlier you accept a loss, the more money you'll save in the long run.

What is the statute of limitations on worthless stocks

seven years

Statute of limitations

If you're just now realizing that some of your shares became worthless four or five years ago (or six or seven), you still have time to amend your return to claim the loss. The clock runs out seven years after the due date of the return for the year the stock became worthless.

How long can a stock stay under $1 before delisting

for 30 days

With investors trying to exit their positions, sellers outweigh buyers, causing a stock's price to fall. If a stock's share price drops below $1.00 and remains below that level for 30 days, the exchange may notify the company that it is not in compliance with listing requirements and is at risk of being delisted.

Can I sell my delisted stock on Robinhood

What Can I Do With My Delisted Robinhood Stock Robinhood doesn't currently support OTC trading. Therefore, if your stock is delisted from the NYSE or Nasdaq, Robinhood will only let you sell the stock, but not buy additional shares. Bear in mind that the prices of delisted stocks can drop significantly.

Can you write off 100% of stock losses

If you own a stock where the company has declared bankruptcy and the stock has become worthless, you can generally deduct the full amount of your loss on that stock — up to annual IRS limits with the ability to carry excess losses forward to future years.

How long can you carry over stock losses on taxes

indefinitely

In general, you can carry capital losses forward indefinitely, either until you use them all up or until they run out. Carryovers of capital losses have no time limit, so you can use them to offset capital gains in subsequent tax years until they are exhausted.

What happens when you own stock that is delisted

Investors holding shares after a delisting will only be able to sell them OTC. That generally means less liquidity, finding it harder to locate buyers at the price you want, and potentially being left in the dark about what the company is up to.

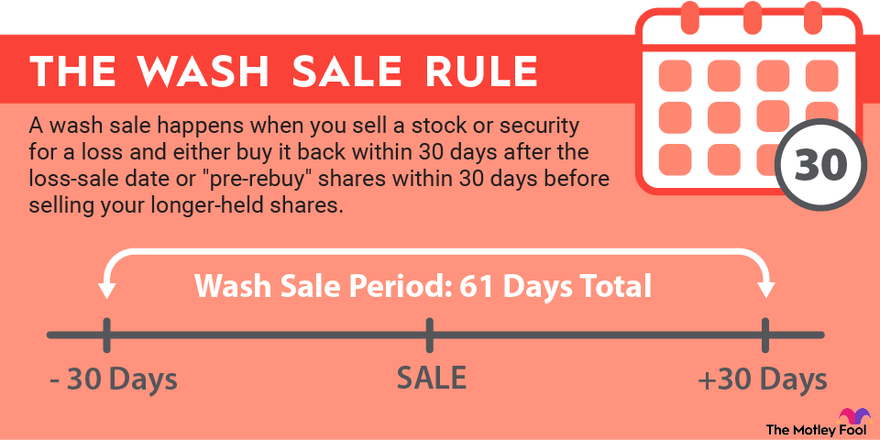

What is the 30 day rule in stock trading

Q: How does the wash sale rule work If you want to sell a security at a loss and buy the same or a substantially identical security within 30 calendar days before or after the sale, you won't be able to take a loss for that security on your current-year tax return.

What is the 7% stop-loss rule

To make money in stocks, you must protect the money you have. Live to invest another day by following this simple rule: Always sell a stock it if falls 7%-8% below what you paid for it.

What is the 30 day rule on stock loss

The wash-sale rule states that, if an investment is sold at a loss and then repurchased within 30 days, the initial loss cannot be claimed for tax purposes. So, just wait for 30 days after the sale date before repurchasing the same or similar investment.

How far back can you claim a stock loss

Tax Loss Carryovers

Any net realized loss in excess of this amount must be carried over to the following year. If you have a large net loss, such as $20,000, then it would take you seven years to deduct it all against other forms of income (a $3,000 loss every year for 6 years and a $2,000 loss in the seventh year).

How long can you claim stock market losses

You can claim the loss in future years or use it to offset future gains, and the losses do not expire. You can reduce any amount of taxable capital gains as long as you have gross losses to offset them.

Do shorts have to cover before delisting

If you short a stock and it then rises in price to the point where the losses exceed the liquidation value of your trading account, you will receive a margin call. At this point, you must deposit more collateral to cover the position. If you don't, the position will be closed and your balance wiped out.